Elusive Recovery

It is estimated that the Camp Hill, Pennsylvania-based company serves around one million Americans every day, providing them a wide range of healthcare services and products. The services are delivered through 2,400-odd retail pharmacies located in 18 states. The pharmacy benefits & services arm Elixir has been a key growth driver since it was acquired by Rite Aid about five years ago.

RxEvolution

Currently, the focus is on implementing RxEvolution, the management’s strategic plan that was launched early last year. Under the initiative, both the Retail Pharmacy and Pharmacy Services segments are undergoing aggressive rebranding, integration, and merchandising. Also, efforts are on to ramp up the retail segment and enhanced the digital experience. The long-term goal is to become a dominant mid-market pharmacy benefit manager.

For the company, fiscal 2020 was a busy year due to the extensive organizational restructuring and management rejig. As part of strengthening the balance sheet, corporate expenses were slashed by $55 million on an annualized basis and debt was reduced considerably.

From Rite Aid’s third-quarter 2020 earnings call transcript :

“Every day we’re introducing new products to our stores that are on trend and reinforced our commitment to whole health. We changed out or replaced thousands of products over the last nine months and adjusted our merchandising presentation standards in the stores to showcase these new products and provide customer education on their ingredient benefits. We’re actively refreshing the exteriors of all of our Rite Aid stores and have completed more than 700 to date and expect to complete all stores next year.”

Challenges

The healthcare services industry turned highly competitive in recent years amid continuing consolidation and heavy discounts on generic drugs. Rite Aid’s retail segment competes with drugstore chains, healthcare supermarkets, discount stores, and online drugstores, among others. For the pharmacy benefit management operations, the main rivals include Caremark and Express Scripts (ESRX).

With not many blockbuster drugs hitting the market these days and the FDA’s approval process taking longer than earlier, pharmacy sales continue to be under pressure despite a marked increase in prescription drug usage in the U.S. Since the business is dependent on government programs like Medicaid and Medicare to a large extend, changes in the subscription policies often affect sales.

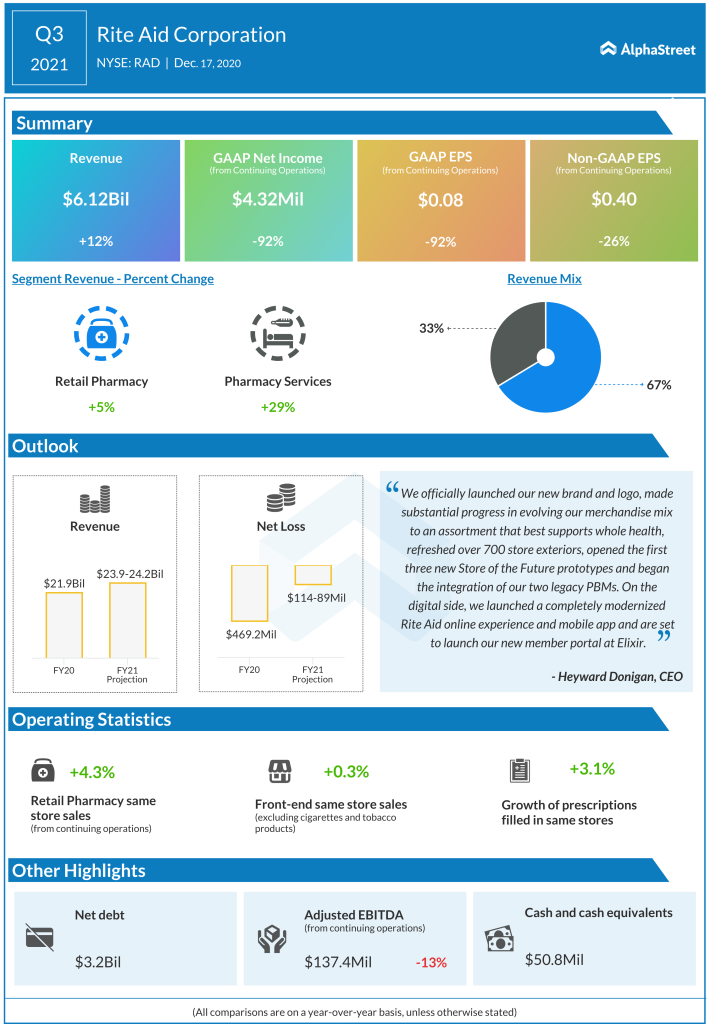

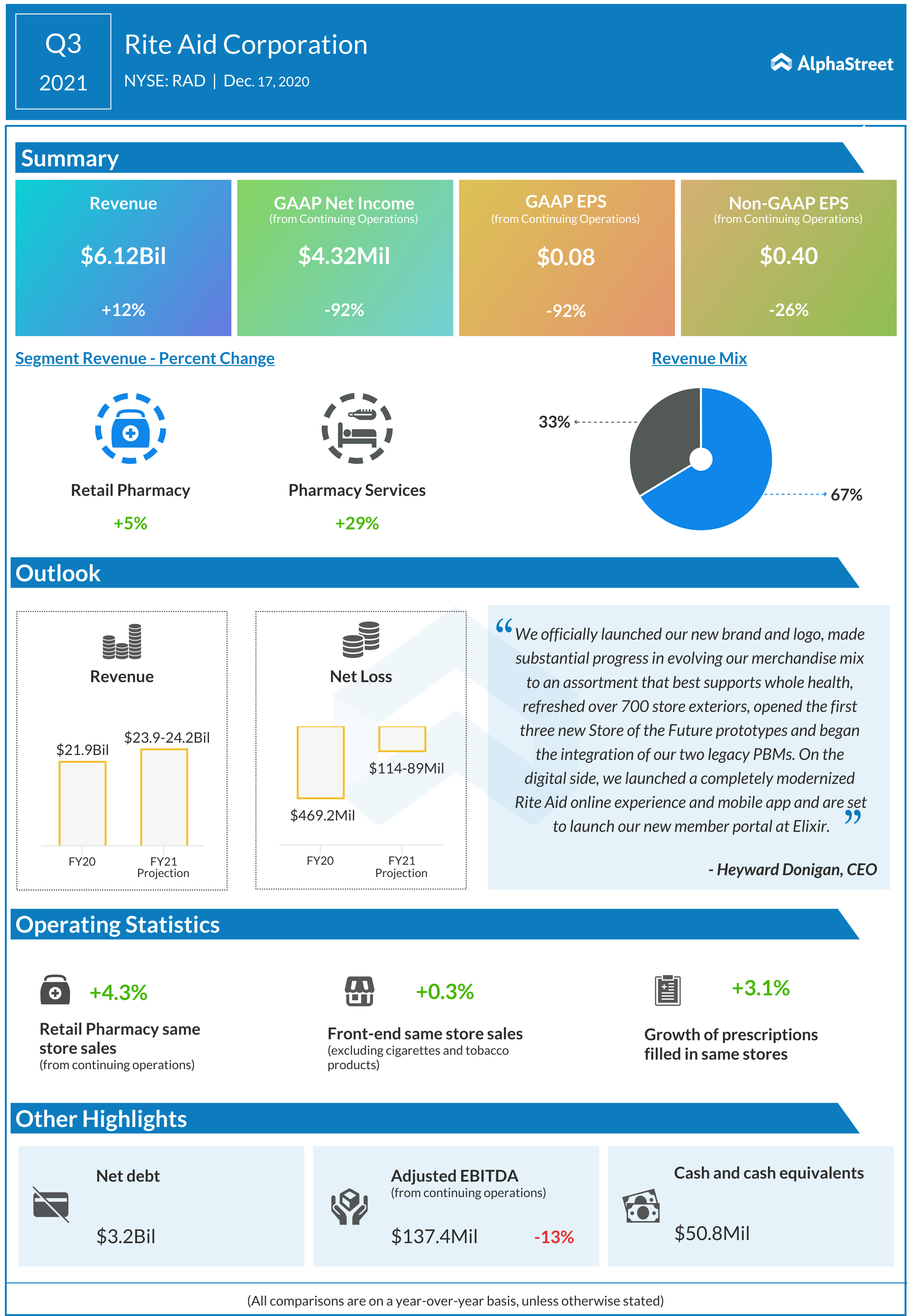

Q3 Boost

Rite Aids adjusted earnings dropped to 40 cents in the third quarter from 54 cents in the year-ago period. On the other hand, total revenues moved up 12% to $6.12 billion, reflecting strong comparable sales performance by both the operating segments. The management attributed the better-than-expected performance to the expansion of the physical and digital platforms under the RxEvolution plan.

Read management/analysts’ comments on Rite Aid’s Q3 2020 results

Rite Aid’s stock is yet to recover from the mass sell-off seen a few years ago. However, the stock gained nearly 40% in the past twelve months, with the momentum picking up significantly after the positive first-quarter results.