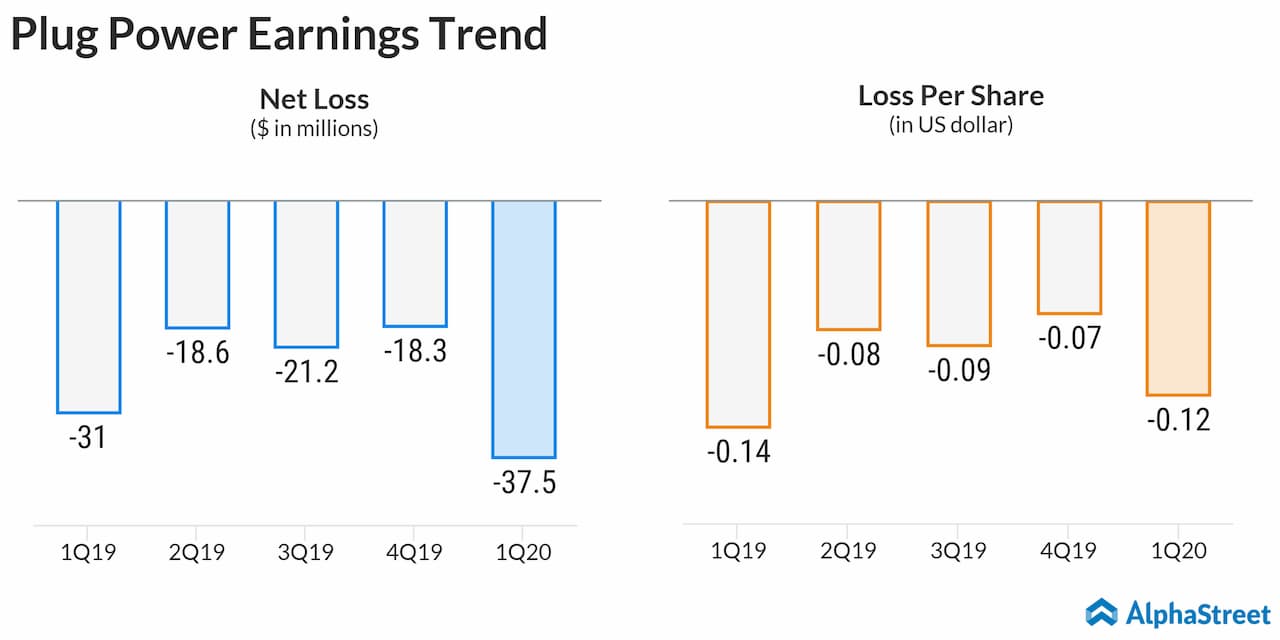

Plug Power Inc. (NASDAQ: PLUG) reported its financial results for the quarter ended March 31, 2020, on Thursday before the market opens. The company posted a wider loss in the first quarter of 2020 due to higher costs and expenses.

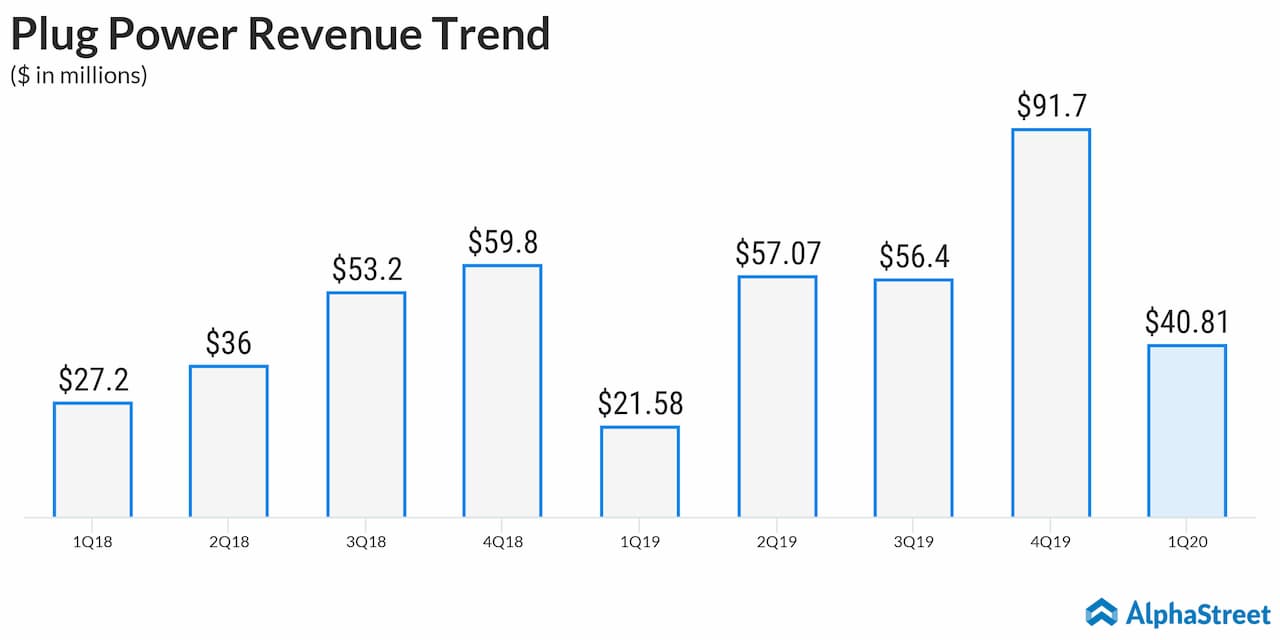

The company achieved record gross billings of $43 million, which reflects year-over-year growth of 89%. The company deployed over 1,000 fuel cell systems and had billings associated with 4 hydrogen infrastructure programs in the quarter.

Plug Power reaffirmed its guidance to achieve $300 million in gross billings in 2020, which represents more than 25% growth year-over-year. This pandemic is causing a global economic slowdown. The company is also impacted by this, but given its mix of customers and product offerings, Plug Power remains on track to deliver on its stated objective of gross billings guidance for 2020. The 2024 target remains $1 billion in gross billings, $170 million in operating income, and $200 million in adjusted EBITDA.

The company is pursuing the acquisition of two companies in the hydrogen generation and distribution business. In particular, Plug Power is in advanced negotiations to buy United Hydrogen, which currently has 6.4 tons per day of liquid hydrogen generation capacity. If completed, this acquisition is expected to be accretive immediately and to have a meaningful positive impact on Plug Power’s cost of hydrogen, especially as it goes into 2021 and beyond.

Plug Power is also pursuing the purchase of an electrolyzer company. Both these transactions, if completed, are expected to significantly expand Plug Power’s capabilities in the hydrogen generation, liquefaction, and logistics business, which is turning it into a cash flow generating business. Both the acquisitions are expected to be completed by the end of the second quarter of 2020 as Plug Power has not yet entered into a definitive acquisition agreement.