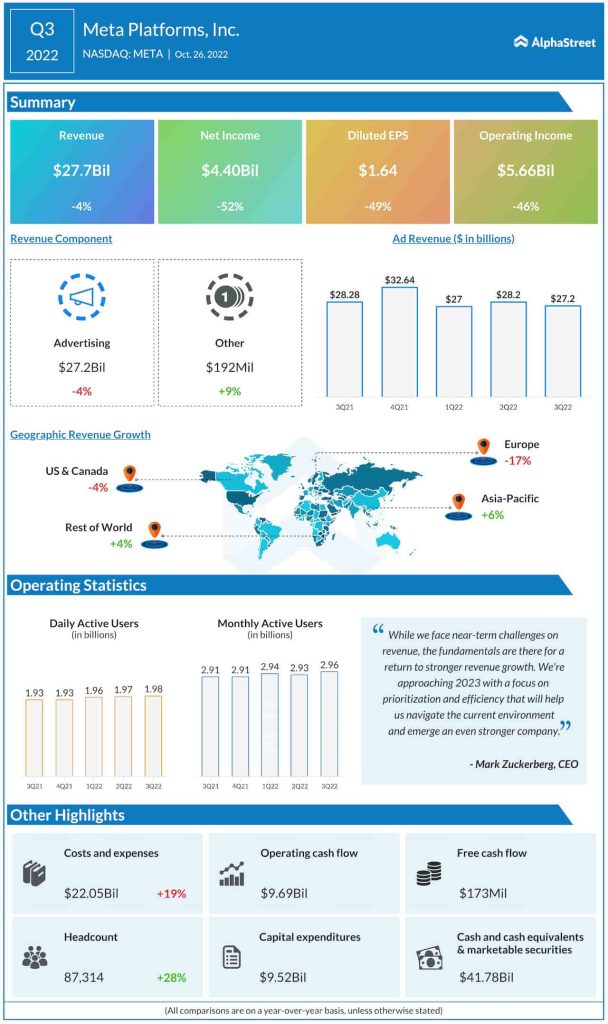

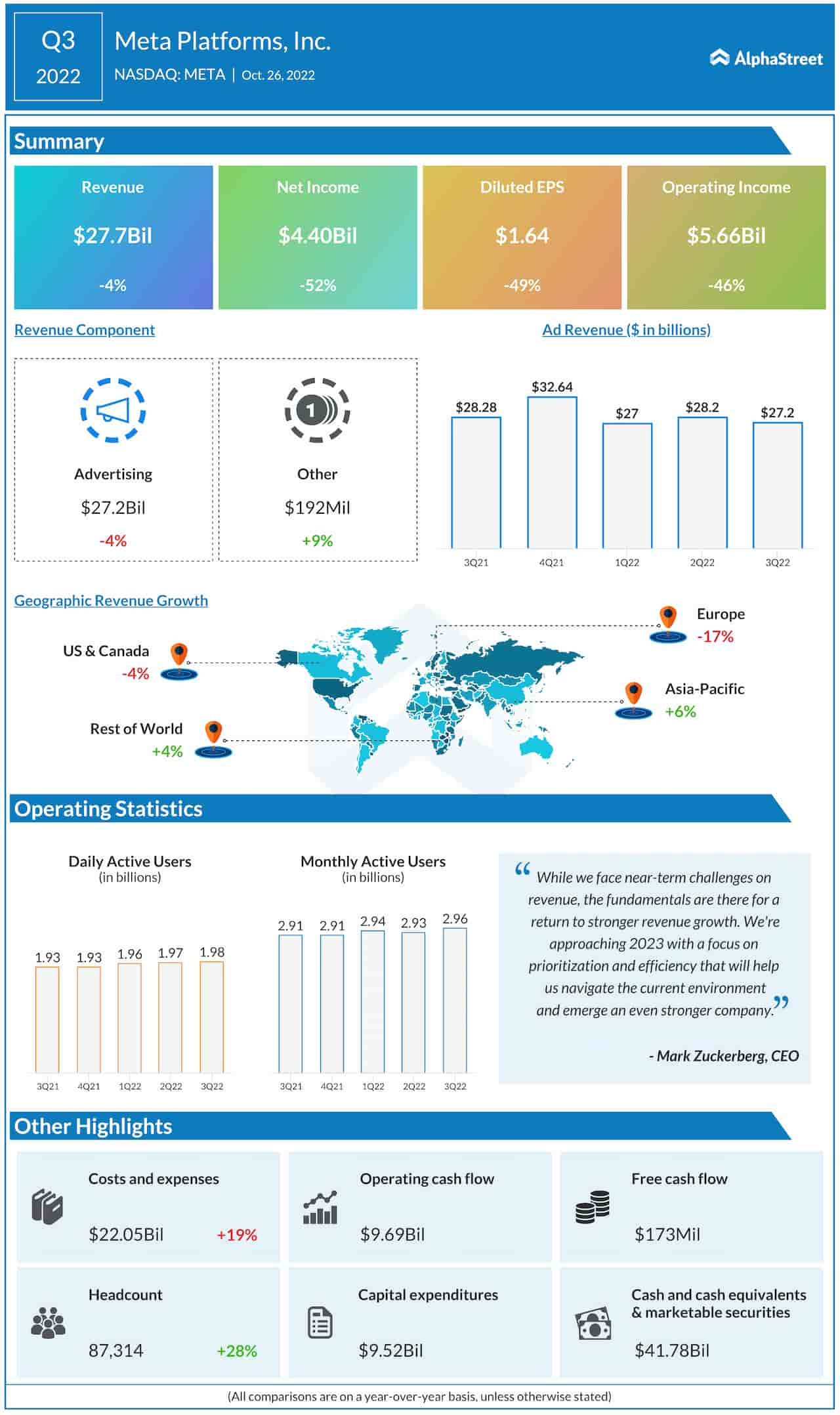

Third-quarter revenues decreased by 4% to $27.7 billion, mainly reflecting a slowdown in the demand for advertising services. At the end of the quarter, the company had 2.96 billion monthly active users even as the number of daily active users rose by 3%.

Reflecting the weak top-line performance, third-quarter net profit decreased to $4.40 billion or $1.64 per share from $9.19 billion or $3.22 per share in the same period of 2021. Earnings also fell short of expectations.

Check this space to read management/analysts’ comments on Meta Platform’s Q3 2022 earnings

Meta’s stock has lost a dismal 60% in the past twelve months. It closed Wednesday’s regular trading lower and lost further in the after-hours following the earnings release.