Shares of Macy’s Inc. (NYSE: M) were down 2.7% in morning trade on Wednesday. The stock has gained 37% since the beginning of the year. A day ago, the retailer reported fourth quarter 2020 earnings results which surpassed expectations. Digital played a key role in driving sales growth during the period. The company expects to see a recovery in 2021 and the digital channel is expected to help fuel this pickup significantly.

Quarterly performance

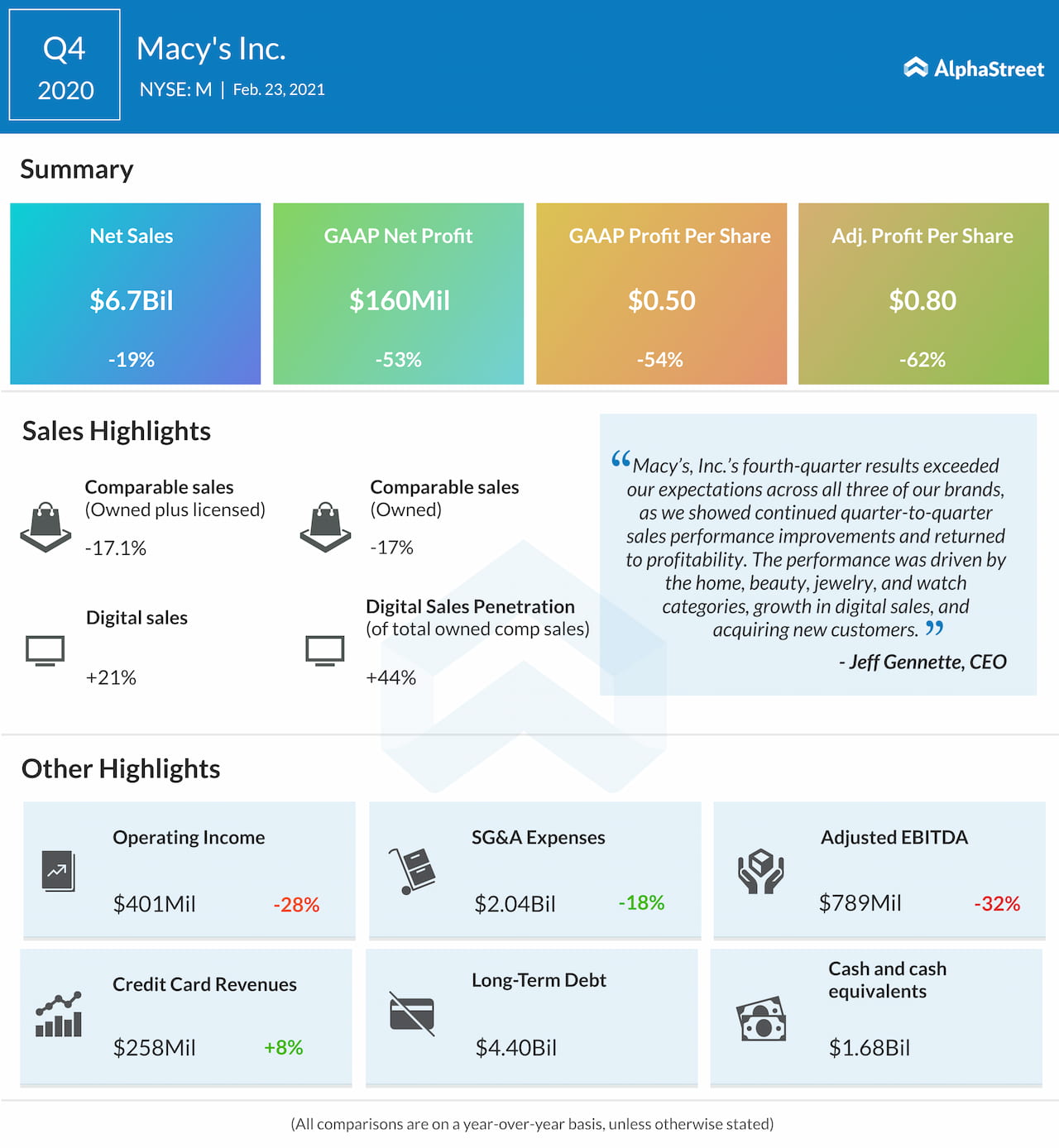

Sales dropped 19% year-over-year to $6.7 billion while adjusted EPS of $0.80 was down 62% compared to $2.12 last year. Comparable sales were down 17% on an owned basis and 17.1% on an owned plus licensed basis as the impacts from the COVID-19 pandemic continued to hurt operations. Despite the declines, the results were better than expected.

Digital strength

The digital channel remains an area of strength for Macy’s. Digital sales grew 21% over Q4 2019 to $3 billion and digital penetration stood at 44% of net sales compared to 30% in the year-ago period. Macy’s saw strong holiday demand in November and December which carried forward into January and the company benefited from its investments in its digital channel, in-store facilities and assortments.

Macy’s gained 7 million new customers in the fourth quarter, most of them through the digital channel. The number of digital-only customers rose 50% from the prior year period to over 6 million during the quarter. The pandemic continued to hurt mall traffic during the quarter which led to a decline in overall store sales. This decline was partly offset by strength in the digital channel.

The company’s store fleet played a meaningful role in sustaining the digital momentum. Approx. 25% of Macy’s digital sales were fulfilled in its stores. On its quarterly conference call, the company said that stores form a key part of its digital strategy as it has observed its digital sales growth rate drop meaningfully when stores are closed both in multi-store markets and single-store markets.

Macy’s invested significantly in its digital, supply chain and technological capabilities to better integrate its physical and digital channels in order to improve the shopping experience for its customers. These investments have paid off and the company expects approx. $10 billion in sales to come from the digital channels by 2023.

Outlook

Macy’s considers 2021 to be a year of recovery and rebuilding. Net sales are expected to grow 14-20% over 2020 to a range of between $19.75 billion to $20.75 billion. Adjusted EPS is expected to be $0.40-0.90. About 65% of net sales are expected to come from stores while around 35% are expected to come from the digital channel. In the first quarter of 2021, Macy’s expects net sales of $4.2-4.3 billion and an adjusted loss per share of $0.52-0.45.

Over the long term, the company expects annual sales comps of low single digits as the business sees a normalization. Digital penetration is expected to exceed 40%. On the other hand, the store channel is expected to see low to mid single digit comp store sales declines as malls are likely to see headwinds even after the pandemic subsides in 2021 and 2022.

Click here to read the full transcript of Macy’s Q4 2020 earnings conference call