Mixed results

Business performance

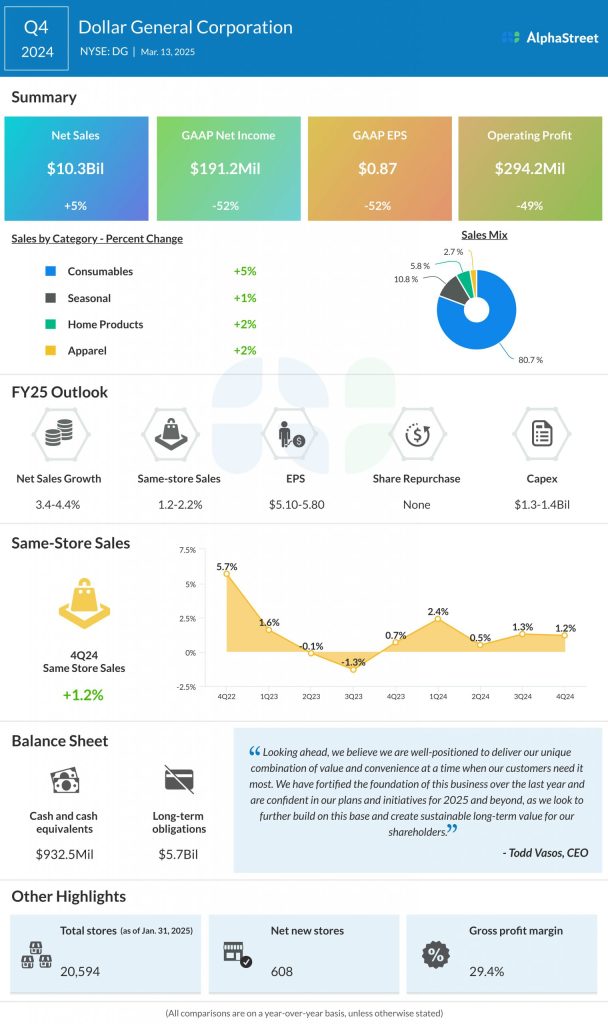

In Q4, same-store sales grew 1.2% YoY. Although customer traffic dropped 1.1%, average transaction amount increased 2.3%. Same-store sales results included growth in the consumables category, partly offset by declines in all the other categories.

During the fourth quarter, Dollar General recorded net sales growth across all its categories. Consumables recorded the highest growth of 5.3% followed by home products, which saw sales grow by 2%. Seasonal and apparel posted sales increases of 1% and 1.6% respectively.

Gross margin dipped by 8 basis points to 29.4% in Q4, mainly due to higher discounts, inventory damages, and a greater portion of sales coming from the low-margin consumables category.

Store portfolio optimization review

In Q4, DG began a store portfolio optimization review of its Dollar General and pOpshelf stores, which involves closing or re-bannering stores based on their performance. Based on this review, the company plans to close 96 Dollar General stores and 45 pOpshelf stores, and convert six pOpshelf stores to Dollar General stores in the first quarter of 2025.

Outlook

For fiscal year 2025, Dollar General expects net sales to grow approx. 3.4-4.4% and same-store sales to grow approx. 1.2-2.2%. EPS is expected to range between $5.10-5.80. The company plans to open around 575 new stores in the US and up to 15 new stores in Mexico during the year. It plans to fully remodel around 2,000 stores, remodel around 2,250 stores through Project Elevate, and relocate around 45 stores.