Shares of Okta Inc. (NASDAQ: OKTA) have gained 81% since the beginning of this year. The company reported a double-digit increase in revenue and achieved profitability on an adjusted basis for the second quarter of 2021 and also raised its guidance for the full year.

Okta’s business has benefited from the momentum seen in the adoption of cloud and hybrid IT, digital transformation and security, all of which have seen a pickup due to the health crisis. The company believes the world will not return to the pre-COVID work environment. Organizations are rapidly changing their digital strategy in the current environment as their remote work needs grow and Okta’s platform appears well-positioned to benefit from this trend.

Quarterly performance

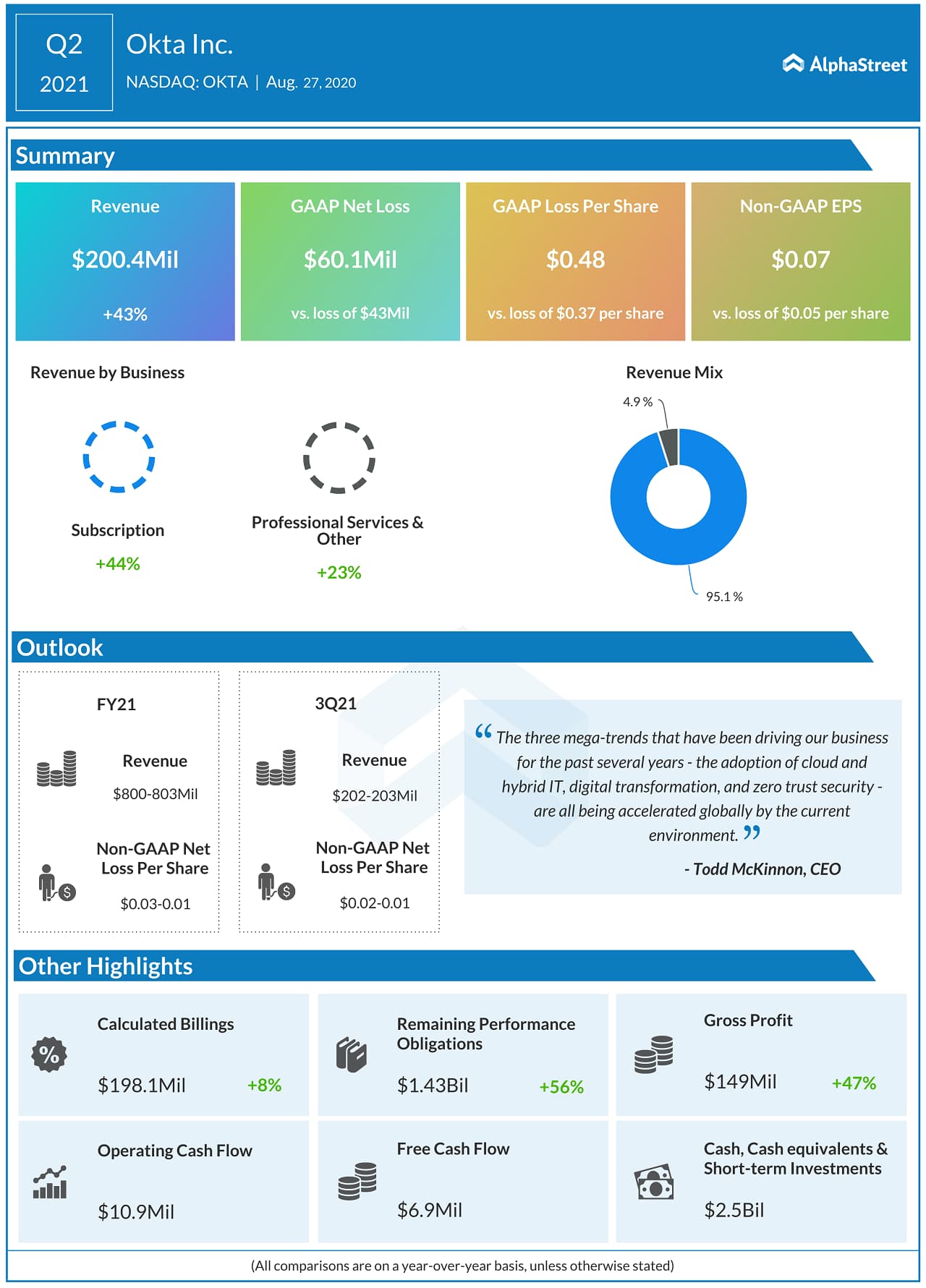

Revenue rose 43% year-over-year to $200.4 million while adjusted earnings amounted to $0.07 per share versus a loss of $0.05 per share last year. Subscription revenue increased 44% while subscription revenue backlog rose 56%. Total calculated billings grew 27%.

The company achieved profitability in the quarter helped by strong revenue growth and lower expenses. However, this profitable trend is expected to fluctuate in the near term as the business environment normalizes and people return to offices. Expenses are also expected to rise as the company increases its investments in growth and expansion.

Increased adoption

The usage of Okta’s platform has increased significantly during the pandemic period. From March through July, the number of unique app logins increased around 70% to nearly 16 billion. During this time, the company also achieved a one-day record of over 145 million logins.

Total multifactor authentication usage rose nearly three times year-over-year. This momentum was driven by the vast number of new remote workers around the world. The company also witnessed strong growth in total customers, especially large enterprise companies.

Okta is focused on growing its large enterprise customer base and the company added 105 customers with an annual contract value greater than $100,000 during the second quarter. The company currently has close to 1,700 customers with values over $100,000 and over 100 customers with an annual contract value of over $1 million.

Okta’s dollar-based net retention rate for the trailing 12-month period was 121%, consistent with last quarter. There was no degradation in gross renewal rates during the pandemic period and the company witnessed strong customer upsells.

Partnerships and investments

Okta continues to invest significantly in its systems and infrastructure and recently achieved a key milestone in cloud reliability by offering 99.99% uptime to all customers globally. The company has also joined hands with CrowdStrike, Netskope and Proofpoint to provide businesses with better security amid the spike in remote work. The group will provide integrated solutions and architectures for end-user, device, network and data security.

Outlook

Although Okta expects to face pandemic-related headwinds during the second half of the year, the company is optimistic about the demand for its products. For the third quarter of 2021, revenue is expected to grow 32-33% to $202-203 million. Adjusted loss per share is expected to be $0.02 to $0.01.

Okta raised its guidance for fiscal year 2021 and now expects total revenue to grow 37% year-over-year to $800-803 million. Adjusted loss per share is expected to be $0.03 to $0.01.