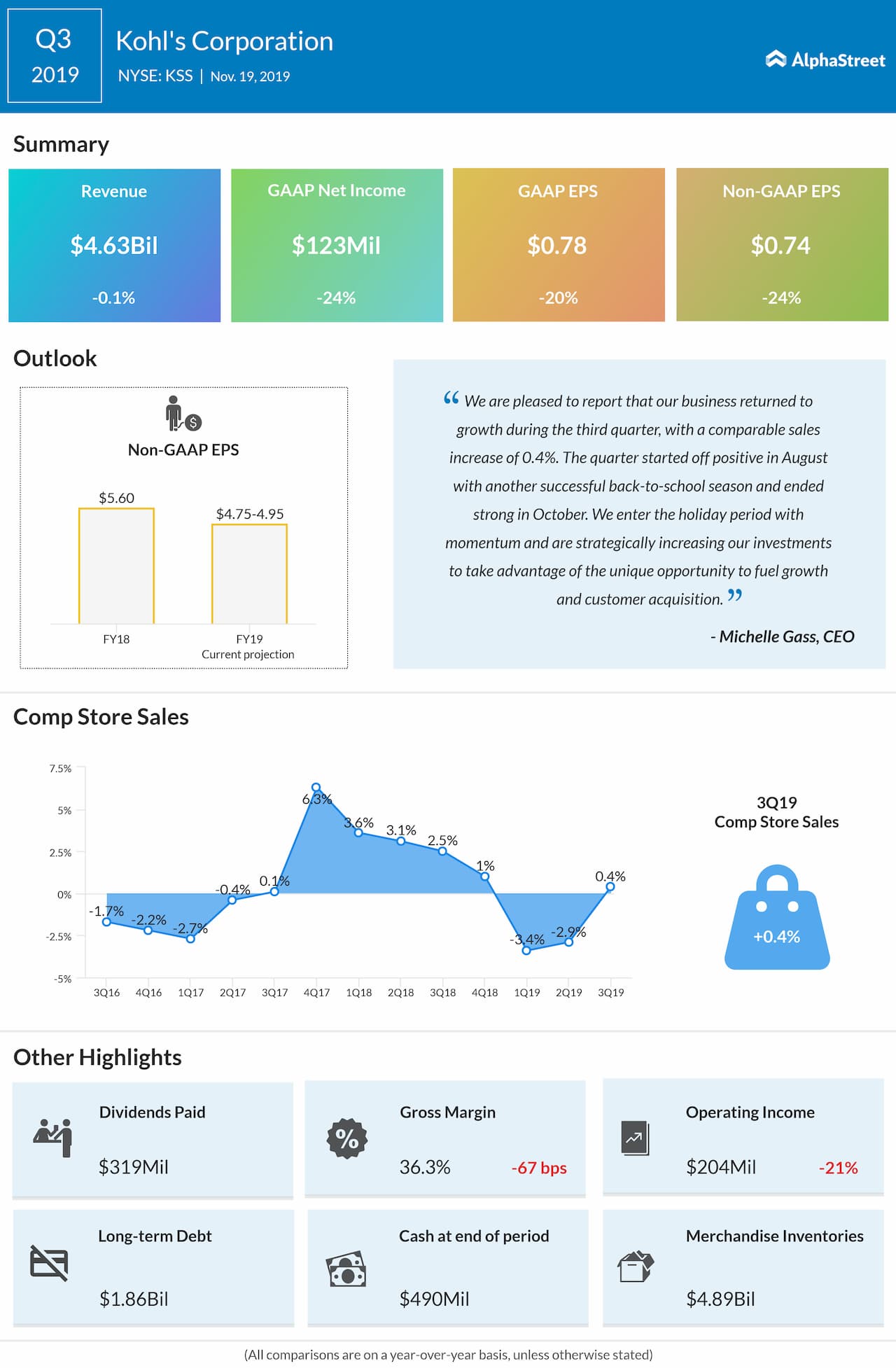

Kohl’s Corporation (NYSE: KSS) reported a 24% drop in earnings for the third quarter of 2019 due to lower revenue as well as higher costs and expenses. The bottom line missed analysts’ expectations while the top line missed consensus estimates. Further, the company lowered its earnings guidance for the full year 2019.

Net income dropped by 24% to $123 million or $0.78 per share. Adjusted earnings decreased by 24% to $0.74 per share. Revenue declined by 0.1% to $4.63 billion despite a 0.4% rise in comparable sales.

Comparable sales turned positive this quarter, which started off positive in August with another successful back-to-school season and ended strong in October. The company entered the holiday period with momentum and is strategically increasing its investments to take advantage of the unique opportunity to fuel growth and customer acquisition.

Looking ahead into the full year 2019, the company lowered its earnings guidance to the range of $4.75 to $4.95 per share from the previous range of $5.15 to $5.45 per share. The revised estimates exclude $0.22 per share related to the extinguishment of debt and impairments, store closing and other costs recognized in the first nine months of 2019.

Read: Lowe’s Companies Q3 earnings preview

ADVERTISEMENT

On November 13, the company’s board declared a quarterly cash dividend on its common stock of $0.67 per share. The dividend is payable on December 24, 2019, to shareholders of record at the close of business on December 11, 2019.

As of November 2, 2019, Kohl’s has a long-term debt of $1.86 billion while it had only $490 million of cash and cash equivalents. The total current assets decreased by 9% to $5.78 billion while total current liabilities rose by 2% to $4.08 billion. The total debt-to-equity ratio is at 1.11 and this means the company is aggressive in financing its growth with debt.