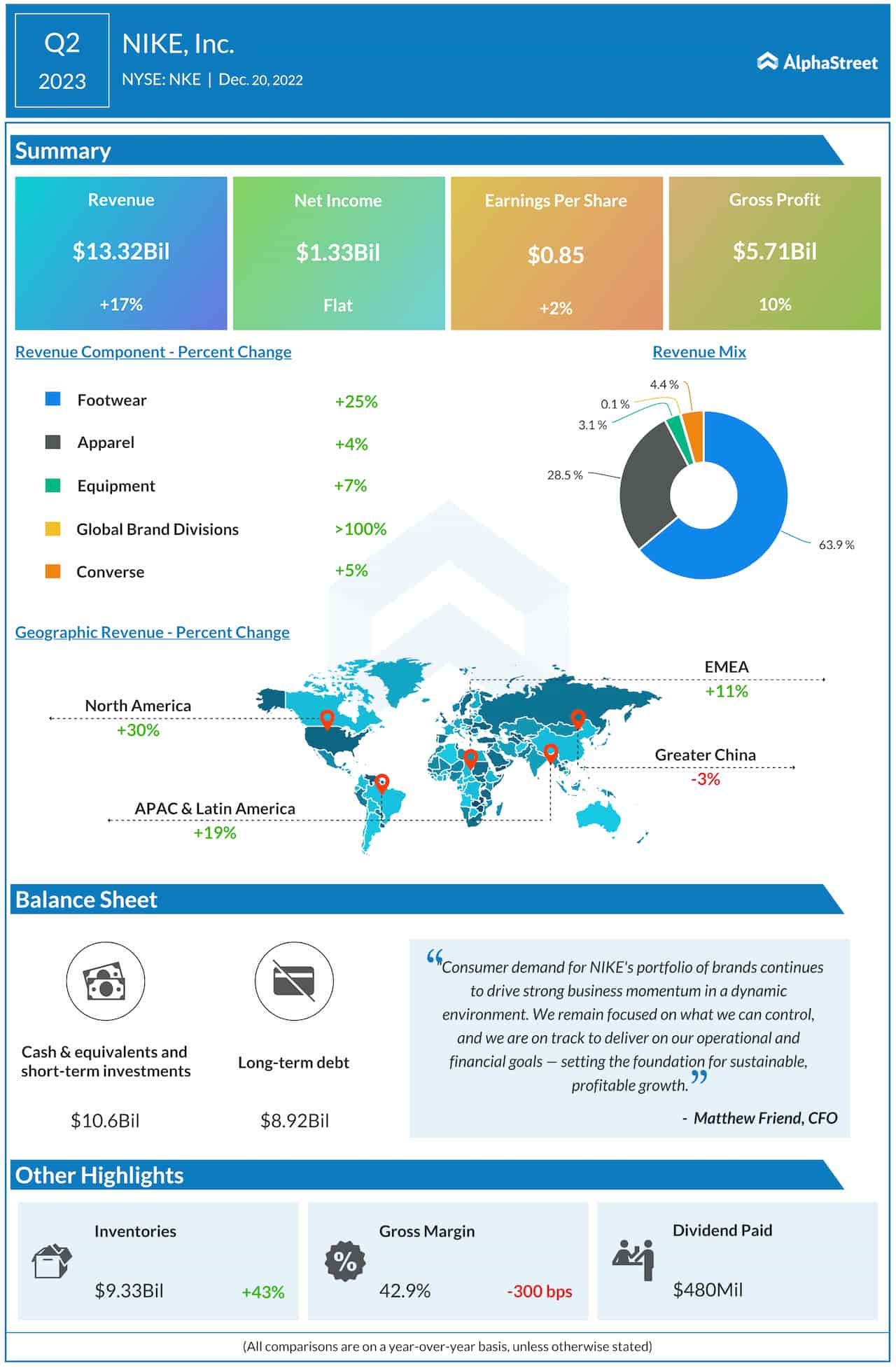

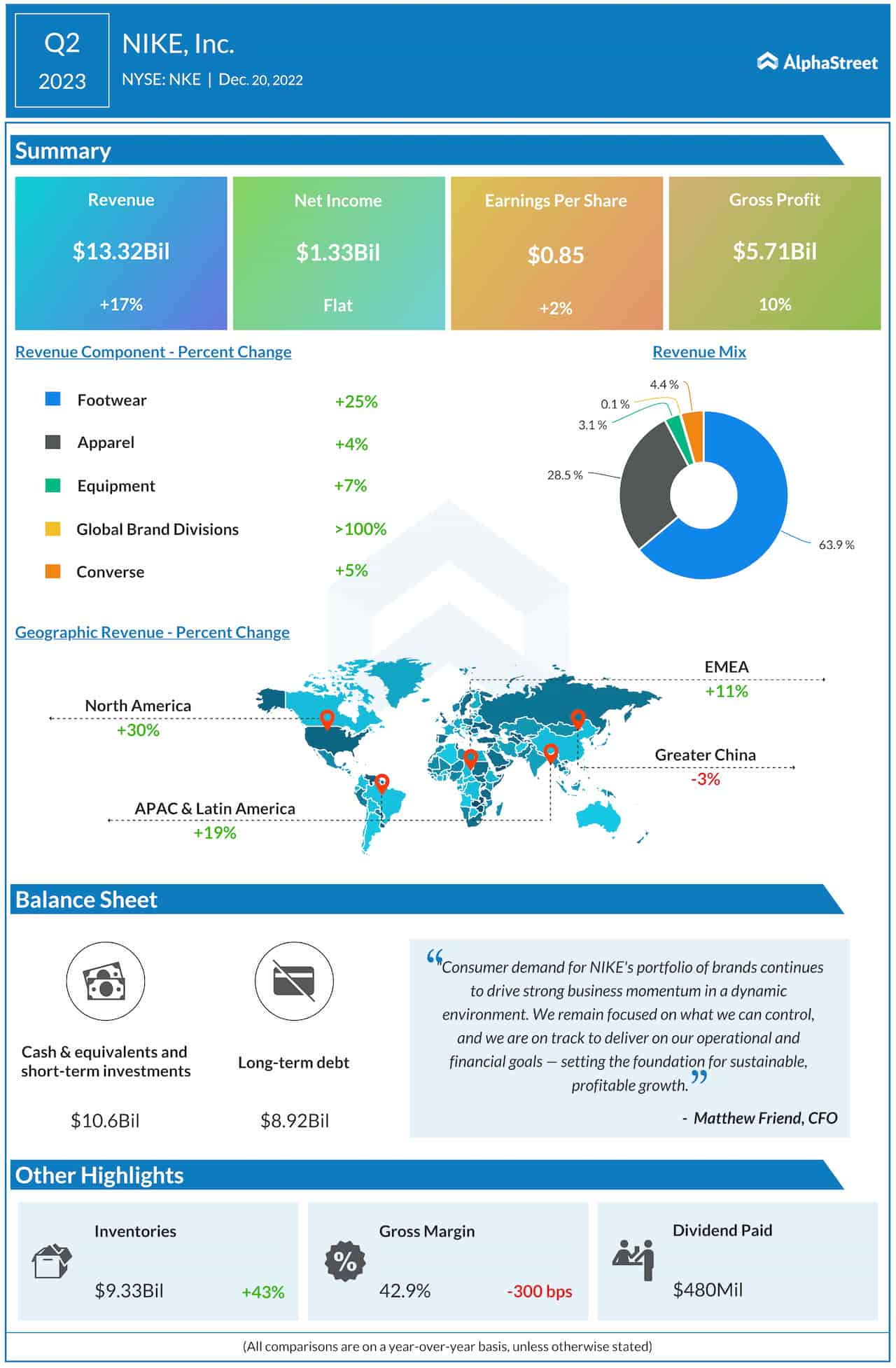

The market downturn, caused by the pandemic initially and more recently by the economic crisis, has been a litmus test for some of the top brands. For sneaker giant Nike, Inc. (NYSE: NKE), it was an opportunity to ascertain the global acceptance of its products. The company has effectively tackled the slowdown and excess inventory by offering discounts, while also maintaining decent margins.

Stock Up

However, the market has not been kind to the Beaverton-based sportswear firm’s stock, which suffered a big loss in the past twelve months. The downturn was broadly in line with the general market trend, with the S&P 500 index slipping to a two-year low recently. But NKE changed course this week and rose an impressive 14% in a single day after the company reported second-quarter earnings.

The rally, which was apparently triggered by the stronger-than-expected numbers, continued in the following session, reflecting investors’ optimism about the Nike brand. Given the bullish outlook on the stock — which is forecast to bounce back and rise well above $100 by next year – it would be wise to buy it at the current lows. The shares traded up 13% on Wednesday afternoon.

Read management/analysts’ comments on quarterly reports

After the pandemic-induced boom died down, the footwear and apparel industry entered a rough patch due to high inflation and recession fears. The positive second-quarter outcome shows that Nike’s strategy to push excess inventory ahead of the holiday season by attracting shoppers with discounts and promotional offers yielded the desired results. The question is how things would play out in the second half of the fiscal year and beyond.

What’s in Store

With inventory pressure easing – which was a major concern – the company should be able to maintain the sales momentum by keeping prices low and ensuring a timely supply of products because demand remains strong. Moreover, the situation in China is improving after authorities relaxed the new COVID curbs, which is significant considering Nike’s high exposure in that market. Recent improvements on the shipping and supply-chain fronts allows the company to better serve customers. On the downside, the measures being adopted for boosting sales, combined with unfavorable exchange rates and elevated logistics costs, would put margins under pressure.

From Nike’s Q2 2023 earnings conference call:

“NIKE is already learning more about our members, which helps us elevate in areas such as product creation, line planning, and the experiences we deliver. And our partners are telling us that these engaged members are driving improved traffic conversion and mutual profitability for them as well. And so, while it’s still early days on this journey, we’re excited by the foundation we’re creating. The ability to give consumers a personalized experience across channels, fueled by data and insight, opens up a whole host of opportunities for us.”

Foot Locker Q3 2022 Earnings: Key financials and quarterly highlights

Though Nike’s bottom line experienced weakness in the early days of the coronavirus outbreak, when movement restrictions curtailed store footfall, it bounced back and soon returned to the pre-pandemic levels. Since then, the company reported strong earnings that consistently topped expectations. An almost similar trend was visible in sales performance also.

Key Numbers

Net profit, on a per-share basis, moved up 2% from last year to $0.85 per share in the November quarter, aided by sales growth across all five operating segments. Revenues increased in double-digits to $13.3 billion and beat analysts’ forecast. Sales grew in all the key regions, except China where the economy is experiencing a slowdown due to the resurgence of COVID-19.