The ongoing slump in cryptocurrency remains a cause for concern, considering the company’s relatively bigger exposure to that sector

Nvidia will be announcing results for the second quarter of 2019 on Thursday after the market closes. Analysts expect that earnings will more than double to $1.66 per share on revenues of $3.11 billion, which represents a 50% growth compared to the year-ago quarter.

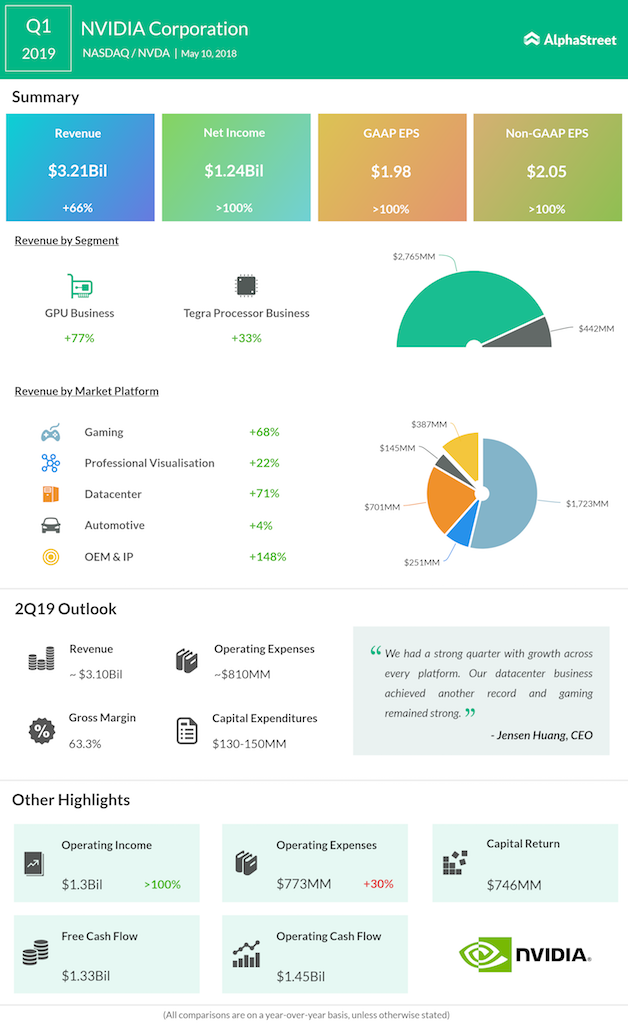

The company enjoys the rare distinction of posting above-consensus profit for all the trailing four quarters. In the first quarter, earnings jumped to $1.98 per share aided by broad-based demand growth across all categories.

RELATED: AMD defies crypto blues in Q2

Earlier this week, Nvidia unveiled its advanced Turing architecture and the GPU that carries the technology, offering near real-life lighting effects in graphics, which according to the company is a first in the industry. That followed reports that the company has been doing the groundwork for the closely-followed launch of the GeForce GPU update before year-end.

Among the other chipmakers, Intel (INTC) posted a 78% growth in third-quarter earnings aided by a surge in its data-centric business. California-based Advanced Micro Devices (AMD) staged a turnaround in the most recent quarter and posted adjusted earnings of 14 cents, beating estimates.

RELATED: Intel reports mixed results for Q2

Nvidia’s shares made significant gains over the past 12 months, growing about 62% and crossing the $260-mark. Though the stock dropped soon after opening on Tuesday, it pared the losses as trading progressed and ended the session up 2%.

RELATED: Nvidia Q1 earnings surge, beat estimates