Brand Power

Chipotle Mexican Grill: A few points to keep in mind if you have an eye on this restaurant chain

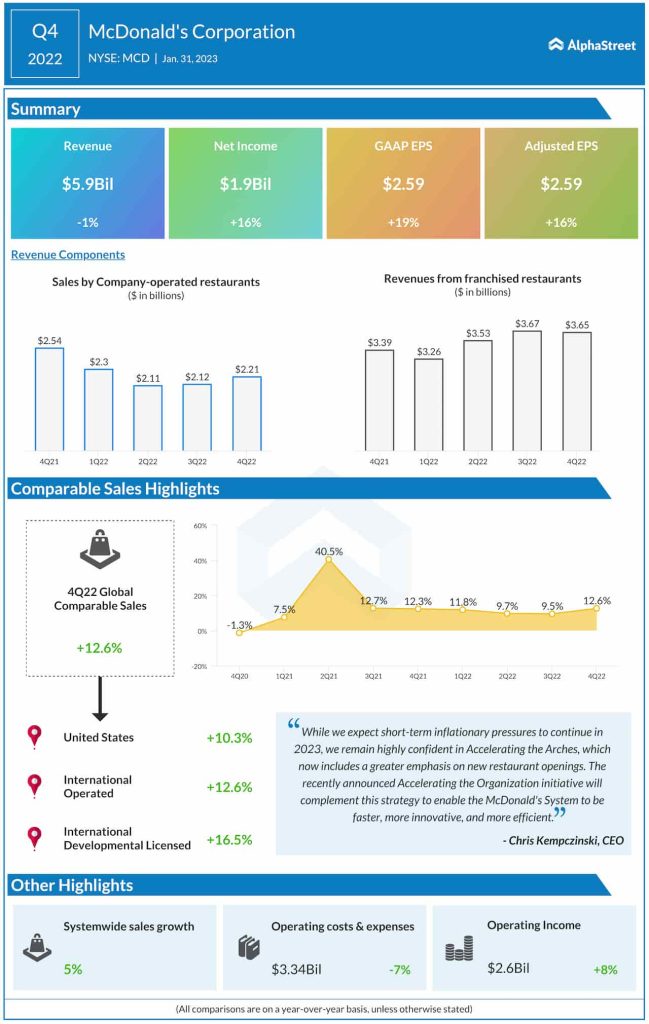

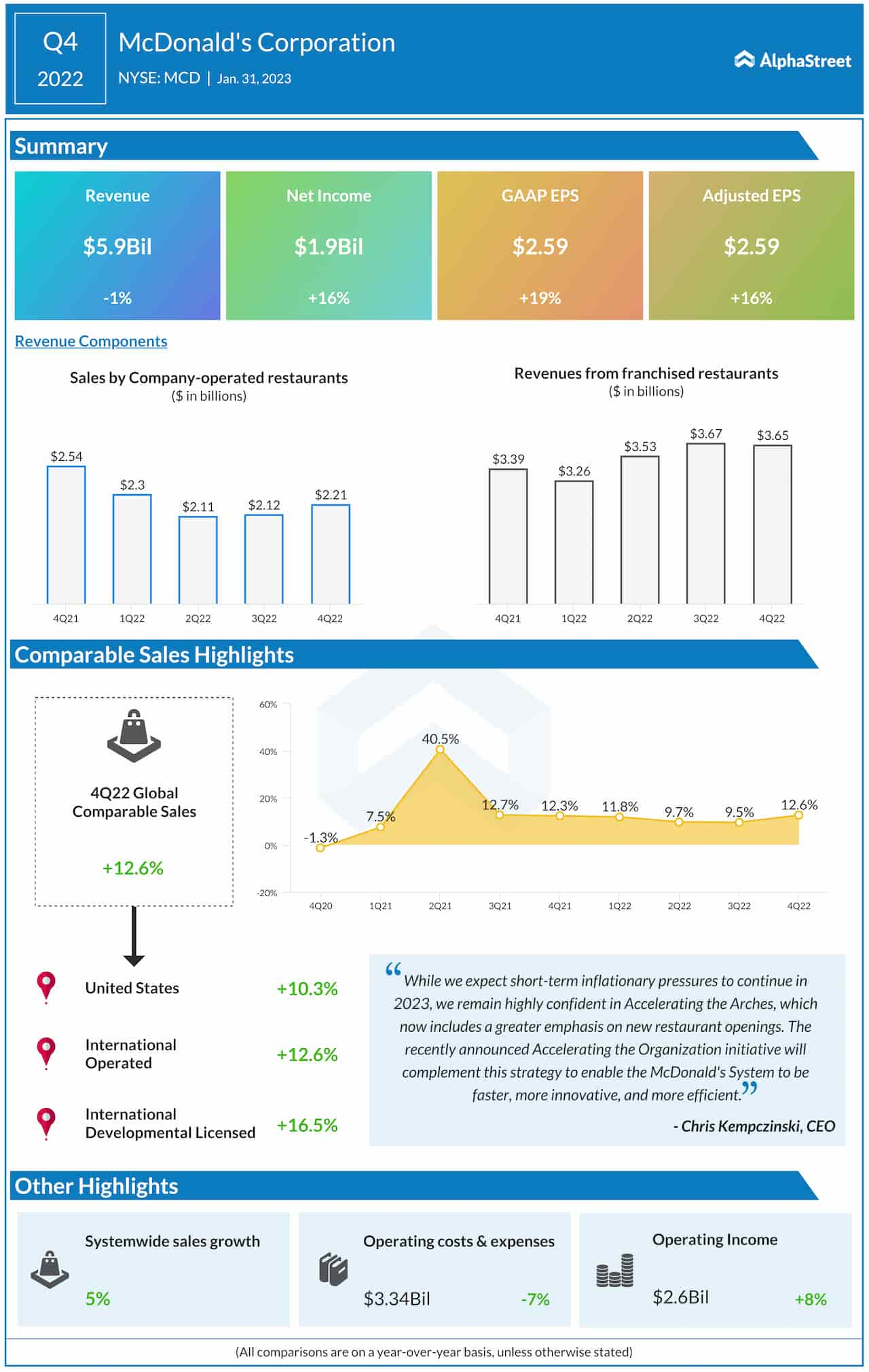

Meanwhile, investors were not impressed by the stronger-than-expected fourth-quarter results — which were published on Tuesday — due to the muted top-line growth. The stock dropped soon after the announcement and traded lower throughout the session, but still stayed above its long-term average. MCD had mostly traded sideways after peaking around two months ago. After the recent gains, the stock is trading at a premium now. But the company’s financial strength shows it would continue giving returns to shareholders in the foreseeable future. That, combined with the handsome dividends, makes the stock an attractive bet.

Risks

While the company looks well positioned to meet its growth goals, higher raw material and energy costs would be a drag on operating margins going forward. Also, there has been an increase in competition for its drive-thru platform, lately.

McDonald’s CEO Chris Kempczinski said, “while we expect short-term inflationary pressures to continue in 2023, we remain highly confident in Accelerating the Arches, which now includes a greater emphasis on new restaurant openings. The recently announced Accelerating the Organization initiative will complement this strategy to enable the McDonald’s System to be faster, more innovative, and more efficient. We’re proud of our continued strong performance, but we’re not satisfied.”

Earnings

Earnings topped expectations every quarter in fiscal 2022. In the fourth quarter, the top line also came in above the consensus forecast. Ever since customers shifted to home delivery during the pandemic, sales have remained stable, while higher menu prices and strong demand continue to drive margin growth.

Adjusted net profit climbed to $2.59 per share in the December quarter while net sales edged down to $5.9 billion. There was double-digit growth in comparable store sales across all geographical segments. Sales at company-operated restaurants picked up sequentially, after dropping in the trailing quarters. Revenue from franchised restaurants rose to $3.65 billion, extending the recent uptrend.

Read management/analysts’ comments on quarterly reports

The management is planning to open more stores this year – as many as 1,900 units globally — at an accelerated pace and to further expand the MCD growth pillars. The stock opened Tuesday’s trading at $270.89 and lost more than 2% during the session. It is up 15% from the lows seen four months ago.