NetApp Inc. (NTAP) reported a 39% jump in earnings for the second quarter driven by strong product revenues. The results exceeded analysts’ expectations. The data storage provider guided third-quarter earnings and revenue in line with consensus. Despite this, shares of the company inched down over 5% during extended hours of trading.

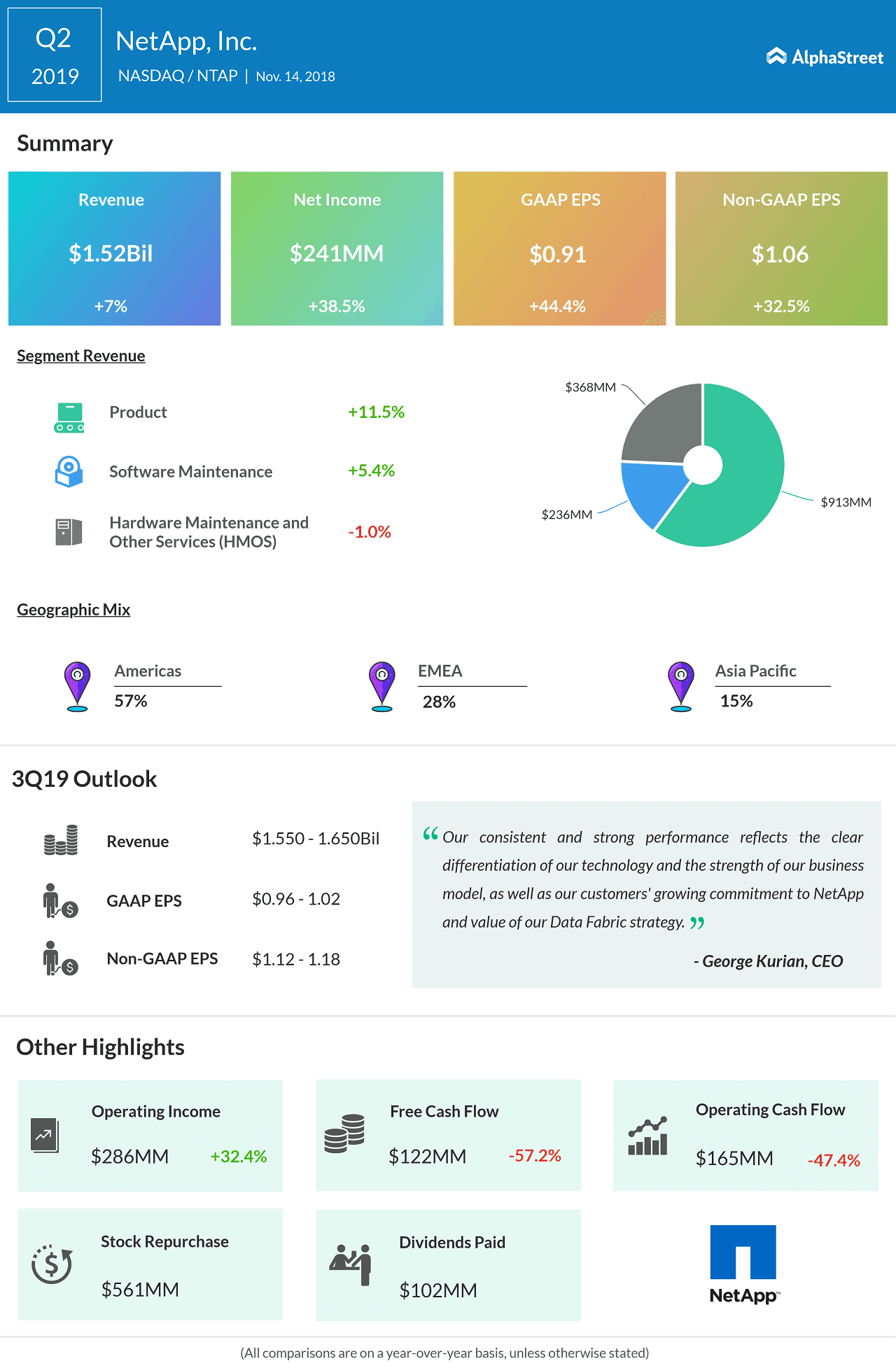

Net income climbed by 39% to $241 million or $0.91 per share. Non-GAAP earnings jumped by 32.5% to $1.06 per share. Revenue rose by 7% to $1.52 billion.

Looking ahead into the third quarter, the company expects net revenues in the range of $1.55 billion to $1.65 billion and GAAP earnings in the range of $0.96 to $1.02 per share. Non-GAAP earnings are anticipated to be in the range of $1.12 to $1.18 per share.

For the second quarter, product revenues increased 11% year-over-year helped by a rise in revenue from strategic product and higher mature product revenues. Revenue from software maintenance rose by 5.3%, while that from hardware maintenance declined by 1.1%.

On a geographic mix, the majority of the revenue came from the Americas of 57% as Americas Commercial provided a large share in the revenue accumulation. The US Public Sector contributed a 14% while EMEA and the Asia Pacific assisted in a 28% and 15% of revenue share, respectively.

All-flash array annualized net revenue run rate of $2.2 billion increased 29% year-over-year. Cloud data services net revenue run rate was $27 million for the second quarter.

The next cash dividend of $0.40 per share will be paid on January 23, 2018, to shareholders of record as of January 4, 2018. The company has returned $663 million to shareholders through share repurchases and cash dividends.

Shares of NetApp ended Wednesday’s regular trading session down 1.09% at $78.03 on the Nasdaq. The stock has risen over 41% in the year so far and over 71% in the past year.