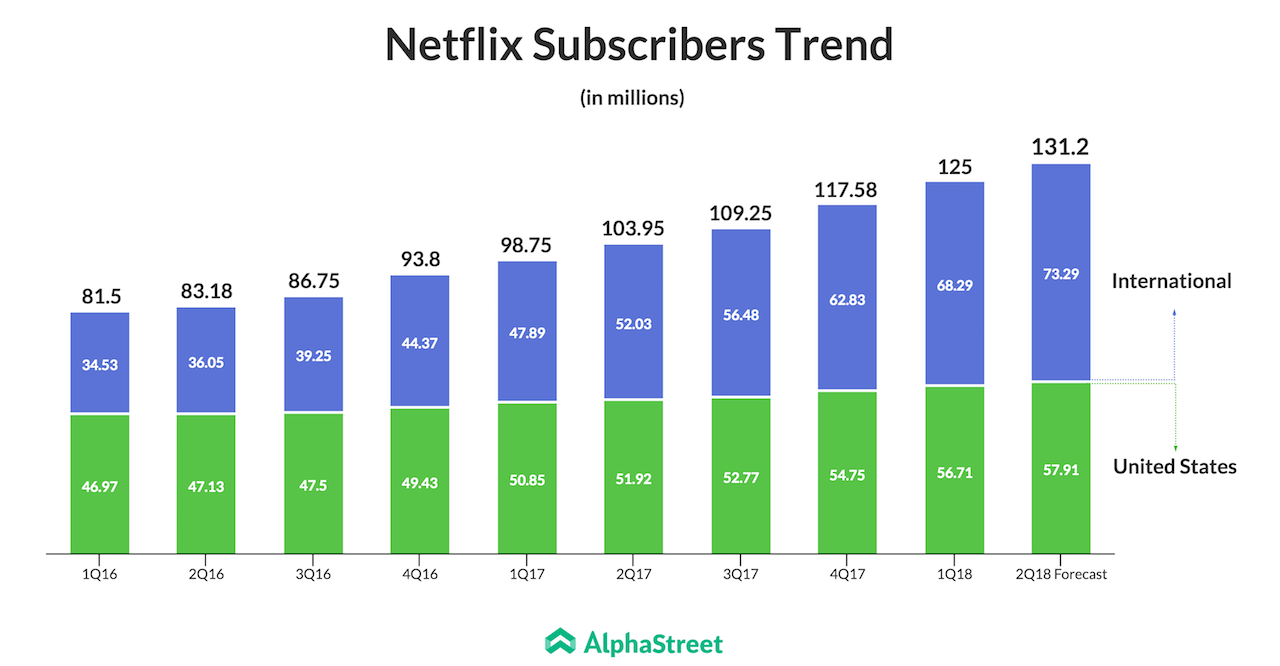

For the second quarter, the management expects to further add 6.2 million members of which, around 5 million is expected to come from foreign markets. It may be noted that Netflix is known for giving a conservative outlook, which helps it to consistently beat expectations. Going by the trend, the streaming giant should add around 7 million customers this quarter.

RELATED: 6 headwinds to Netflix’s growth that you neglected

Keep track of any management comments on the progress of its international expansion, especially in India, where internet consumption is seeing a tremendous increase.

While some analysts and many investors see Netflix as a high-valuation stock, not many seem concerned by its long term prospects. Meanwhile, the influx of promising entrants at regular intervals, as well as entry plans by some major companies including Disney (DIS) and Apple (AAPL), could pose threat to Netflix’s customer base in the long term. For the short term though, Netflix is the undisputed king.

During the second quarter, Wall Street expects Netflix to report revenue of $3.94 billion, 41% higher than what it reported last year. EPS is expected to jump five-fold to 79 cents per share. Operating margins are expected to more-than-double to 11.9% during this period.

We highly recommend you hit the bull’s eye this Monday.

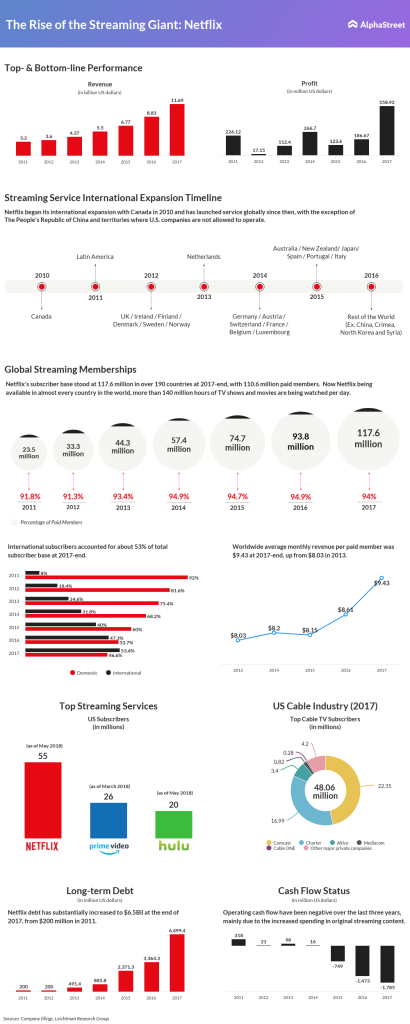

Netflix at a glance – Inforgraphic