Merck & Co., Inc. (NYSE: MRK) reported stronger than expected earnings for the fourth quarter of 2019. However, the company’s sales slightly missed the forecast. The stock declined early Wednesday immediately after the announcement.

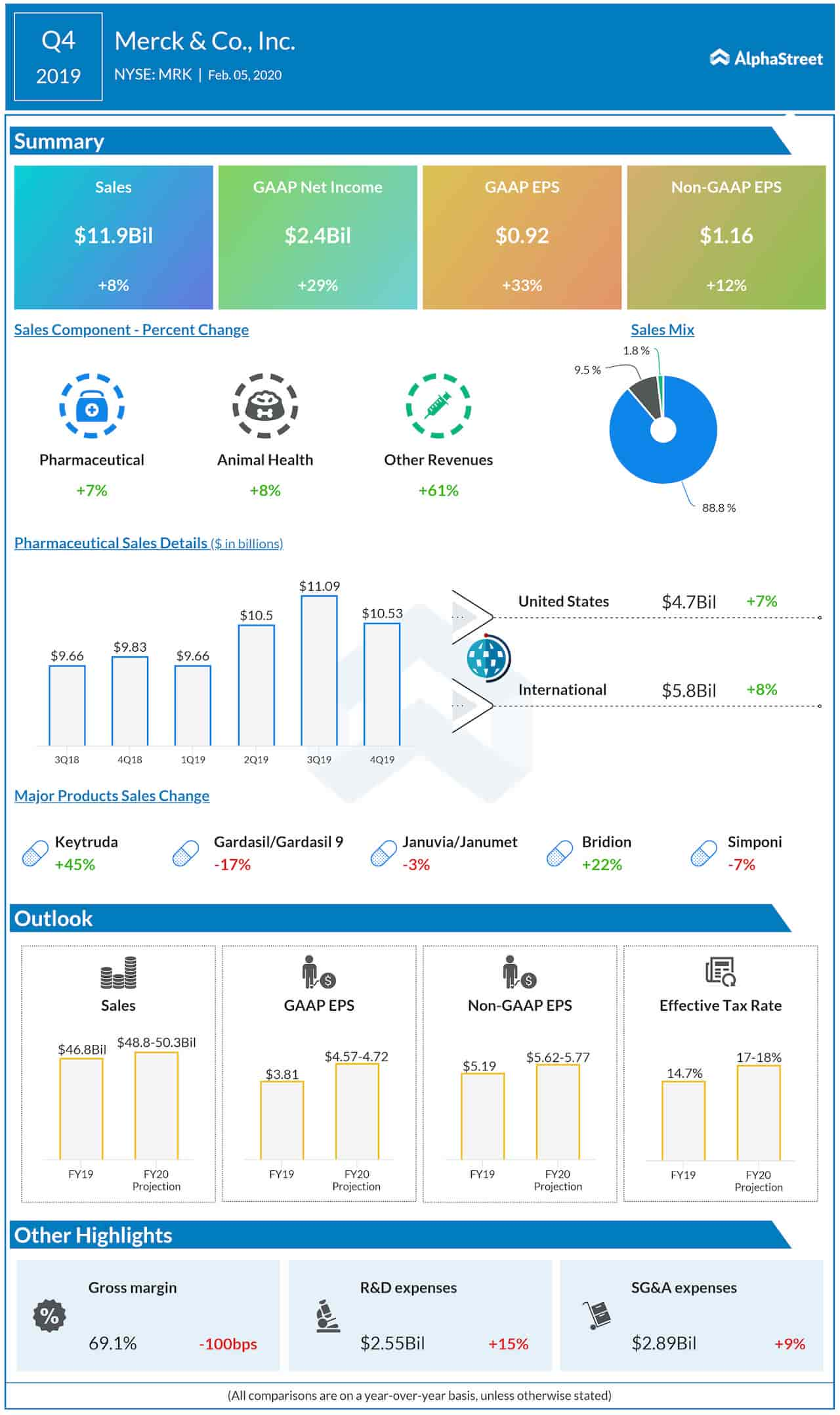

Worldwide sales of the drugmaker rose 8% year-over-year to $11.87 billion but fell short of expectations. Excluding foreign exchange impacts, sales grew 9%. The top-line benefitted from the strength of oncology and human health vaccines.

Net earnings, on an adjusted basis, rose to $1.16 per share from $1.04 per share in the fourth quarter of 2018 and exceeded the market’s forecast.

Unadjusted net income advanced to $2.36 billion or $0.92 per share from $1.83 billion or $0.69 per share last year.

“As evidenced by our results and our 2020 guidance, Merck had an extraordinary year and is in a position of operational and financial strength. It is this position of strength, born of our focused execution, that gives us the confidence to spin off our Women’s Health, trusted Legacy Brands and Biosimilar products into a new company,” said CEO Kenneth Frazier.

Outlook

Looking ahead, the company expects worldwide sales to be between $48.8 billion and $50.3 billion in fiscal 2020, which includes a negative impact of about 1% from foreign exchange. Full-year unadjusted earnings are expected to be in the range of $4.57 per share to $4.72 per share. The management is looking for adjusted earnings per share of $5.62-$5.77 for the year.

Reorganization

Merck said it is considering a spin-off of its Women’s Health business, trusted legacy brands, and biosimilar products into a new company so as to focus on the “key growth pillars.”

During the quarter, the company’s cancer drug KEYTRUDA obtained FDA approval for use as monotherapy for the treatment of patients with high-risk, non-muscle invasive bladder cancer.

Updates

As part of diversifying its oncology portfolio, the company closed the acquisition of ArQule last month. It also entered into a tie-up with Taiho Pharmaceutical and Astex Pharmaceuticals focused on the development of small-molecule inhibitors against several drug targets.

Related: Merck Q3 2019 Earnings Conference Call Transcript

ADVERTISEMENT

Merck’s shares dropped during Wednesday’s premarket session, soon after the earnings announcement. The stock had closed the last session higher.