A week ago, Corona beer maker Constellation Brands (STZ) upped its stake in the world’s largest medical marijuana company Canopy Growth (NYSE: CGC) by acquiring 104.5 million shares of the Canada-based company for C$48.6 per share. The winemaker had already invested $191 million in Canopy last October. In the last one week, Canopy has skyrocketed over 50% and on Tuesday the stock grew 3.01% to $38.67.

You may also like: Constellation increases stake in Canopy Growth

Trading in cannabis stocks was higher on Tuesday as these companies announced supply agreements with retail operators ahead of the launch of the cannabis recreational market in October 2018. Canadian-based pot company Cronos Group (Nasdaq: CRON) that got listed on Nasdaq in February this year, announced its initial supply agreements for retail distribution across Canada. Shares of Cronos Group jumped 13.25% to $8.29 in Nasdaq when the market closed yesterday.

Another Canadian marijuana company Tilray (Nasdaq: TLRY), which was listed in the US in July, surged 11.25% to $39.94 at the end of Tuesday’s trading session. This was helped by the Ontario Cannabis Store’s announcement of supply agreements with 26 authorized cannabis manufacturers, including Tilray.

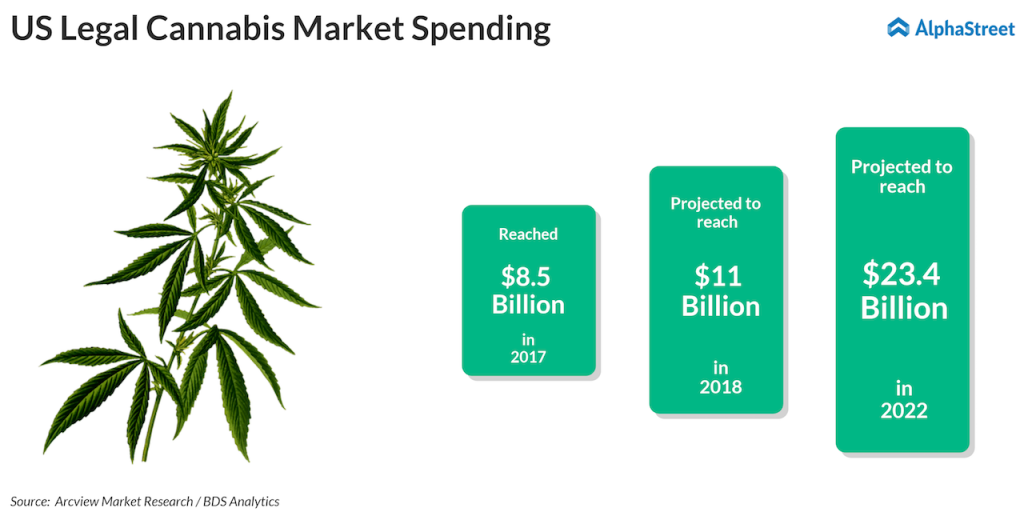

A report released by Arcview Market Research/BDS Analytics in June 2018 states that the US legal cannabis market is estimated to reach $11 billion in consumer spending in 2018 and $23.4 billion in 2022. The report adds that the global spending is expected to hit $32 billion by 2022. Also, the roll-out of international legalization is touted to reduce the US share from 90% in 2017 to 73% in 2022.

In its February 2018 report, Arcview Market Research/BDS Analytics stated that the global spending on legal cannabis is estimated to reach $57 billion by 2027 with North America accounting for $47.3 billion. However, headwinds like volatility in the marijuana industry and inconsistent regulations might curtail the expansion opportunities for marijuana producers.