China-based auto firm Nio Inc. (NYSE: NIO) recorded a decline in deliveries in February but the numbers came in above estimates, underscoring the electric car maker’s resilience to the market turmoil triggered by the Covid-19 outbreak that crippled industries across the globe. The company, which is often referred to as the Tesla (TSLA) of China, has been burning cash at a high rate, raising concerns about the sustainability of the business.

That the year-over-year drop in February sales was much slower than the industry-average is testimony to Nio’s ability to woo customers with high quality products. But the company is struggling to stay afloat amid continuing losses and heavy capital spending, which forced it to go for several rounds of fundraising. In contrast, Tesla is rapidly gaining foothold in the Chinese market where it recently obtained regulatory nod to launch Model 3.

Estimate

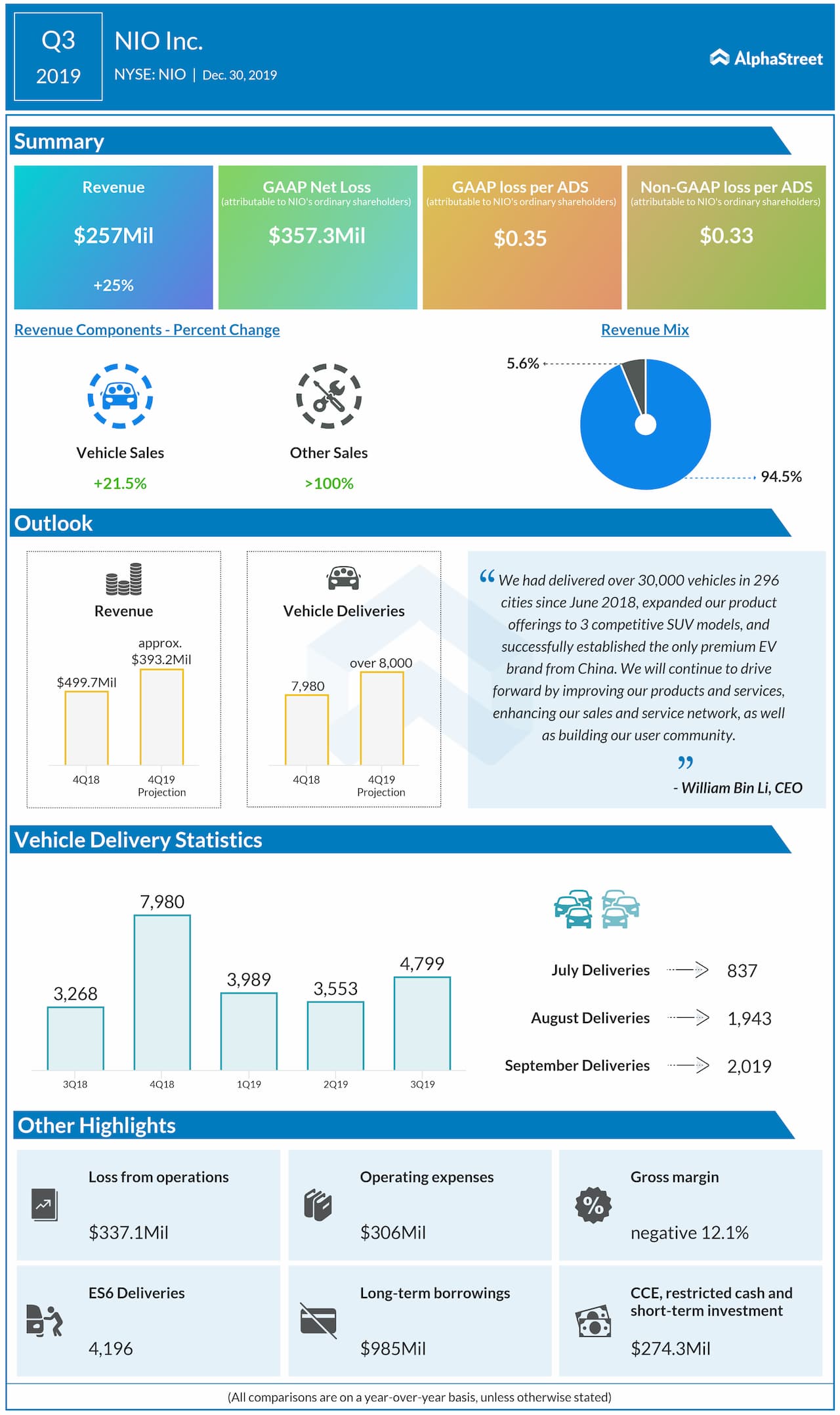

Nio is estimated to have registered a decline in revenues to $405.3 million in the fourth quarter, the results for which are expected to be out on Wednesday before the opening bell. Though it’s been quite some time since the company went public, it is not yet profitable. Fourth-quarter loss is estimated to be $0.33 per ADS, which marks an improvement from the year-ago quarter when the company posted a wider loss.

Related: Tesla gets another boost after securing $1.4-bln loan

Initial estimates indicate that December-quarter sales benefited from the steady demand for Nio’s successful premium SUV ES6. The five-seater electric model has beaten several odds in the past, like the global slump in auto sales and subsidy cuts by the Chinese government, and maintained steady sales.

What Next?

Nio, which is backed by Chinese internet giant Tencent Holdings Limited, last year announced new model called EC6, an all-electric SUV, and a more advanced battery pack. The market will be curious to know how and when the management will be making the company profitable. At the post-earnings conference call, Nio executives will likely face questions on the company’s near-term delivery goals and turnaround strategy.

Q3 Loss

In the third quarter, the company incurred a loss of $0.33 per share on revenues of $257 million, which is up 25% year-over-year. In February, it delivered 707 units, down 13% from the same period of 2019.