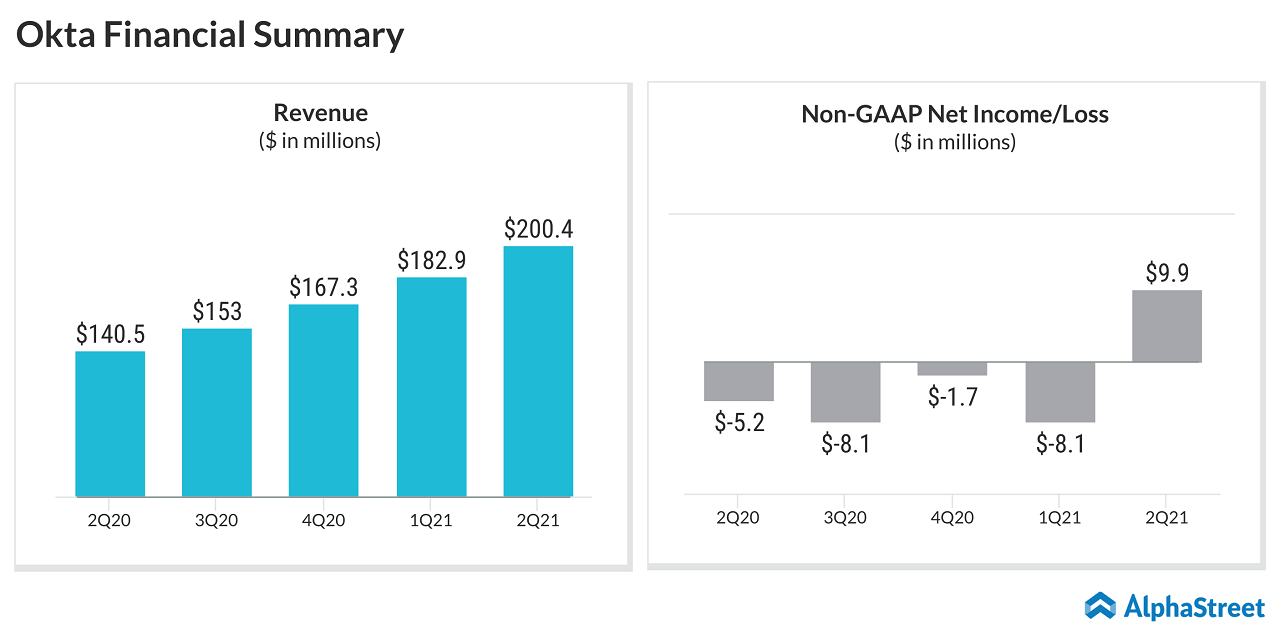

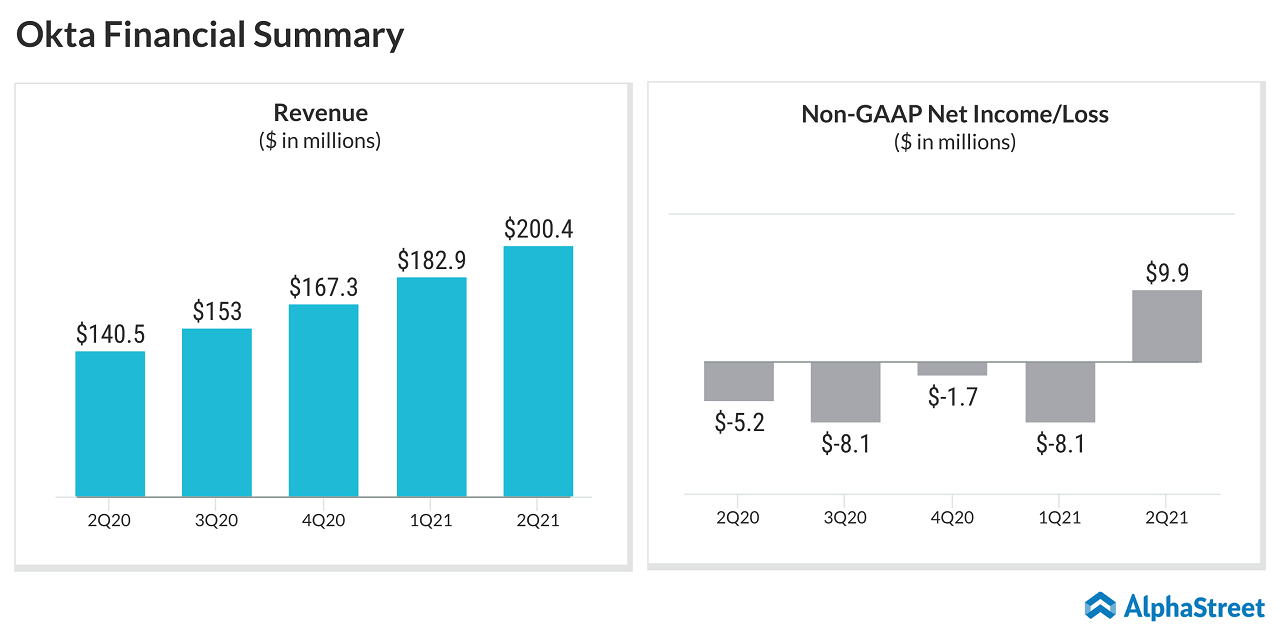

Okta (NASDAQ: OKTA) stock dropped about 3% in the extended trading session today despite the upbeat second quarter 2021 results and raise in the FY21 outlook. On a non-GAAP basis, the company swung to a profit in the second quarter.

GAAP net loss widened to $60.1 million or $0.48 per share from $43.0 million or $0.37 in the second quarter of fiscal 2020. Non-GAAP net income was $9.9 million or $0.07 per share compared to a net loss of $5.2 million or $0.05 per share.

For the third quarter of fiscal 2021, Okta expects non-GAAP net loss per share of $0.02 to $0.01 and revenue of $202 million to $203 million.

For the fiscal year 2021, the company raised the guidance it gave in the first quarter of 2021. Okta now expects a non-GAAP net loss per share to be $0.03 to $0.01 compared to the previous net loss per share outlook of $0.23 to $0.18. FY21 revenue is now projected to be in the range of $800 million to $803 million versus the prior guided range of $770 million to $780 million.

“The three mega-trends that have been driving our business for the past several years – the adoption of cloud and hybrid IT, digital transformation, and zero trust security – are all being accelerated globally by the current environment,” said CEO Todd McKinnon.