The shares, which are trading above $115, have remained above the 50-day and 200-day moving average of $111.20 and $107.37, respectively. The majority of the analysts recommended a “buy” rating with an average price target of $129.33. The stock is likely to show big momentum after the earnings report.

The results will be driven by strong transaction and total payment volumes. The company is expected to leverage its operating model and continue expanding its operating margin for the fourth quarter. Mobile continues to be a major driver for growth as consumers are anticipated to use PayPal more as part of their everyday financial life.

The top-line growth is likely to narrow due to pricing challenges and currency-related headwinds. However, the company has an edge over its rivals backed by the strong product portfolio and user engagement that could drive the top line higher. The positive economic environment continues to show steady improvement in the business of payment service providers.

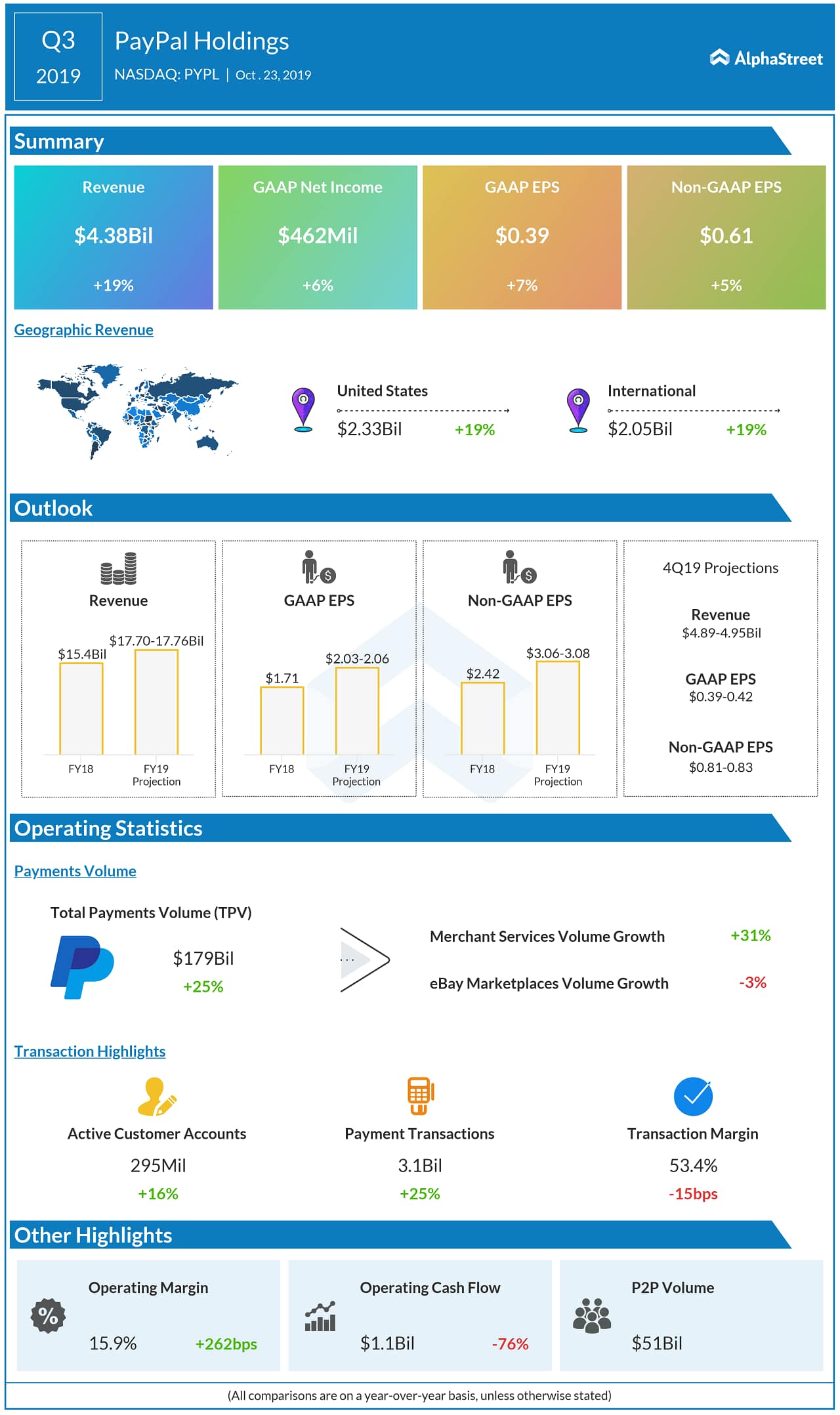

For the third quarter, PayPal reported a 6% increase in earnings driven by higher revenue. For full-year 2019, PayPal expects revenue to grow 15% on an FX-neutral basis, to a range of $17.70-17.76 billion, GAAP EPS in the range of $2.03–2.06 and non-GAAP EPS in the range of $3.06–3.08.