The Business

Ocean Biomedical has three wholly owned subsidiaries – Oncology Company, Fibrosis Company, and Infectious Disease Company. The oncology and fibrosis franchises are licensed from Brown University, while the infectious diseases franchise is licensed from Rhode Island Hospital. Diversification of the portfolio helps the business optimize value creation and mitigate risks.

Research Programs

Ocean Biomedical has a promising pipeline of late-stage pre-clinical assets in cancer, malaria, and fibrosis — a breakthrough vaccine candidate for malaria is currently being advanced. The company is developing three programs based on discoveries of novel, first-in-class biological targets, with each having the potential for multiple indications.

Cancer Program: The biotech firm is advancing immunotherapies for lung, brain, and other cancers, while continuing to enhance the understanding of the broad anti-tumor mechanisms behind its anti-CHi3L1 discoveries. Studies have revealed the effectiveness of anti-CHi3L1 in brain cancer, creating a 60% reduction in tumor growth in human glioblastoma multiforme stem cell model in vivo.

Malaria Program: The Ocean Biomedical team is pushing its discovery science forward on several fronts to develop new solutions to address the urgent global need to develop more effective therapies for malaria treatment, including by advancing understanding and control of the mechanisms by which the company’s PfGARP antigen induces malaria parasite death and optimizing/developing an mRNA vaccine candidate based on discoveries of PfGARP, PfSEA, and another antigen that may be able to simultaneously target the malaria parasite at different stages of the blood cycle, ideally for prevention in sub-Saharan Africa

Fibrosis Program: Scientists at Ocean Biomedical are also actively working to address the standard of care and treatment options for those suffering from Idiopathic Pulmonary Fibrosis, a patient population with a major unmet medical need. There are indications that the company’s candidate for treating IPF may also prove effective against many other fibrotic diseases. The progress includes testing its anti-fibrotic treatment candidate OCF-203, which has generated impressive reductions of fibrosis in multiple models and reduced collagen accumulation by 85%-90%.

Updates

The company is preparing to host a Research and Development Day on September 14, featuring a live Q&A with its scientific co-founders Dr. Jack A. Elias and Dr. Jonathan Kurtis. They are expected to provide insights into their research and development work.

In June 2023, the company joined the Russell 2000 Index and the broad-market Russell 3000 Index. By becoming a member of the Russell 3000 Index, it gets automatically included in the large-cap Russell 1000 Index or small-cap Russell 2000 Index, as well as in the appropriate growth and value style indexes.

The addition to the Russel 2000 index came on the heels of the company receiving US patent for its bispecific cancer immunotherapy treatment. Earlier, it was granted a new patent for its malaria vaccine discoveries– for the breakthrough approach to disrupting the malaria parasite’s life cycle. Ocean Biomedical’s growing patent portfolio has 25 patents, and an additional 38 are pending.

Financials

For the three months ended June 2023, the company reported a net loss of $13.02 million or $0.49 per share, compared to a loss of $7.33 million or $0.31 per share in the prior-year period. Meanwhile, total operating expenses more than halved to $2.68 million in the June quarter from $6.9 million last year. At the end of the quarter, the company had total assets of $20.9 million.

At the Bourses

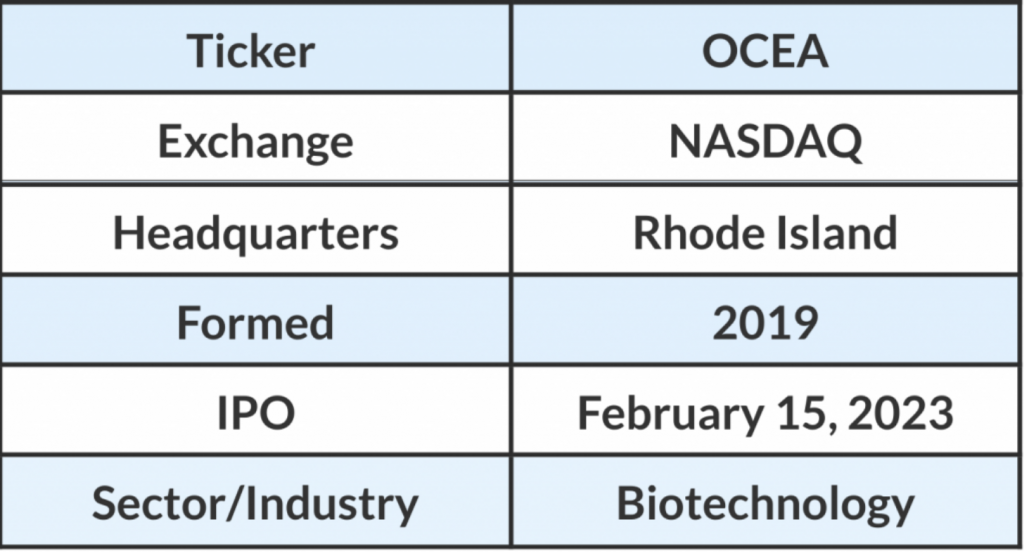

Ocean Biomedical’s stock started trading on the Nasdaq stock market on February 15, 2023, under the ticker symbol OCEA, following a reverse merger of special purpose acquisition company Aesther Healthcare Acquisition Corp. In the second week of August 2023, the stock traded mostly higher after experiencing a slump earlier. In general, analysts are optimistic about OCEA’s growth prospects. The average price target on the stock is $18.21, with three research firms giving it ‘Buy’ rating.

EF Hutton, which initiated coverage of the company with a share price target of $10 in 2022, raised it to $17 this year. Fundamental Research Corporation increased its price target from $16.40 to $17.63, in advance of the company’s addition to the Russell 2000 Index in June. More recently, Taglich Brothers initiated coverage with a price target of $20.

Strengths & Weaknesses

Ocean Biomedical has committed financial backing, including funding facilities with White Lion Capital and Alto Opportunity Master Fund. Despite its innovative business model, however, the company is not immune to the growing competition the healthcare market is witnessing. A major challenge facing businesses engaged in the development and commercialization of medicines is the uncertainties in the pharmaceutical industry.