Performance

In the first half of fiscal 2020, before the coronavirus

outbreak, Nike’s revenues grew 9% (11% on a currency-neutral basis) helped by

strong consumer demand and growth in digital sales. The back-half of the year,

particularly the fourth quarter, saw store closures and business disruptions

due to the health crisis, which led to a 4% drop in revenues to $37.4 billion.

The decrease was 2% on a currency-neutral basis.

The company saw revenues drop in footwear, apparel and equipment across all its geographic regions barring Greater China, which alone recorded increases in all three categories for fiscal year 2020. One more example to show how this pandemic brought yet another high-performing giant to its knees.

Digital channel

growth

In fiscal year 2019, digital commerce sales grew 35%. This momentum continued in fiscal year 2020 as well with digital sales increasing 47% fueled by double-digit growth across all geographies. In the fourth quarter of 2020, Nike had to close 90% of its stores for around 8 weeks due to the health crisis. During this period, digital sales rose 75%, making up around 30% of total revenue. Here too the lockdown pushed more people to shop online.

In the fourth quarter, Nike surpassed $1 billion in annual

digital revenue in Greater China and EMEA. The digital channel saw growth

during each month of the quarter with May recording triple-digit growth. These

trends continued through the first three weeks of June and even accelerated in

some markets.

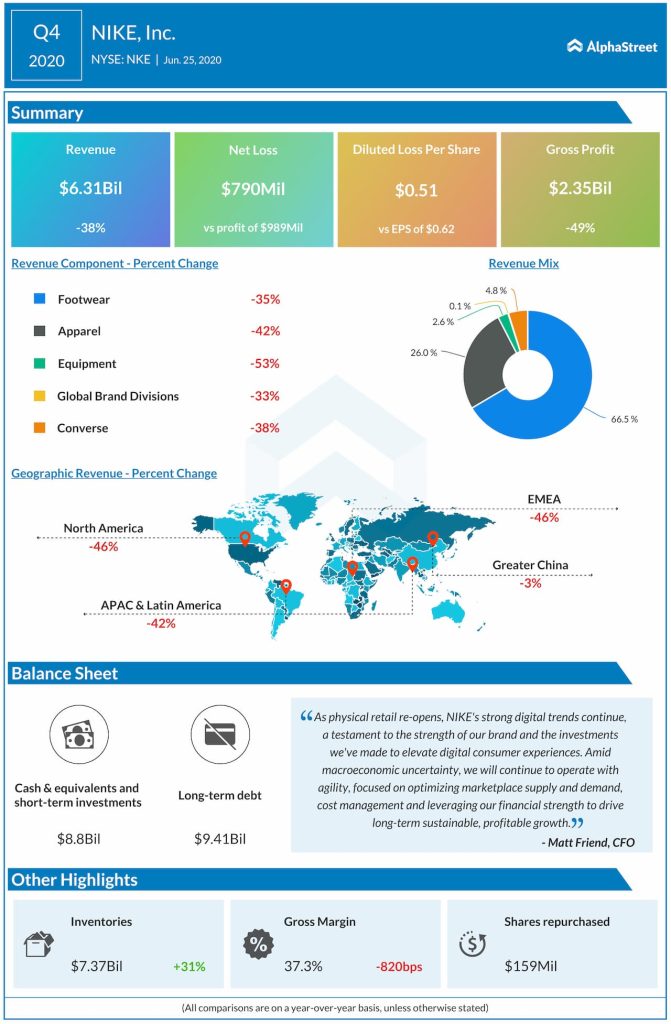

“As physical retail re-opens, NIKE’s strong digital trends continue, a testament to the strength of our brand and the investments we’ve made to elevate digital consumer experiences. Amid macroeconomic uncertainty, we will continue to operate with agility, focused on optimizing marketplace supply and demand, cost management and leveraging our financial strength to drive long-term sustainable, profitable growth.” – Matt Friend, EVP and CFO

In North America, the digital channel saw 80% growth while

in EMEA it rose nearly 100%. Greater China registered a 53% increase while the APLA

region also witnessed an increase of around 80%.

Several experts have already predicted that the trend of transacting online is here to stay. Nike too believes this momentum in digital reflects an ongoing shift towards a new marketplace in future. The company believes the transformation to a digital and direct business will be financially accretive.

Nike had previously aimed to reach 30% digital penetration

by fiscal year 2023 but in the light of its current performance, the company

believes it can reach this mark this coming year which would be over two years

ahead of plan. Looking ahead, Nike expects its overall business to reach 50%

digital penetration.

However, Nike believes that customers are looking for a

seamless shopping experience which combines both physical and digital

capabilities and not one that is centered around digital alone. In other words,

the customer may want to order or reserve goods online and pick them up or try

them out at the store. The company believes that physical and digital

capabilities must go hand-in-hand in order to create a marketplace that meets

customer demands both now and in future.

Outlook

Looking ahead into fiscal year 2021, Nike expects revenue in the first half of the year to be below prior-year levels but the decrease is expected to be lower than the fourth quarter as the company re-opens stores and grows its digital business.

In the second half, revenue is expected to increase significantly versus the prior year. For the full year, revenue is expected to be flat to up compared to the previous year.

Click here to read the full transcript of Nike’s Q4 2020 earnings conference call