$134 Mln

Ocean’s co-founder and chairman Dr. Chirinjeev Kathuria said, “This financing will provide Ocean Biomedical with a stronger capital position, enabling us to move forward quickly towards IND filings and potentially deliver important solutions to end suffering and save hundreds of thousands of lives.”

There is $123.9 million in past and ongoing grants, in use to enable first-in-class drug and vaccine candidates that make up Ocean’s initial core portfolio in oncology, fibrosis, and infectious disease.

“We are appreciative of the support investors are providing so we can move our programs forward,” said Suren Ajjarapu, a director of Ocean Biomedical.

Commenting on the financing, Ocean’s chief executive officer Elizabeth Ng said, “We’re immensely pleased with the progress we’re making as a Company. Our portfolio of drug and vaccine candidates continues to accrue scientific merit, and our relationships with both institutional and retail investors are growing increasingly robust.”

Notice of Allowance

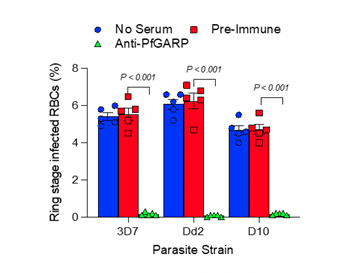

Last week, the company’s scientific co-founder Jonathan Kurtis received a Notice of Allowance from the United States Patent and Trademark Office for his U.S. patent application covering a therapeutic and prophylactic monoclonal antibody that kills falciparum malaria parasites.

The patent allowance will allow the team to pursue the development of the monoclonal antibody as both a potential therapeutic drug for individuals with severe malaria infection as well as a potential short-term prophylactic treatment to prevent malaria infection in travelers, overseas deployed military and government personnel, and individuals living in areas with short malaria transmission seasons.