Strong holiday sales

Last month, the US Census Bureau reported that total adjusted retail and food services sales rose 0.6% in 2020 compared to 2019. According to a report by the National Retail Federation, retail sales during the November-December 2020 holiday season rose 8.3% to $789.4 billion compared to the same period a year ago.

During the Thanksgiving period, digital sales saw strong gains. Based on data from Adobe Analytics, online sales rose 22% to $9 billion on Black Friday in 2020 compared to 2019.

Physical retailers

Several brick-and-mortar retailers changed their operations to deal with the new trends. Those who had invested earlier in their digital capabilities benefited from the shift to online shopping while others who lagged behind had to accelerate their digital transformation to keep up with their rivals.

Macy’s (NYSE: M) saw its digital sales rise 27% year-over-year in the third quarter of 2020 with digital penetration increasing to 38%. The company rolled out its same-day delivery partnership with DoorDash across all its Macy’s and Bloomingdale’s stores and improved its curbside pickup services during the holiday season.

Lululemon Athletica (NASDAQ: LULU) witnessed strength during Thanksgiving and Black Friday as ecommerce helped offset declines from lower store traffic. During the third quarter of 2020, 43% of the retailer’s total revenue came from its digital channel while digital comps increased 93%.

Target (NYSE: TGT) saw comparable sales rise 17.2% year-over-year during the November/December period. Comparable digital sales increased 102%. This growth was driven meaningfully by the company’s same-day fulfillment services – Order Pick Up, Drive Up and Shipt, which on a combined basis grew 193%.

During the holiday season, approx. 95% of Target’s sales were fulfilled by its stores. The retailer spread out its deals throughout the period to reduce the crowds and stress that come with holiday shopping and kept its stores closed on Thanksgiving Day. This strategy paid off well and Target plans to continue this practice in 2021.

Online retailers

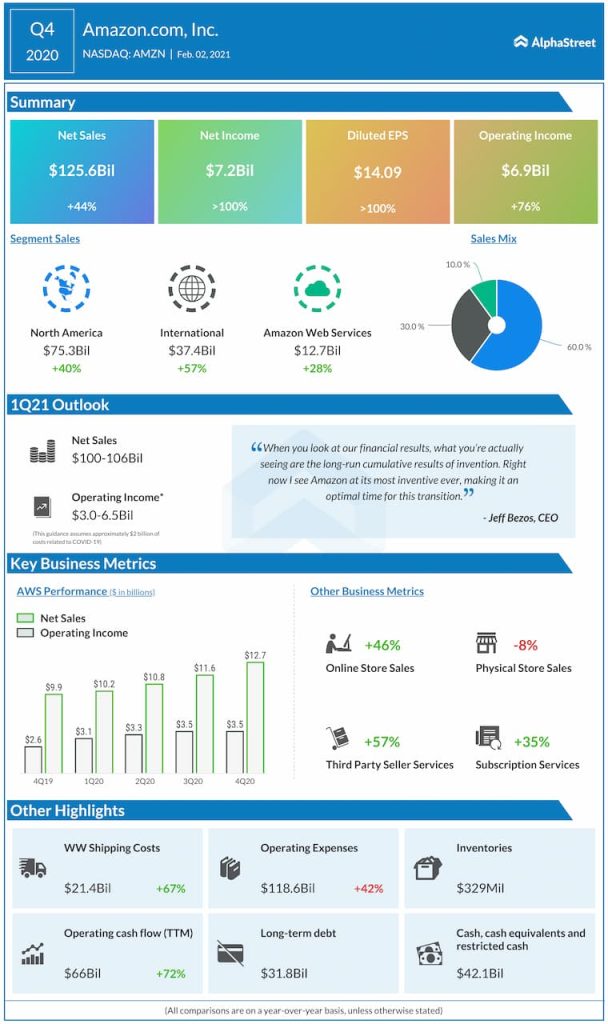

Online retailers like Amazon.com (NASDAQ: AMZN) and Alibaba Group (NYSE: BABA) have seen their sales surge amid the pandemic. Amazon reported a 44% growth in net sales to $125.6 billion during the fourth quarter of 2020 while profits more than doubled compared to the previous year.

During the 2020 holiday season, Amazon saw worldwide sales grow over 50% year-over-year. From Black Friday through Cyber Monday, worldwide sales grew around 60% from the previous year. Amazon held its Prime Day in October as opposed to the third quarter and saw strong seasonal holiday demand through the fourth quarter.

Alibaba too delivered strong results for its third quarter of 2021 with total revenue of $33.8 billion reflecting a YoY growth of 37% and profits increasing 50%. The company spread out its 11.11 Global Shopping Festival, which was originally a one-day festival, over a period of 11 days from November 1 to November 11 to increase the convenience of customers as well as to reduce pressures on logistics and delivery. This year’s festival saw approx. 30 million new product launches and a 35% YoY growth in GMV for new products, excluding unpaid orders.

2021

So how will 2021 unfold? It can be expected that once the COVID-19 situation starts to normalize with the rollout and widespread availability of vaccines, shopping trends could start to pick up and perhaps even return to pre-pandemic levels. After all, the advantages of shopping in stores and being able to physically check out the products that one purchases cannot be replaced that easily.

On the other hand, online shopping is a trend that is here to stay. The strength seen in ecommerce is very much likely to continue due to the convenience factor involved. Retailers are relying on technology and investing significantly in their digital capabilities to drive online sales.

Online shopping has also become a key part of holiday shopping from 2020 and it is likely this trend will continue for the foreseeable future. So it appears that the pandemic has brought significant changes to shopping behaviors and some of them may not go away.