Results miss expectations

Business performance

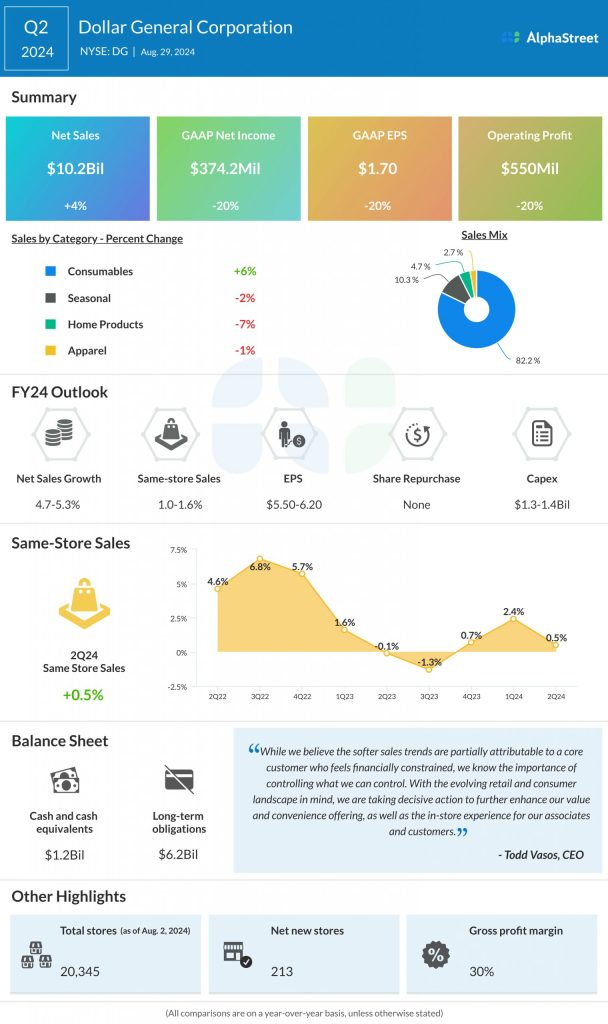

In Q2, DG’s same-store sales increased 0.5%, driven by a rise in customer traffic, which was partly offset by a drop in average transaction amount. Same-store sales included growth in the consumables category, partly offset by declines in the remaining three categories.

For the second quarter, the company saw sales increase 6% YoY to $8.4 billion in the consumables category. Sales in the home products category declined 7% to $480.2 million. Sales in the seasonal category decreased 2% to $1 billion and sales in the apparel category fell 1.3% to $278.1 million.

Gross margin dropped by 112 basis points to 30% in Q2, mainly due to higher markdowns, increased inventory damages, higher shrink, and a larger portion of sales coming from the consumables category.

During the second quarter, Dollar General opened 213 new stores, remodeled 478 stores, and relocated 25 stores. The company ended the quarter with 20,345 stores. DG has planned 730 new store openings, 1,620 remodels, and 85 store relocations.

Lowered outlook

DG lowered its outlook for the full year of 2024 as it expects softness in sales trends and related gross margin impacts to continue through the remainder of the year. The company now expects net sales to grow 4.7-5.3% compared to its prior expectation of 6.0-6.7%. Same-store sales growth is now expected to be 1.0-1.6% versus the previous outlook of 2.0-2.7%. EPS is now expected to be $5.50-6.20 versus the prior range of $6.80-7.55.