Q3 Report on Tap

The company’s stock reached a record high in mid-October before modestly retreating in subsequent weeks. Year-to-date, MNST has climbed 27%—outpacing the S&P 500’s performance. With resilient demand for its core offerings and a favorable multi-year outlook for the energy drink category, the stock appears well-positioned to extend its momentum in the near term.

Key Metrics

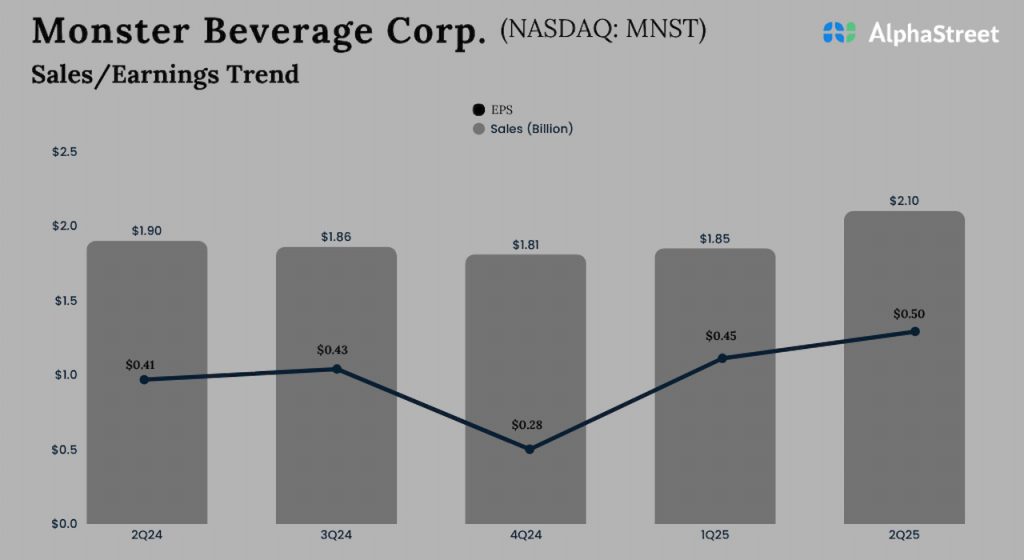

In the second quarter, Monster’s net sales increased 11% to $2.11 billion from $1.90 billion in the same period a year earlier. On a currency-adjusted basis, sales were up 11.4%. The top line came in slightly above expectations, after missing in the prior quarter. Adjusted earnings, excluding one-off items, climbed 25% to $0.51 per share from $0.41 per share in Q2 2024. On an unadjusted basis, net income was $488.8 million or $0.50 per share in the June quarter, compared to $425.4 million or $0.41 per share a year ago.

From Monster Beverage’s Q2 2025 Earnings Call:

“We believe our portfolio of energy drink offerings is well-positioned to participate in the growing global energy drink category, appealing to a broad range of consumers across geographies, price points, and need states. Innovation continues to be an important contributor to category growth, and we maintain a robust innovation pipeline. Our marketing messaging continues to resonate globally. Highlights from the second quarter include the continued successes of our sponsorship and endorsement activities, including our McLaren Formula One team sponsorship, UFC and MMA, Summer X Games, Supercross and Motocross, and Stagecoach Music Festival, among others.”

High Spirits

Recently, the company launched Monster Energy Lando Norris Zero Sugar in select EMEA markets, with plans for a broader introduction in the second half of the year. It is on track to roll out the Juice Monster Pipeline Punch. While the business has remained resilient to new import duties to a large extent, the tariff landscape continues to be complicated and dynamic. That is a concern because Monster imports some raw materials into the US and exports certain raw materials as well as some ot its finished products.

The average price of Monster Beverage’s stock for the past 12 months is $58.77. On Monday, the shares opened at $66.82 and tarded sllightly lower in the early hours of the session.