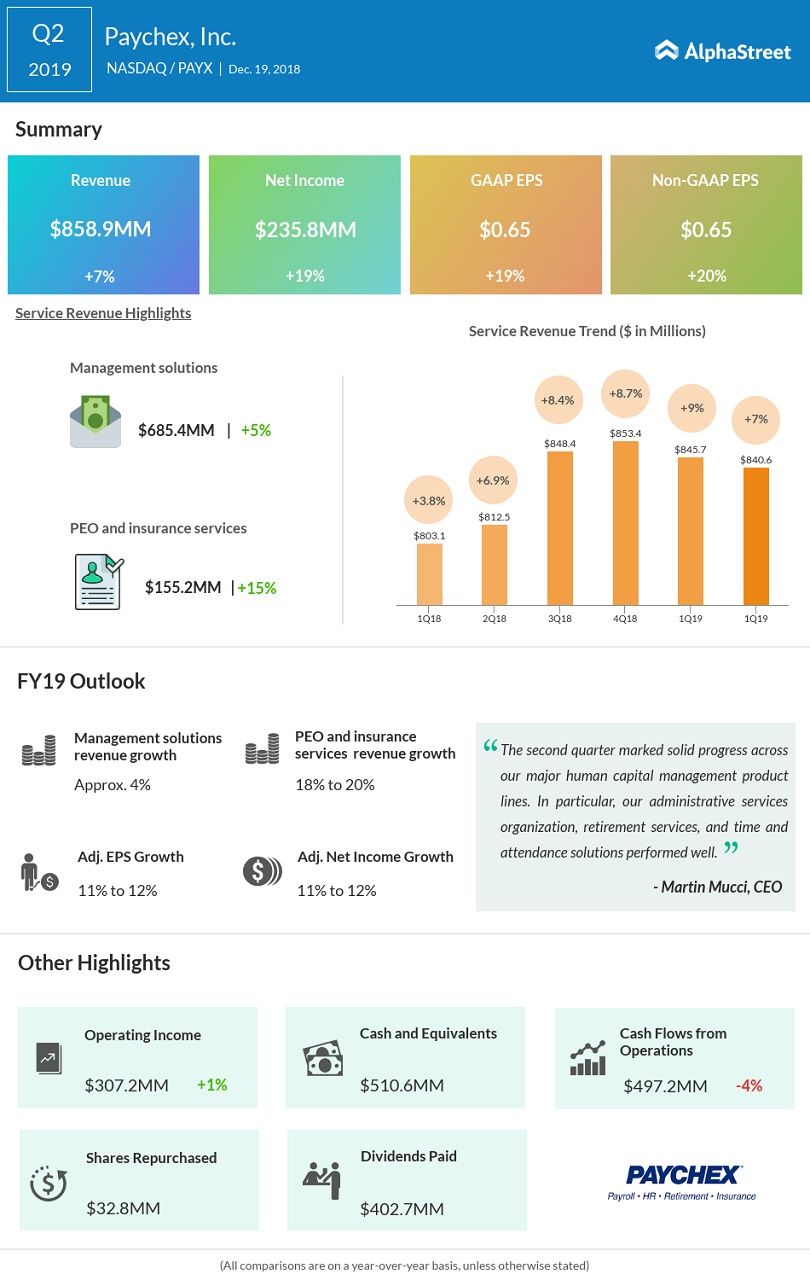

Shares of Paychex (PAYX) rose 0.6% after the company reported better-than-expected second quarter results. Earnings rose 20% to $0.65 per share, surpassing $0.63 per share expected by analysts.

Total revenue improved 7% to $858.9 million driven by a 5% increase in Management Solutions revenue. Analysts had expected Q2 total revenue of $856.73 million.

CEO Martin Mucci said, “The second quarter marked solid progress across our major human capital management product lines. In particular, our administrative services organization, retirement services, and time and attendance solutions performed well.”

Management Solutions revenue climbed 5% during the quarter to $685.4, driven by an increase in customer base. Contribution from PEO and Insurance Services jumped 15% to $155.2 million, primarily riding on a higher number of clients.

The company reiterated its guidance for 2019. It continues to expect Management Solutions revenue to grow approx 4%, while PEO and Insurance Services revenue is anticipated to increase 18-20%.

Both adjusted net income and EPS are expected to grow in the range of 11-12%.

In November, Paychex displayed the might of its strong cash balance and low debt as it agreed to buy privately-held professional employer organization Oasis Outsourcing Acquisition Corp based in West Palm Beach, Florida.

The addition of Oasis is expected to contribute considerably to Paychex’s revenues in the forthcoming quarters by allowing the company to expand to new markets and offer its HR solutions to a larger number of clients.

Paychex stock is down 4.5% so far this year.