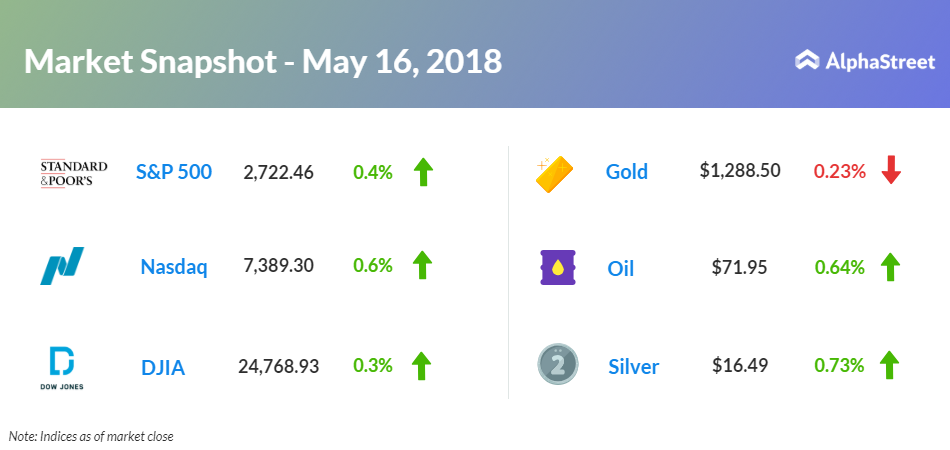

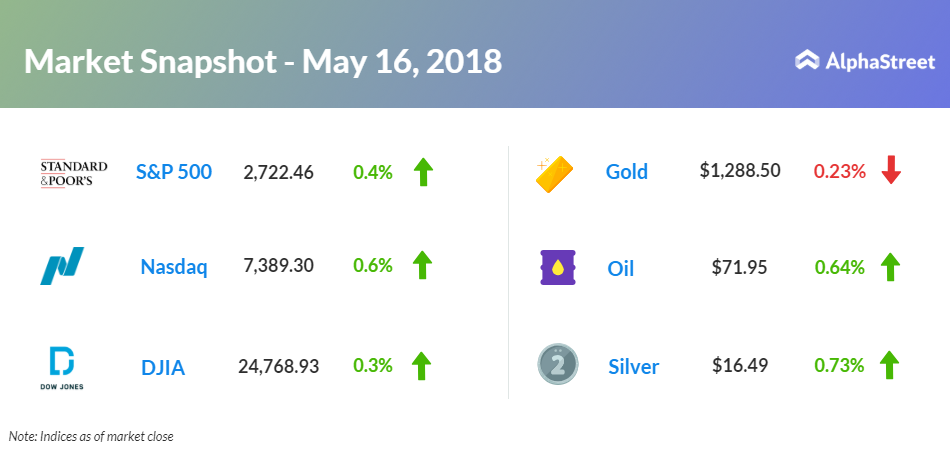

On May 16, US ended higher, with Dow moved up 0.3% to 24,768.93. Nasdaq advanced 0.6% to 7,398.30, and S&P 500 gained 0.4% to 2,722.46. Traders reacted positively to Macy’s (M) earnings, which came in ahead of Street’s expectations.

On the economic front, the Labor Department report showed unemployment benefit claims rose by more-than-expected in the week ended May 12. Initial jobless claims rose by 11,000 to 222,000 from an unrevised level of 211,000 in the previous week. The less volatile 4-week moving average fell by 2,750 to 213,250.

A report from the Philadelphia Federal Reserve showed an unexpected acceleration in the pace of growth in regional manufacturing activity in May. The diffusion index for current general activity increased to 34.4 in May from 23.2 in April. This was due to a significant jump in new orders growth. The diffusion index for future general activity dropped to 38.7 in May from 40.7 in April.

A Conference Board report showed a continued uptrend by its leading economic indicators in the month of April. Leading economic index rose 0.4% in April, matching the upwardly revised growth in March. The coincident economic index increased 0.3% in April after rising 0.2% in March, and the lagging economic index rose 0.3% in April after inching down 0.1% in March.

After announcing their earnings results today, Walmart (WMT) stock slid 0.89% after unrealized losses on equity investment in JD.com hurt first-quarter earnings. J C Penney (JCP) stock fell 10.89% after weak quarterly performance and outlook. The Children’s Place (PLCE) stock slipped 8.37% after first-quarter earnings missed Street’s expectations. Dillard’s (DDS) stock jumped 8.64% after upbeat first-quarter earnings. Applied Materials (AMAT) stock declined 1.75% ahead of its second-quarter results.

Crude oil future is up 0.64% to $71.95. Gold is trading down 0.23% to $1,288.50, while silver is up 0.73% to $16.49. On the currency front, the US dollar is trading up 0.52% at 110.846 yen. Against the euro, the dollar is down 0.15% to $1.1792. Against the pound, the dollar is down 0.03% to $1.3508.