Shares of Nio Inc. (NYSE: NIO) gained 1.9% on Wednesday even as the company delivered mixed results for the second quarter of 2022 and provided guidance that failed to meet expectations. The stock has dropped 44% year-to-date and 54% over the past 12 months.

Quarterly numbers

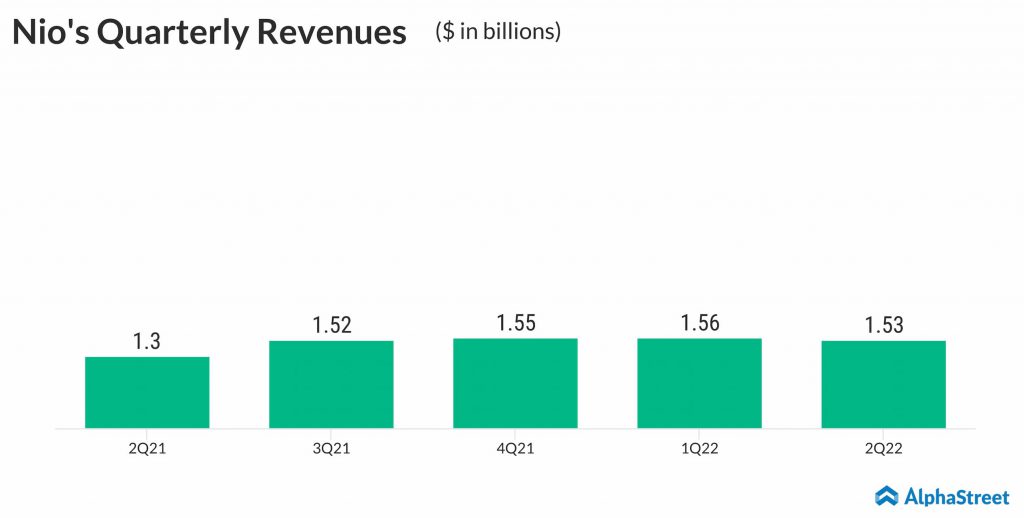

Nio’s total revenues for the second quarter of 2022 increased 21.8% to $1.54 billion compared to the same period a year ago, beating estimates of $1.4 billion. Vehicle sales were up 21% year-over-year at $1.42 billion. Other sales rose nearly 35% YoY to $108 million.

The Chinese EV-maker’s losses widened during the quarter. Net loss attributable to Nio’s ordinary shareholders were up 316.4% YoY in Q2 to $409.8 million. Adjusted net loss was up 551% to $326.3 million. Net loss per ADS was $0.25 while adjusted net loss per ADS was $0.20, which missed analysts’ projections of a loss of $0.17.

Gross profit decreased 14.8% YoY to $200.1 million while gross margin dropped to 13% from 18.6% in the year-ago quarter. Vehicle margin fell to 16.7% from 20.3% last year. Cost of sales increased 30.2% to $1.33 billion.

The company ended the second quarter with $8.1 billion in cash and cash equivalents, restricted cash and short-term investment.

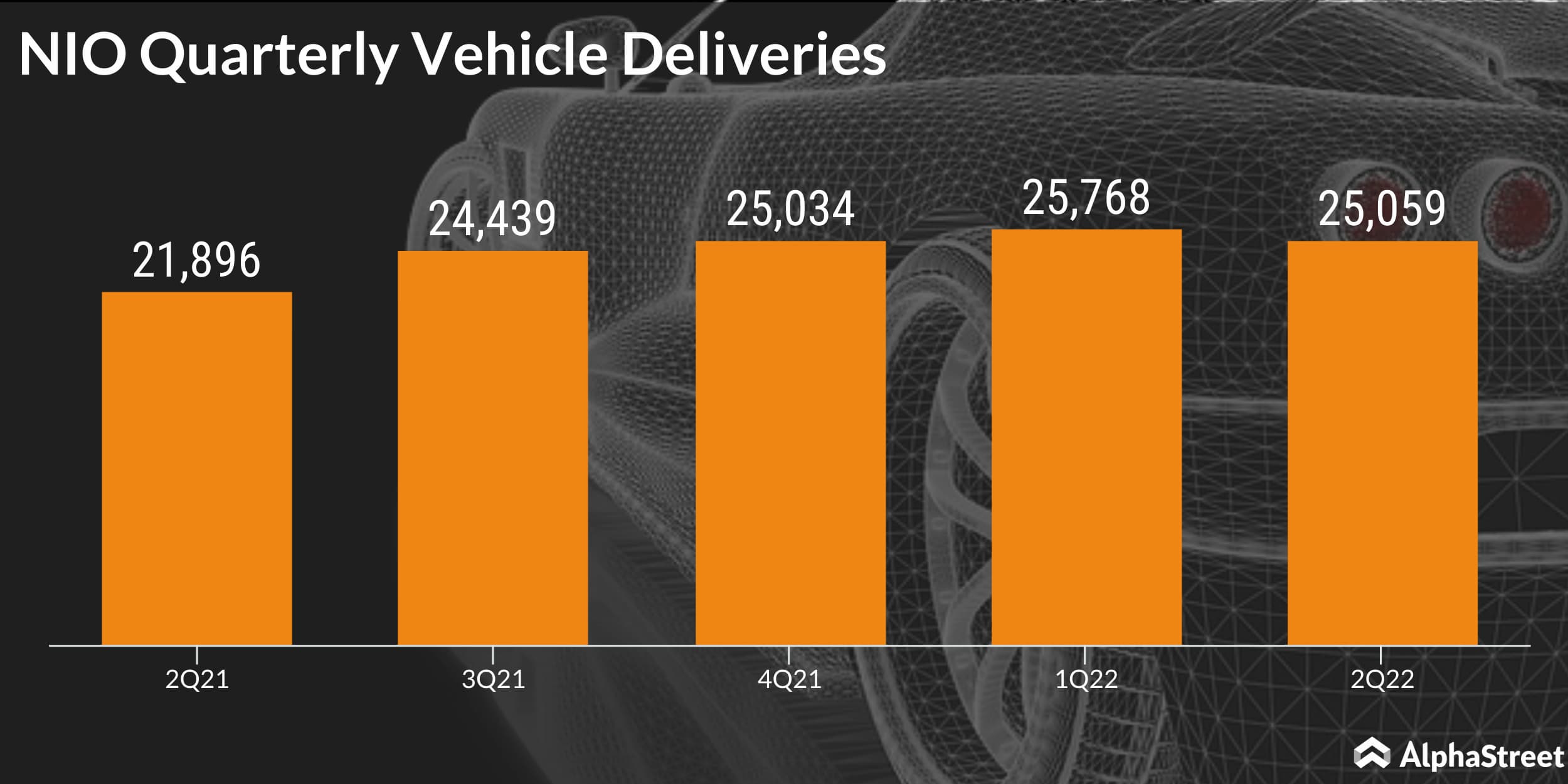

Deliveries

Vehicle deliveries increased 14.4% YoY to 25,059 vehicles. These included 3,681 ES8s, 9,914 ES6s, 4,715 EC6s and 6,749 ET7s. Although deliveries were down 2.8% from the first quarter, they began to recover with the company delivering 10,052 units in July and 10,677 units in August. As of August 31, cumulative deliveries reached 238,626 vehicles.

Nio’s CEO William Bin Li stated that the second half of 2022 is a critical period for Nio to scale up the production and delivery of multiple new products. The company saw a strong order inflow for the ES7, its smart electric SUV, and started its deliveries at scale in August. It also expects to start the mass production and delivery of the ET5 in late September.

Outlook

For the third quarter of 2022, Nio expects to deliver 31,000 to 33,000 vehicles, representing a YoY growth of around 26.8-35%. Total revenues for Q3 are estimated to range between $1.91-2.03 billion, reflecting a YoY growth of around 31-38.7%. The revenue guidance fell short of market estimates of $2.32 billion.