Quarterly performance

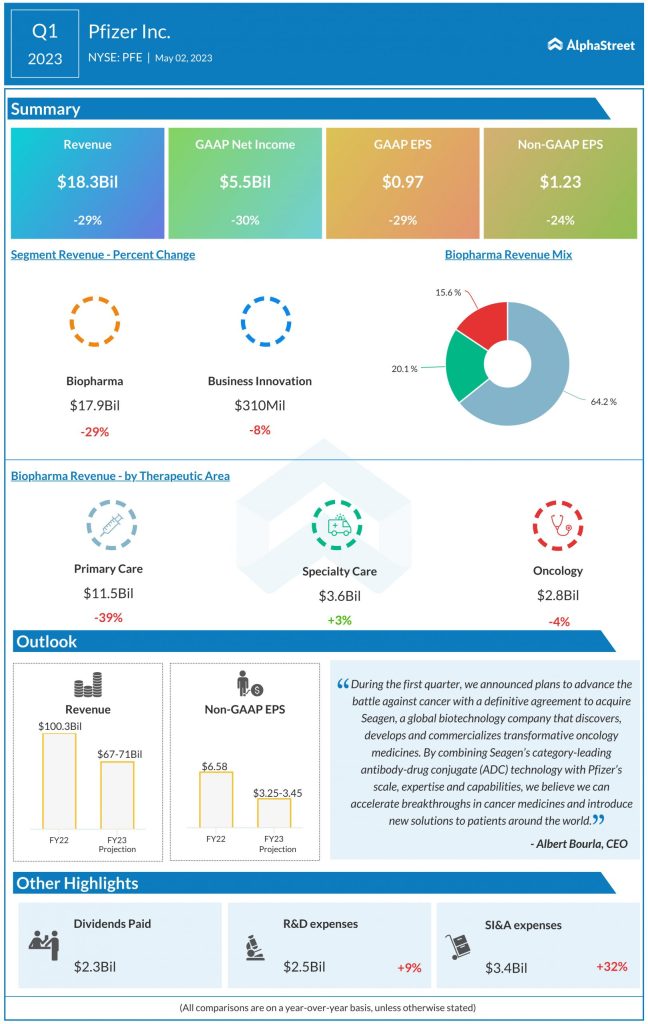

GAAP EPS was $0.97, down 29% YoY while adjusted EPS decreased 24% to $1.23. Despite the YoY declines, both the top and bottom line numbers surpassed expectations.

COVID-19 products

In Q1 2023, revenues from Pfizer’s COVID-19 products Comirnaty and Paxlovid were $7.1 billion. Comirnaty revenues were down 75% operationally from last year, mainly due to lower contracted deliveries and demand in international markets.

Paxlovid revenues increased, helped by the favorable timing of a final delivery related to the US government contract, along with strong demand in China, and launches in certain international markets.

For fiscal year 2023, Pfizer expects Comirnaty revenues of approx. $13.5 billion, down 64% YoY and Paxlovid revenues of approx. $8 billion, down 58% YoY. This guidance is no longer based on expected deliveries under supply contracts but includes anticipated sales through traditional commercial markets in the US in the latter half of the year.

Seagen acquisition

Pfizer has entered into an agreement to acquire Seagen, a biotechnology company that develops oncology medicines. The addition of Seagen’s antibody-drug conjugate (ADC) technology to its portfolio is expected to increase Pfizer’s capabilities in oncology significantly. Pfizer expects this acquisition could contribute over $10 billion in risk-adjusted revenues in 2030, with significant growth potential ahead.

Outlook

For FY2023, Pfizer expects total revenues to decline 29-33% YoY to $67-71 billion, due to expected revenue declines for its COVID-19 products. The company expects sales contributions from its COVID products to be significantly lower in the second quarter versus the first quarter. Excluding the COVID-19 products, revenues are expected to be up 7-9% operationally. Adjusted EPS for the year is expected to decline 48-51% YoY to a range of $3.25-3.45.