Like most retailers, The Kroger Co. (NYSE: KR) is experiencing a slowdown in sales as inflation and economic uncertainties put pressure on family budgets. To attract more customers to the stores and give them additional value, the grocery retailer has lowered prices and launched promotional offers.

Investing

Last month, shares of the Cincinnati-based grocery chain slipped to a two-year low but they changed course since then and are in recovery mode now. In the past six months, the value dropped around 3%. Though KR dropped soon after last week’s earnings, reflecting the management’s cautious guidance, it picked momentum in the following sessions.

The uptrend is expected to continue in the coming months and the stock offers a buying opportunity to long-term investors, especially those focused on income. Recently, Kroger’s board raised its dividend to $0.29 per share, with a bigger-than-average yield of 2.6%.

Cost-Cutting

The company has initiated a cost reduction program to ease the pressure on margins, mainly due to price cuts and promotional activities. Meanwhile, those benefits are offset by investments being done to drive long-term sales growth. Being a late entrant to e-commerce, Kroger has been ramping up its digital capabilities, lately. The online business is growing steadily and delivered double-digit growth in both pickup and delivery in the most recent quarter. Considering the growth initiatives, the company looks on track to meet its productivity improvement target.

“We are growing households and increasing loyalty, positioning Kroger for sustainable future growth. Customers are managing many economic factors that are pressuring their spending, including higher interest rates, reduced savings, and fewer government benefits, including SNAP. Although inflation is decelerating, customers are still adjusting to the impacts from eight consecutive quarters of broad and significant inflation,” said Kroger’s CEO Rodney McMullen.

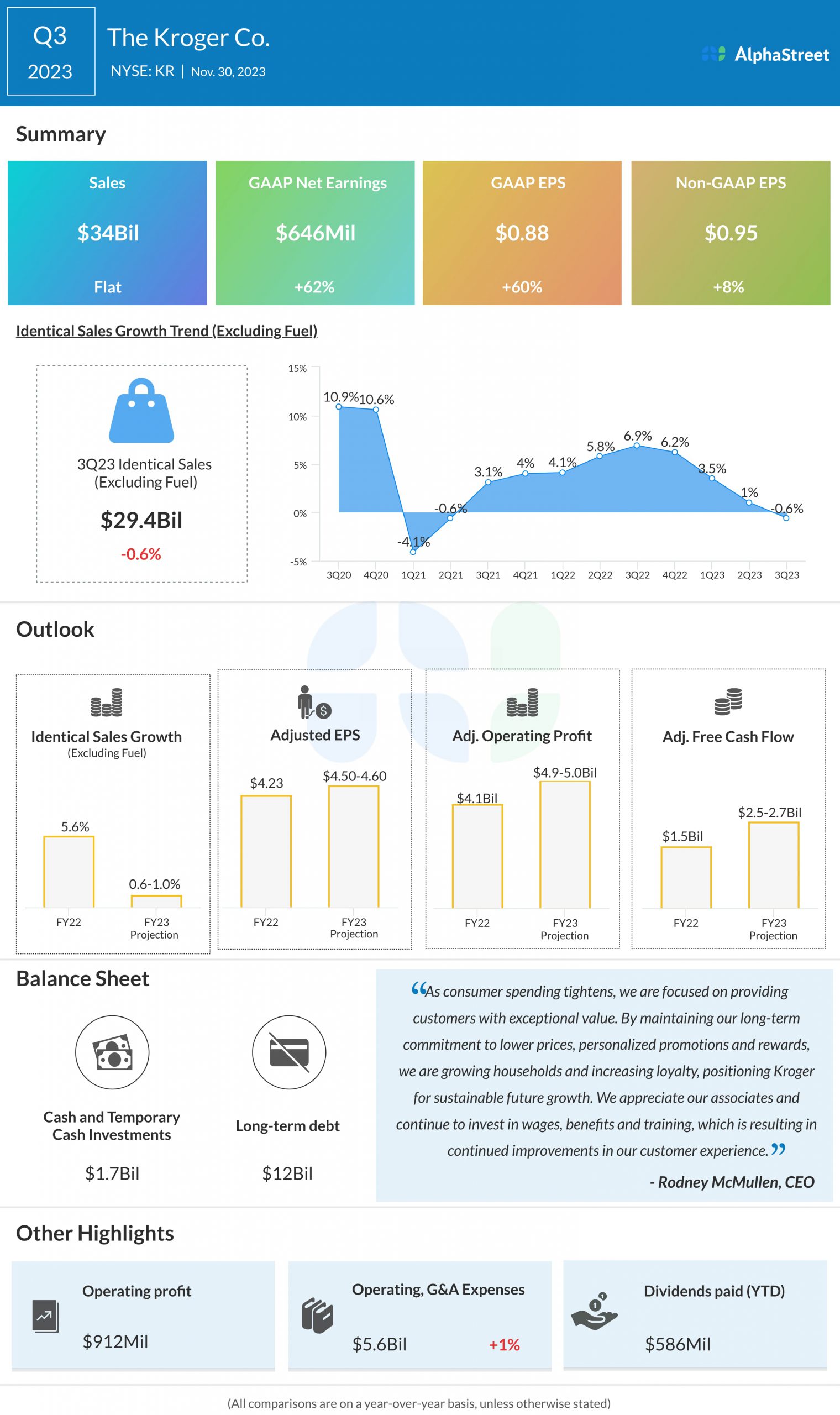

In recent years, the store operator impressed stakeholders by delivering better-than-expected quarterly profits regularly. In the third quarter, both earnings and the top line exceeded Wall Street’s estimates. Adjusted for one-off items, Q3 earnings per share rose 8% from last year and reached $0.95, while net sales remained unchanged at $34 billion. Identical sales, a key measure that evaluates the performance of existing stores, were down 0.6% year-over-year.

Guidance

For the full fiscal year, the management expects that identical sales will rise at a significantly slower pace of 0.6-1% compared to last year due to the impact of near-term economic pressures and food-at-home disinflation. Currently, the company expects full-year net sales to grow at a slower pace than initially estimated. Meanwhile, it raised the lower end of the adjusted earnings per share guidance range and currently expects 2023 EPS between $4.50 and $4.60.

Kroger is preparing to acquire rival retailer Albertsons for $25 billion. As per the deal, which was announced more than a year ago, the companies are offloading several stores to obtain antitrust clearance. After clearing regulatory hurdles, the transaction is expected to close in early 2024.

Kroger’s stock mostly traded lower on Tuesday, after opening the session slightly higher. The shares remained below their 12-month average.