Effective Risk Assessment

In an interview with AlphaStreet, Alex Xu who took over as the new CFO last month, said that during the crisis period the management took precautionary measures based on early warning signals – thanks to its effective risk assessment model – and navigated through the pandemic effortlessly.

“Quick response to unexpected events and excellent execution capabilities also helped us act fast and early, thus reducing our exposure to the potential risks,” said Xu. The confidant stance assumes importance considering the uncertainty the business world is currently facing.

Collection Rebounds

China being the first region to contain the pandemic since its outbreak, the country’s economy hit the recovery path much earlier than most virus-hit countries, and so did people’s personal finances. The trend is evident from the fact that 360 Finance’s 30-day collection rate bounced back to the pre-crisis level of 88% in the second quarter. Xu attributed the recovery to the company’s effective risk management capabilities and the improvement of the macro environment, which according to him will continue in the coming months.

As part of expanding the purview of the brand, the management will be holding a special meeting on September 15 to seek shareholders’ approval for the plan to rechristen the company to 360 DigiTech. It is expected that the new identity would help in representing the company’s long-term strategic positioning in the market more effectively.

Tech Innovation

Replying to a question on the topic, Xu told AlphaStreet that the new name stands for ‘digital technology in all angles’. The transition complements the management’s strategy of empowering institutional partners and consumers technologically with better platform services covering the entire consumer finance cycle — ranging from market-orientated product innovation and data-driven marketing to AI-empowered risk management and transaction-focused ecosystem.

Elaborating on the company’s operating model, Xu noted, “We were founded on the belief that we should enable financial institutions to provide better and targeted products and services to a broader consumer base through our leading digital platform. As we maintained strong growth momentum in recent years, a significant and increasing proportion of our business has already been derived from technology enabling services that we provide to our institutional partners.”

‘Controlled’ Customer Acquisition

Despite the uncertainties, the company’s customer base has remained stable so far. In the latter part of the first half, there was a sharp decline in sales and marketing costs, reflecting the more conservative customer acquisition strategy and effective acquisition model. The strong business momentum witnessed during that period continued in current quarter. However, the executives have adopted a cautious stance and are maintaining a controlled pace with regard to customer acquisition, in view of the volatile environment.

We continue to improve efficiency in customer acquisition by deepening relationship with our partners, such as Xiaomi, Meituan, etc.. New products, such as V-pocket proves to be a quite effective tool to improve users’ activity level and increase stickiness.

ADVERTISEMENTAlex Xu, Chief Financial Officer of 360 Finance

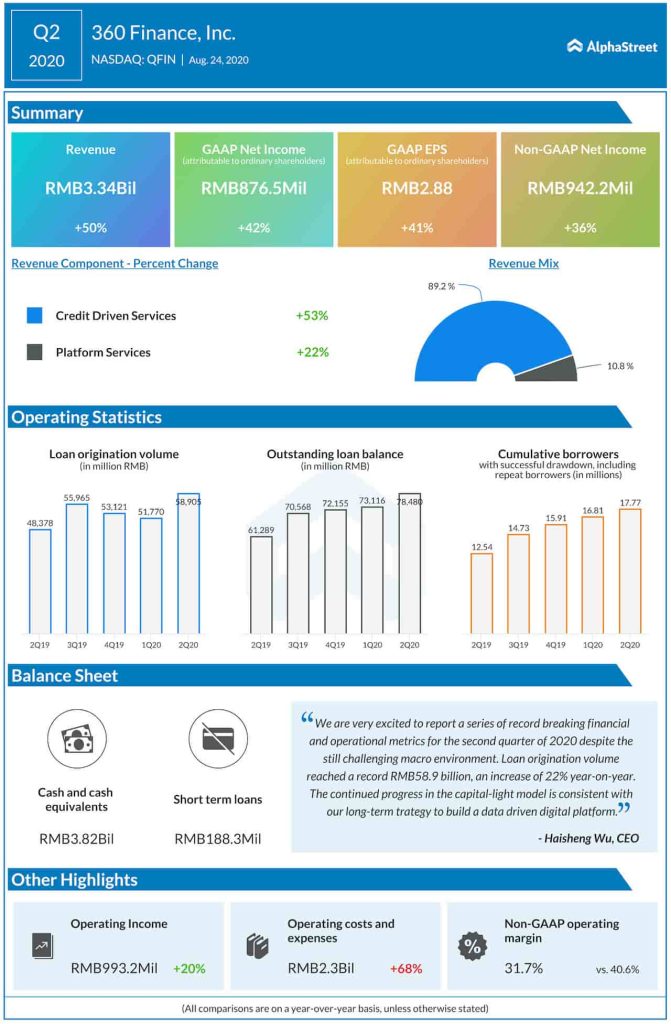

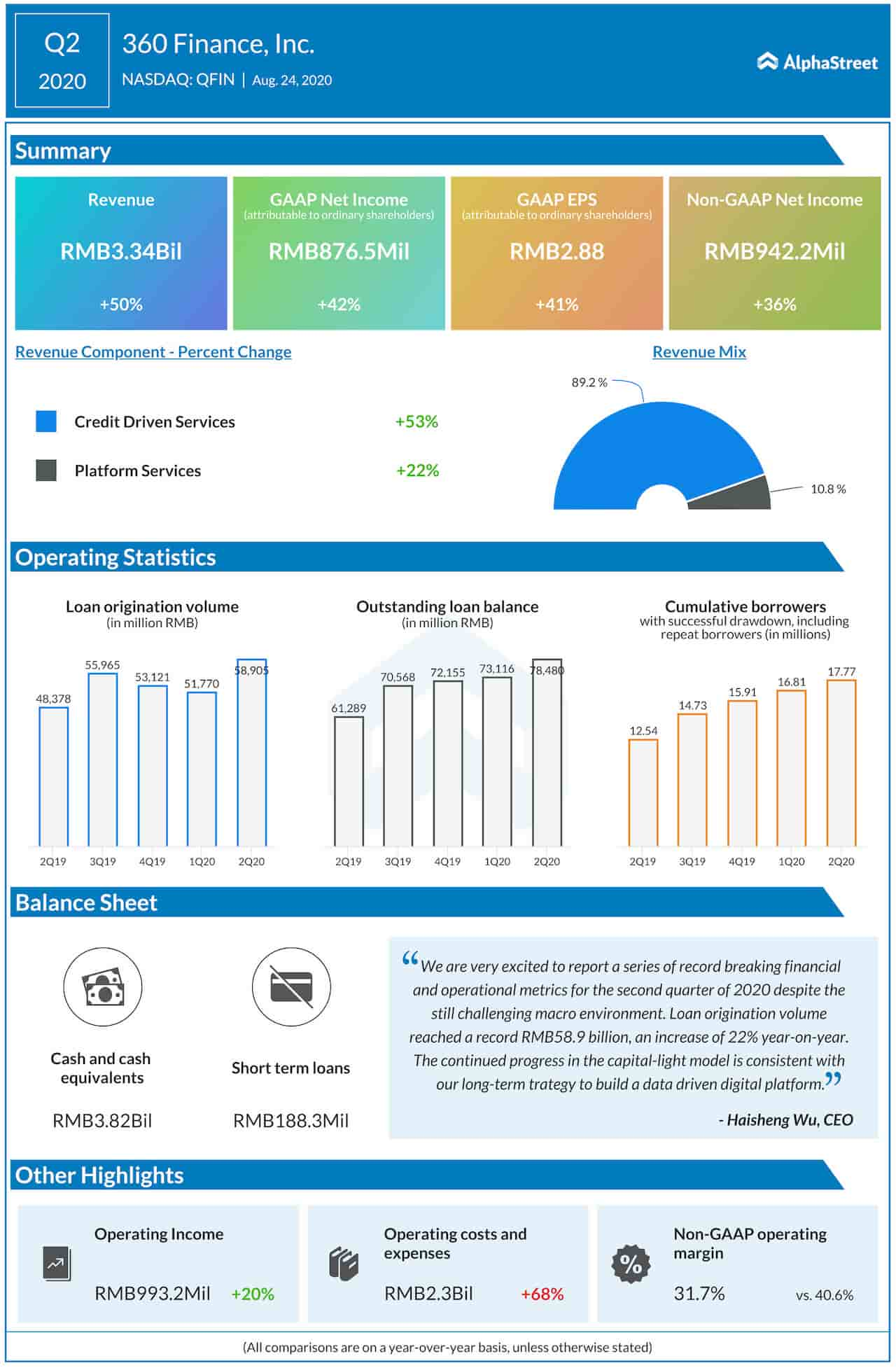

Strong Q2

Earnings, adjusted for non-recurring items, climbed 36% in the second quarter to RMB942.2 million. Both the business segments — Credit Driven Services and Platform Services – registered double-digit growth, resulting in a 50% surge in total revenues to RMB3.34 billion. Loan origination and loan balance grew sharply even as the borrower base rose to 17.77 million.

Analysts following the company are bullish about its prospects, and recommend buying the stock, which closed the last trading session at $12.5. The current valuation looks favorable as far as investing is concerned, while experts’ average target price represents a 38% growth. The shares have gained 25% since last year.

_____

For more insights into 360 Finance, read the latest earnings conference call transcript here.