Quarterly performance

Comirnaty

During the third quarter, Pfizer generated $13 billion in revenue from Comirnaty, the majority of which came from outside the US. The company has produced 2.6 billion doses thus far and shipped 2 billion doses to 152 countries across the world. Pfizer continues to sign agreements with governments worldwide and of the 3 billion doses it plans to produce this year, at least one billion is set to go to middle and low income countries.

The company has seen its weekly market share of vaccines administered go up mainly because its booster dose was the first to receive emergency use authorization and because its two-dose series has been preferred for use in younger populations. In the US, its monthly average market share rose to around 74% in October from about 56% in April. In the EU, it increased from around 70% to about 80% in the same period.

Pfizer has received US FDA approval for its COVID-19 vaccine for children aged 5-11. The US government has purchased 115 million pediatric doses in total, which the company believes is sufficient for every child in the country.

The company has raised its outlook for revenues from Comirnaty to approx. $36 billion from the previous number of approx. $33.5 billion.

Pipeline

Pfizer received approvals from agencies in the UK, Japan and Europe for Cibinqo which is intended for the treatment of atopic dermatitis, or eczema. This presents the company with meaningful opportunity for revenue growth. Pfizer also received approval from the FDA for TicoVac, its tick-borne encephalitis vaccine, which is currently the only FDA-approved vaccine in the US against the TBE virus.

Outlook

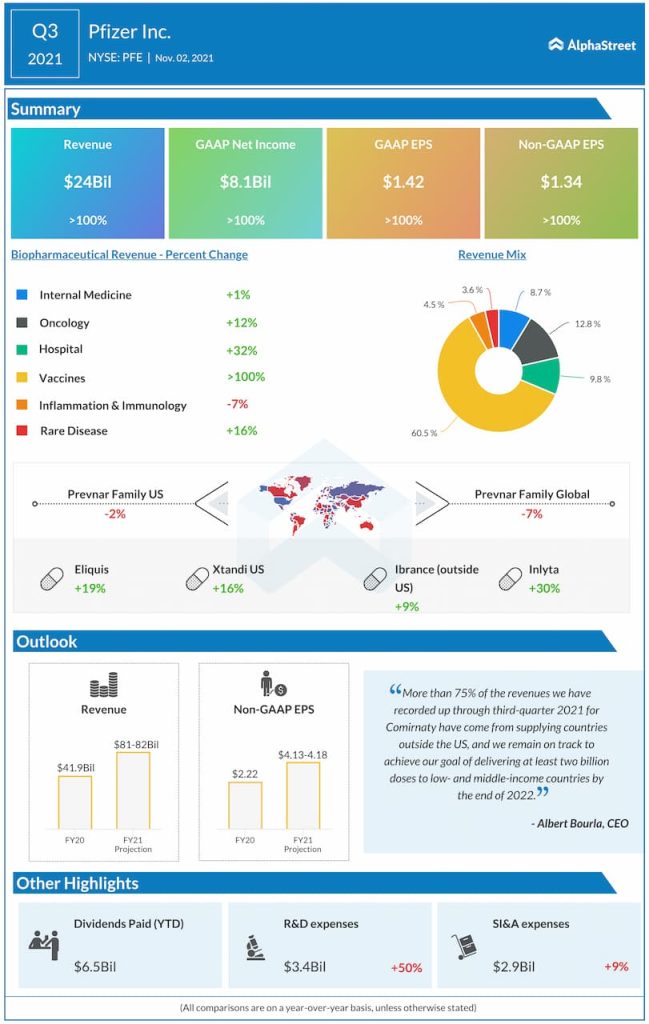

Pfizer increased its full-year 2021 guidance for revenues and adjusted EPS. The company now expects revenues of $81-82 billion and adjusted EPS of $4.13-4.18 for the year. The midpoint of the guidance range represents year-over-year growth of 94% for revenues and 84% for adjusted EPS. Excluding Comirnaty, revenues are expected to be $45-46 billion.

Click here to read the full transcript of Pfizer’s Q3 2021 earnings conference call