Mixed results

Business performance

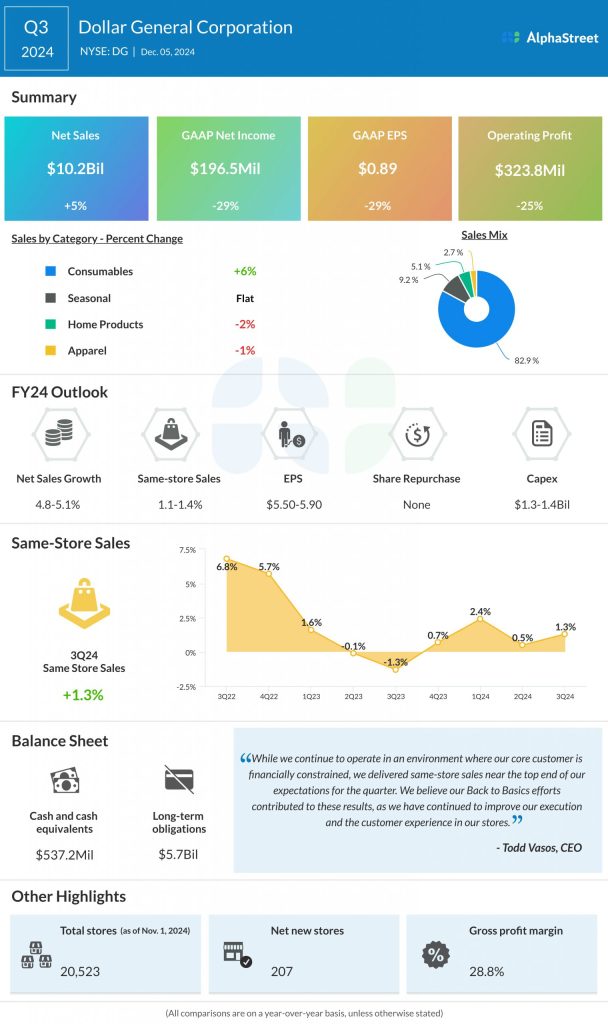

In Q3, Dollar General’s same-store sales rose 1.3%, helped by a 1.1% growth in average transaction amount and a 0.3% rise in customer traffic. The company saw growth in the consumables category while the home, seasonal, and apparel categories witnessed weakness.

Sales in the consumables category increased 6.4% YoY to $8.4 billion. Sales in the seasonal category remained flat at $940 million. Apparel sales dropped 1.2% to $275.1 million while sales for home products fell 2.3% to $522.3 million.

DG’s gross margin decreased 18 basis points to 28.8% in Q3, mainly due to higher discounts and inventory damages, as well as a large part of sales coming from the consumables category. This was partly offset by higher inventory mark-ups, lower shrink and lower transportation costs.

During the third quarter, the company opened 207 new stores, remodeled 434 stores, and relocated 27 stores.

Updated outlook

DG updated its outlook for fiscal year 2024 to include the negative impact from the multiple hurricanes that hurt its business in the third quarter. The company incurred hurricane-related expenses of $32.7 million in Q3 and estimates a negative impact of approx. $10 million in Q4 2024.

The discount retailer now expects net sales to grow approx. 4.8-5.1% in FY2024, versus its previous expectation of 4.7-5.3%. Same-store sales are now expected to grow 1.1-1.4% versus the prior range of 1.0-1.6%. EPS is now expected to range between $5.50-5.90 versus the previous range of $5.50-6.20.