Specialty retailer of kids’ merchandise, The Children’s Place (PLCE), saw its stock slipping 3.26% on Thursday during pre-market trading. The company posted weaker-than-expected earnings for the first quarter of 2018, negatively impacted by winter storms and unseasonably cold temperatures that persisted across the major markets.

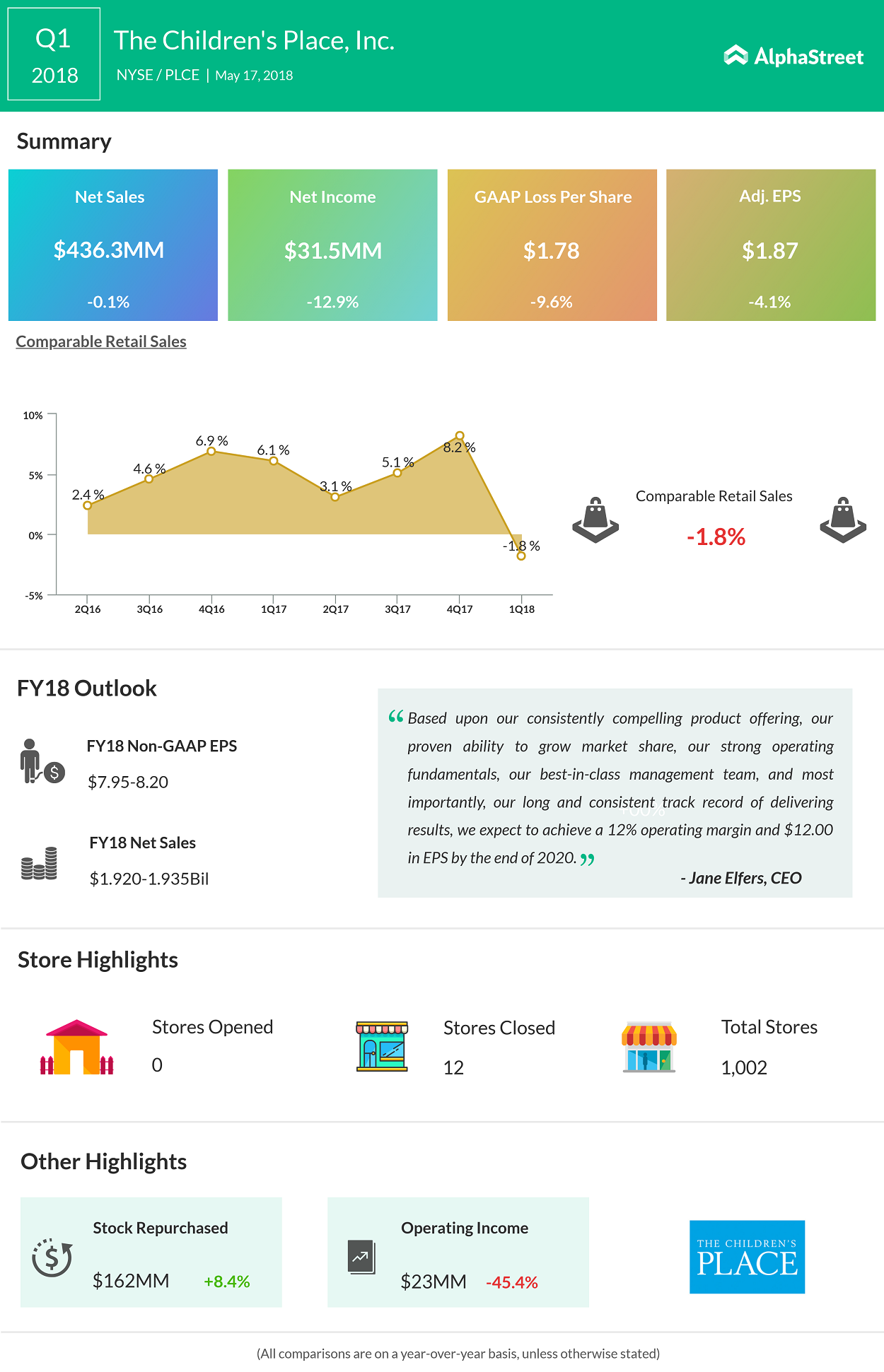

The Secaucus, NJ-based firm saw its earnings fall to $31.5 million or $1.78 a share from $36.2 million or $1.97 a share a year ago. Excluding items, earnings fell to $1.87 a share from $1.95 a share. Sales fell marginally by 0.1% to $436.3 million, and comparable retail sales slipped 1.8% in the first quarter of 2018.

Recently, the company signed an exclusive licensing agreement with a Chinese specialty kids’ apparel retailer Zhejiang Semir Garment. This deal enables Children’s Place to expand into Greater China. This partnership is expected to generate sales between $125-150 million by 2022.

The company’s successful turnaround is due to the CEO Jane Elfers. Under her leadership, the company began closing the oversized stores as well the ones with overpriced leases. And by 2020, the company plans to close some 300 stores. During the first quarter, the company closed 12 stores and did open any new store. Children’s Place ended the first quarter with 1,002 stores, and under the fleet optimization initiative that was introduced in 2013, the Company has closed 181 stores.

For Fiscal 2018, the retailer is expecting adjusted earnings to be in the range of $7.95-$8.20 a share. Total net sales is expected to be in the range of $1.920-$1.935 billion, and a comparable retail sales rise of about 3.5- 4.5%. For the upcoming second quarter, EPS is expected to be in the range of $0.51-0.61.

“The strong sales momentum has continued, and quarter to date, we are currently running a positive 24% comp. We expect that this pent-up demand for seasonal product will continue and enable us to deliver strong second quarter results,” said Elfers.