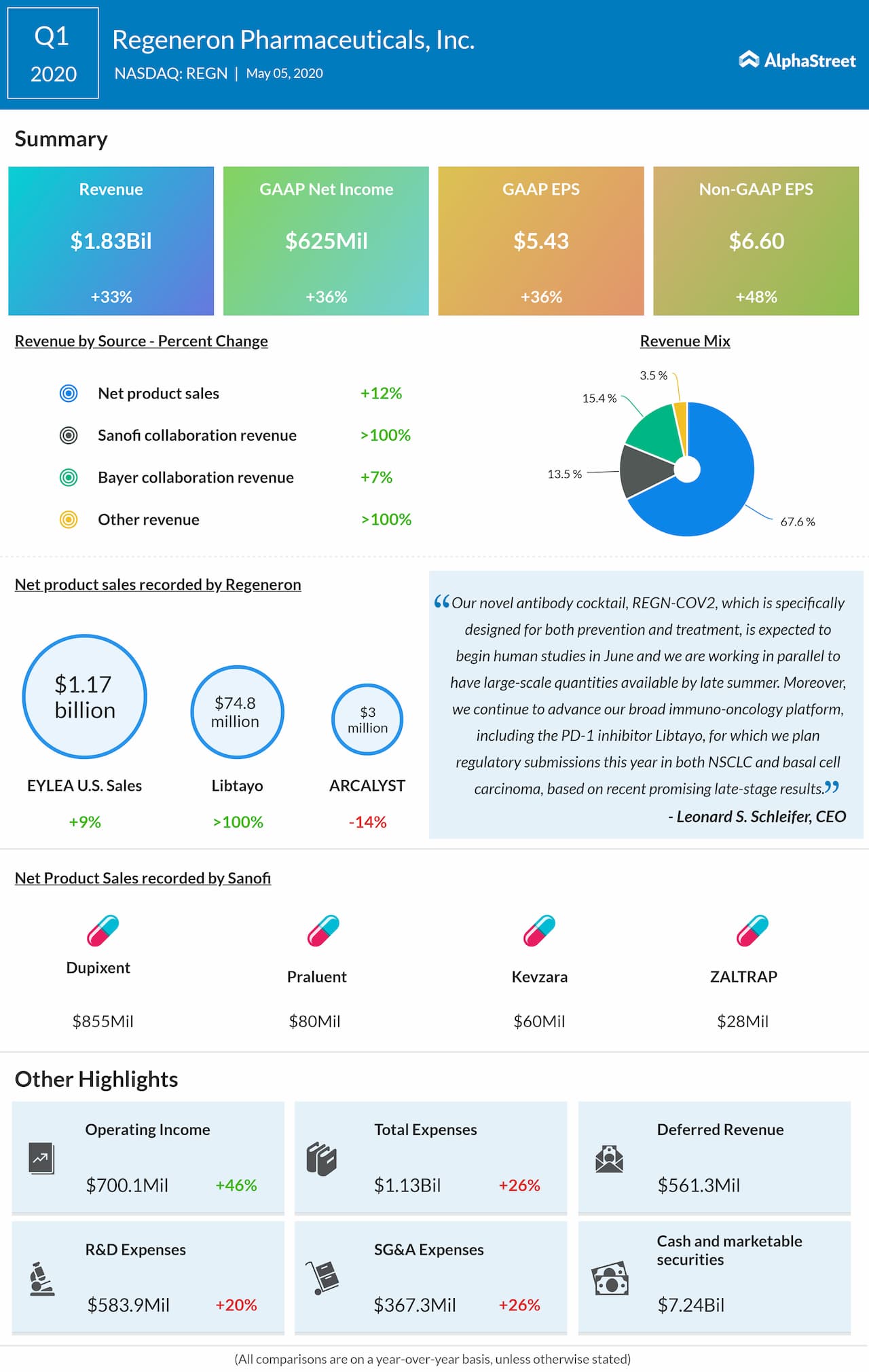

Regeneron Pharmaceuticals, Inc. (NASDAQ: REGN) reported a 36% jump in earnings for the first quarter of 2020 helped by higher revenue. The results exceeded analysts’ expectations. Regeneron has more than 20 product candidates in clinical development, including five marketed products for which it is investigating additional indications. The company now has 6 bispecific antibodies in clinical development for various blood cancers and solid tumors.

The US Food and Drug Administration accepted for priority review the BLA submission for Ebola, with a target action date of October 25, 2020. The company is advancing REGN-COV2, a novel investigational antibody “cocktail” treatment designed to prevent and treat the SARS-CoV-2 (COVID-19) virus. The company is working to rapidly scale-up manufacturing, with a goal to have hundreds of thousands of preventative doses available by the end of August 2020.

The company announced an expanded agreement with the U.S. Department of Health and Human Services (HHS) to fund certain research and development activities related to COVID-19 treatments, including REGN-COV2 and the US Kevzara study. The company continues to monitor the potential impact on product sales as overall US Eylea demand was lower in April.

Regeneron expects fully-recruited clinical studies to remain generally on track. The company has paused new enrollment in certain studies in light of the pandemic and continues to monitor the evolving situation across global trial sites.

Looking ahead into 2020, the company now expects R&D expenses to be $2.15-2.31 billion, SG&A expenses to be $1.38-1.5 billion, and costs of goods sold to be $350-420 million. Capital expenditures are now predicted to be $510-590 million.