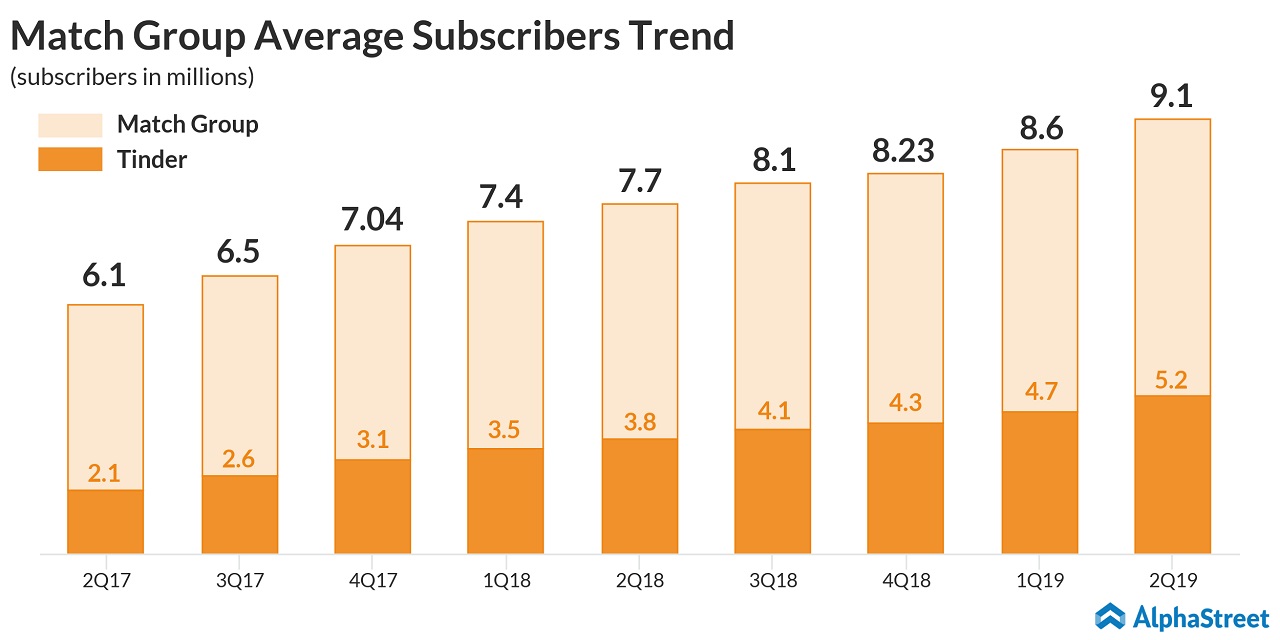

Match Group Inc. (Nasdaq: MTCH) reported better-than-expected revenues and profit for the second quarter of 2019, aided mainly by a further strong increase in the memberships for its search app Tinder. The strong results sent the stock shooting 16% during post-market hours.

The Dallas, Texas-based company, which offers popular dating platforms such as Tinder, OkCupid and Match.com, posted a net profit of 43 cents per share for the June quarter, compared to $0.45 per share in the year-ago quarter. This was better than analysts’ estimate of 40 cents per share.

Revenue grew 18% annually to $498 million, driven by an 18% increase in

average subscriber growth and a slight rise in revenue per user, which was

partially offset by unfavorable foreign exchange effects. Analysts had expected

revenue of $488.96 million.

At 5.2 million, average subscribers for Tinder were 1.5 million

higher compared to last year.

The average revenue per user, excluding foreign exchange effects, moved up 2% to $0.58 during the three-month period.

READ: Meet Group reports Q2 earnings beat, but Q3 sales outlook disappoints

The stock has gained 74% since the beginning of this year and 94% in the trailing 12 months.

The dating company said it repurchased 0.8 million shares during the quarter ended June 30, 2019, for $56 million.