Mixed results

Strength in Foodservice

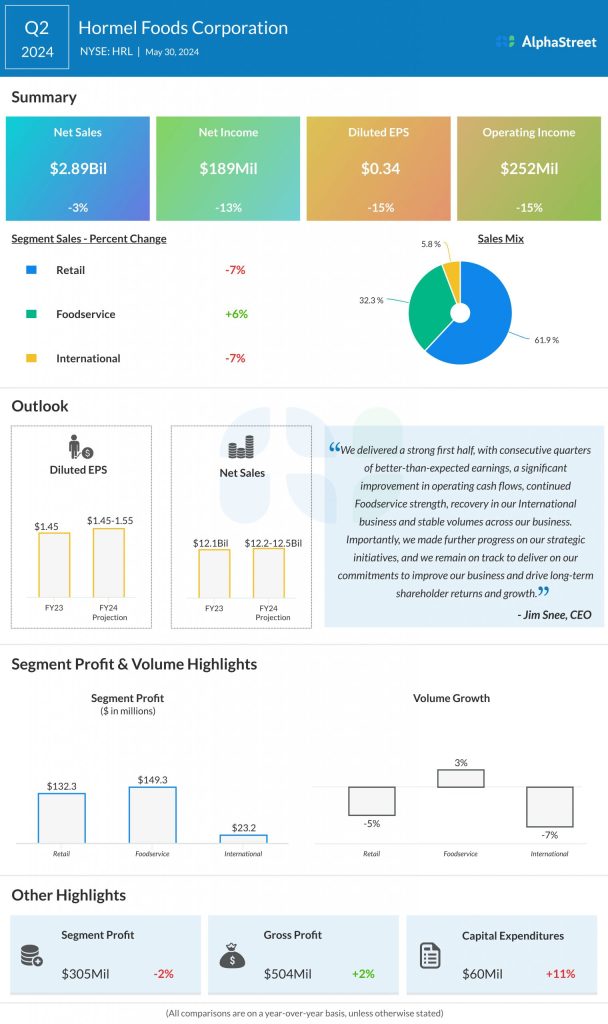

In Q2, Hormel saw sales and volumes decline in its Retail and International segments while the Foodservice segment recorded growth in both metrics. Retail sales were impacted by a significant decline in volume and price for whole-bird turkeys, and lower sales in convenient meals and protein, which offset gains in products like SPAM, Applegate meats, and Planters snack nuts. Retail volume was down 5%, as growth in bacon and emerging brands was offset by declines in value-added meats.

The company saw both sales and volume decline 7% in the International segment during the quarter as double-digit gains for SPAM luncheon meat and refrigerated exports were more than offset by lower commodity export volumes and lower net sales in China.

The Foodservice segment posted sales and volume growth in the quarter, driven by strength in categories like bacon, premium prepared proteins and turkey. Sales rose 6%, helped by double-digit gains in products like Hormel Bacon 1 cooked bacon, Austin Blues smoked meats, and Corn Nuts corn kernels. Volumes in this segment were up 3% in Q2. The company saw robust growth in the convenience channel, led by Planters and Corn Nuts.

Updated outlook

Hormel updated its earnings guidance for fiscal year 2024 to reflect its expectations for continued growth from its Foodservice and International segments, improvements in its supply chain and benefits from its strategic initiatives.

The company now expects GAAP EPS to range between $1.45-1.55 versus its previous outlook of $1.43-1.57. Adjusted EPS is now expected to be $1.55-1.65 versus the prior range of $1.51-1.65. Hormel reaffirmed its sales outlook for the year and expects net sales of $12.2-12.5 billion, representing a year-over-year growth of 1-3%.