Better-than-expected results

Business performance

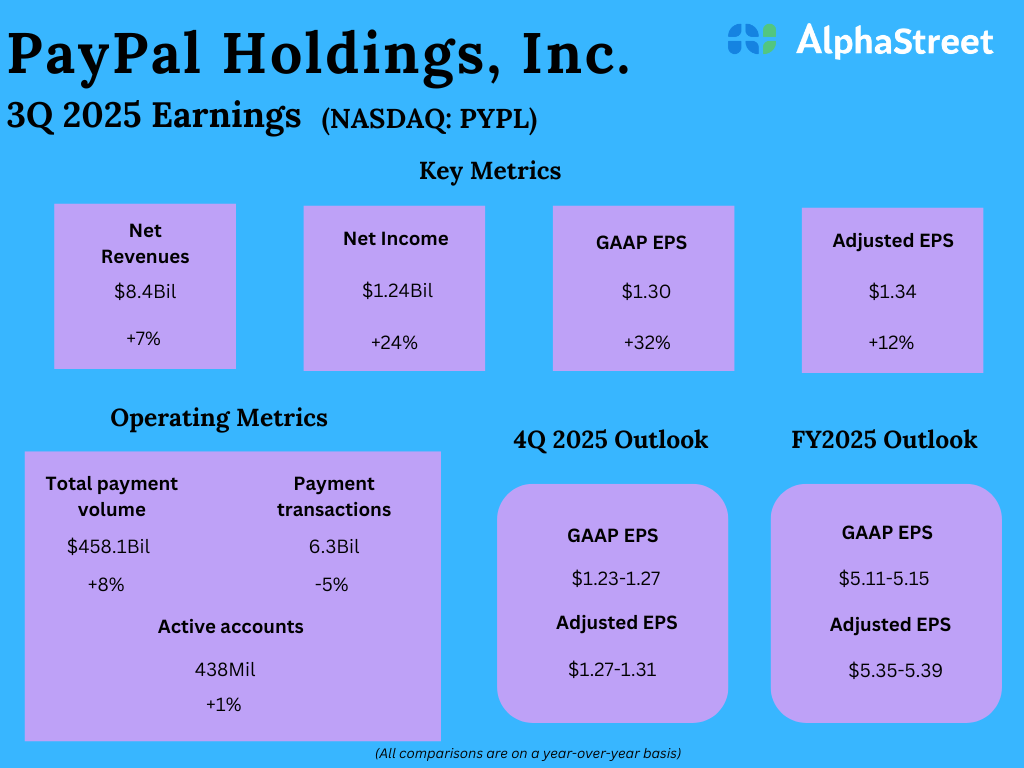

In the third quarter, transaction margin dollars increased 6% to $3.9 billion. Total payment volume increased 8% while payment transactions decreased 5%. The drop in payment transactions reflected lower Enterprise Payments transactions. Active accounts rose 1% and monthly active accounts were up 2%, with contributions from PayPal consumer accounts and Venmo.

In Q3, PayPal saw a 6% growth in transaction revenue, driven by growth across the portfolio, including branded experiences, PSP, and Venmo. Revenue from other value-added services grew 15%, driven by strength in consumer and merchant credit. US revenues grew 5% to $4.7 billion while international revenues rose 10% to $3.6 billion YoY.

PayPal announced it is partnering with OpenAI to offer instant checkout and faster payments processing to users and merchants through the adoption of the Agentic Commerce Protocol. This partnership will provide ChatGPT users with faster and more convenient payments and commerce services.

Guidance hike

Based on its strong quarterly performance, PayPal raised its outlook for the full year of 2025. The company now expects transaction margin dollars to range between $15.45-15.55 billion versus the prior expectation of $15.35-15.50 billion.

GAAP EPS is now expected to range between $5.11-5.15 and adjusted EPS is expected to range between $5.35-5.39 in FY2025 versus the previous ranges of $4.90-5.05 for GAAP EPS and $5.15-5.30 for adjusted EPS.

For the fourth quarter of 2025, PYPL expects transaction margin dollars of $4.02-4.12 billion, GAAP EPS of $1.23-1.27, and adjusted EPS of $1.27-1.31. This outlook represents a YoY growth of 2-5% in transaction margin dollars and 7-10% in adjusted EPS.