Quarterly performance

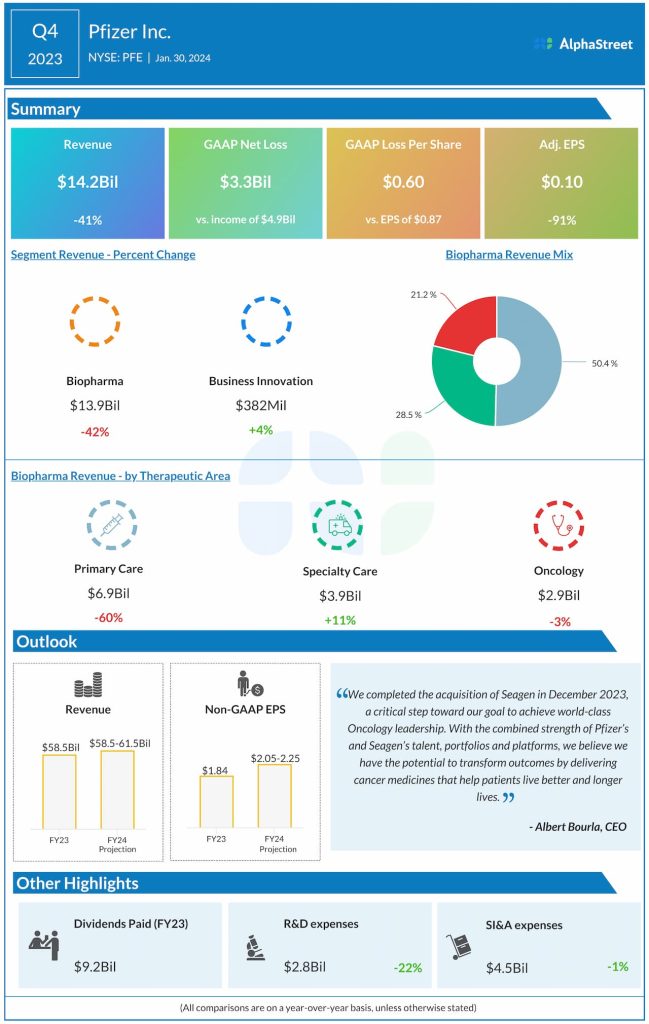

Pfizer’s bottom line was impacted by a $3.5 billion revenue reversal for Paxlovid. The company reported a net loss of $0.60 per share for Q4 on a GAAP basis. Adjusted EPS decreased 91% to $0.10 but managed to surpass analysts’ projections.

COVID and non-COVID product sales

In Q4, sales of Comirnaty decreased 54% to $5.36 billion, mainly due to lower US government contracted deliveries after the transition in September to US commercial market sales, as well as lower international deliveries and demand.

Paxlovid revenues declined by $5 billion to reach negative $3.1 billion in the quarter, due to a non-cash revenue reversal of $3.5 billion related to the return of an estimated 6.5 million EUA-labeled US government treatment courses.

Excluding contributions from the COVID products, Pfizer’s operational revenue growth in the quarter was driven by Abrysvo, Eliquis, and the Vyndaqel family. Abrysvo generated $515 million in revenues in Q4 while Eliquis and the Vyndaqel family reported operational growth of 9% and 39% respectively.

Outlook

For the full year of 2024, Pfizer expects revenues to range between $58.5-61.5 billion. This guidance includes approx. $8 billion in revenues from Comirnaty and Paxlovid, and approx. $3.1 billion of revenue anticipated from the newly-acquired Seagen. Excluding contributions from the COVID products and Seagen, operational revenue growth for 2024 is expected to be 3-5%. Adjusted EPS for the year is estimated to range between $2.05-2.25.