Oracle Corporation (NYSE: ORCL) topped revenue and earnings forecasts for the third quarter of 2020, allowing the stock to gain 3.7% in aftermarket hours on Thursday.

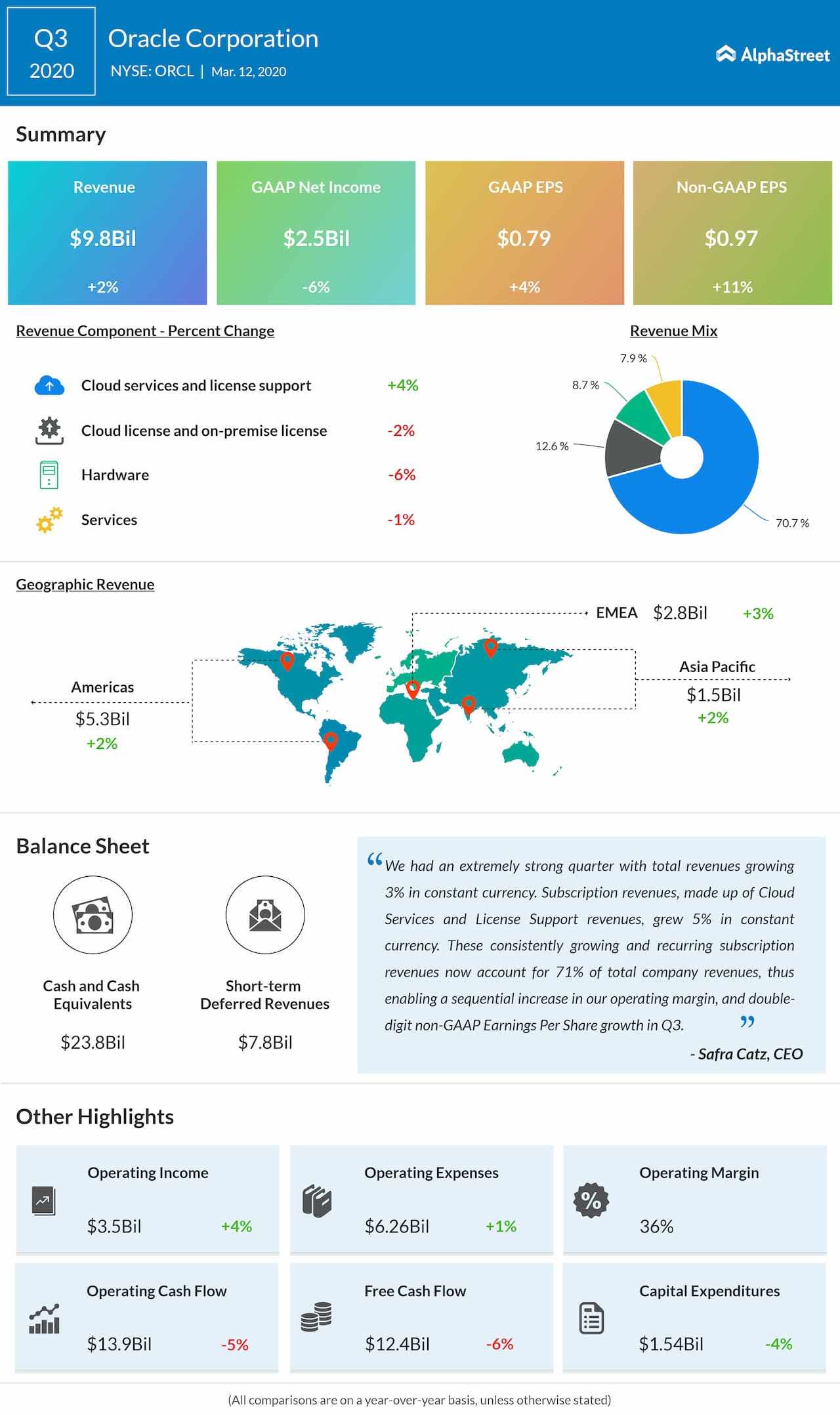

Total revenues rose 2% year-over-year to $9.8 billion, surpassing estimates of $9.7 billion. Revenues were up 3% in constant currency.

GAAP net income fell 6% to $2.6

billion while GAAP EPS rose 4% to $0.79. Adjusted net income was $3.2 billion while

adjusted EPS grew 11% to $0.97, beating forecasts of $0.96.

Short-term deferred revenues were $7.8 billion. Fusion ERP Cloud revenues were up 37% year-over-year on a reported basis and 38% in constant currency.

Subscription revenues were $6.9 billion, up 4% on a reported basis and 5% in constant currency. Subscription revenues now account for the majority of the company’s revenues. Cloud License and On-Premise License revenues were $1.2 billion, down 2% on a reported basis and flat on a constant currency basis. Hardware and Services revenues both saw decreases compared to the prior-year period.

For the fourth quarter, Oracle expects total subscription revenues to range between 3-5% in both constant currency and US dollars. Total revenues are expected to range between negative 2% to positive 2% in both constant currency and US dollars. Adjusted EPS is expected to grow 3-9% to a range of $1.20-1.28 in both constant currency and US dollars.

The Board of Directors declared a quarterly cash dividend of $0.24 per common share, payable to stockholders of record as of April 9, 2020, with a payment date of April 23, 2020. The company also increased its share repurchase authorization by $15 billion.

Oracle’s shares have fallen 24% over the past one year and 28% in the past one month.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.