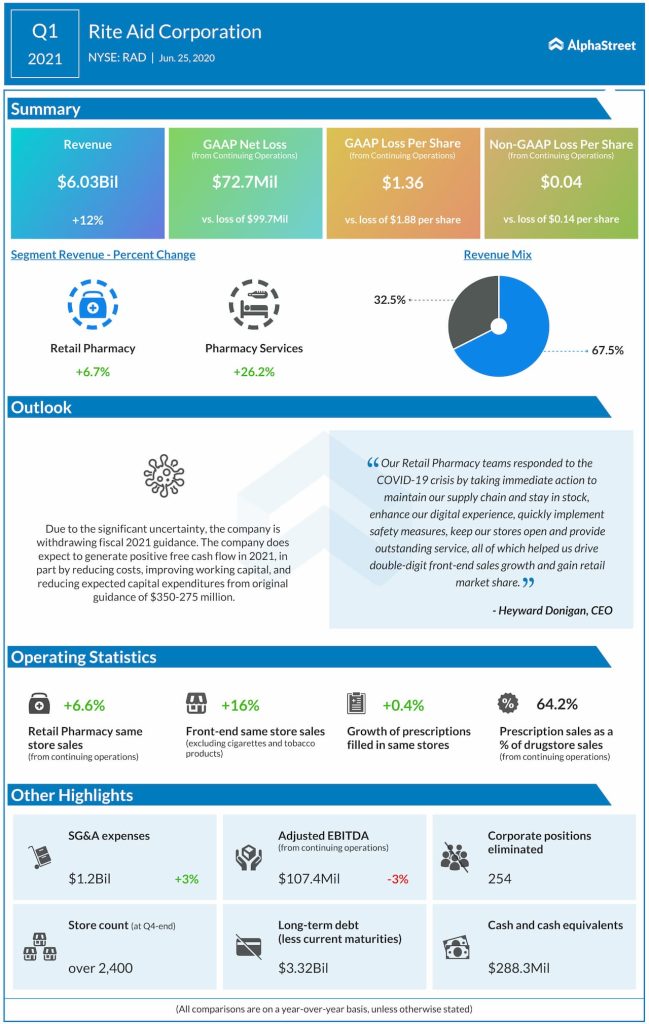

Q1 results

In Retail Pharmacy business, front-end same-store sales increased by 16%, excluding tobacco items. This growth was driven by the sale of general cleaning products, sanitizers, wipes, paper products, over-the-counter products, liquor and summer seasonal items. The reduction in acute prescriptions of 14.8% in the quarter, resulted from the postponement of doctors’ office visits and elective surgical procedures in connection with the COVID-19 pandemic. Revenue grew in Pharmacy Services segment (Elixir) due to an increase in Medicare Part D revenues.

COVID-19 opportunities

Rite Aid expects increased demand for immunization with

recently issued CDC guidance that stresses the importance of flu shots in the

fall. The company also expects demand to continue to increase for its front-end

products, and continued expansion of COVID-19 testing capabilities. So far, the

company has 97 COVID testing centers at Rite Aid stores.

COVID-19 risks

The potential for a second wave of COVID-19 related shutdown activities could result in continued softness in acute prescription demand, slower return to pre-COVID outpatient visit and elective surgery levels. Rite Aid also expects a potential protracted economic recession, supply shortages with certain generic drugs, increased cleaning and sanitation costs, potential reductions in membership at Elixir, and a soft Elixir 2021 selling season.

[irp posts=”64905″]

Looking ahead

Rite Aid withdrew its guidance for fiscal 2021 citing the

uncertain situation in the wake of the global pandemic, the potential volatility in the business related to the

opportunities and risks as previously outlined, and the related short and

mid-term macroeconomic impacts on the business.

Rite Aid expects to generate

free cash flow in fiscal 2021. As part of cost reductions measures, the company

eliminated 254 corporate executives. It has also taken steps to cut other

expenses such as shrink, advertising, rent, travel and call center expenses. Rite

Aid expects these initiatives to result in savings of over $40 million in

fiscal 2021 and an annualized savings of $55 million.

In an email communication to AlphaStreet, Rite Aid spokesperson said since the COVID-19 situation is fluid it cannot determine how long the company would benefit from the increased demand for its front-end products.

GNC bankruptcy

Rite Aid brand vitamin and

mineral supplements are manufactured by its partner GNC Holdings. Under the strategic

alliance, over 1,623 GNC stores were operated within Rite Aid stores as of February

29, 2020. The companies have a contractual commitment to open at least 99

additional GNC stores within Rite Aid stores by December 2021. Last week, GNC filed for Chapter 11

bankruptcy protection.

During the Q1 earnings call, when asked whether GNC’s bankruptcy filing will change the relationship, COO Jim Peters stated,

“We expect them to continue operating during this restructuring period and to continue to partner with us as we provide their products to our customers. So no real insight into anything other than we’re continuing on, and we have no reason to believe that, that will change.”

He added that GNC will

decrease its own retail front door stores, which would intuitively drive more wholesale

business in places like Rite Aid.

Recovery mode

From the closing price of $12.87 on last Wednesday, RAD stock had surged 35% to $17.31 yesterday. This is the sixth time RAD stock had crossed $17 mark in this year. After reaching a 52-week high ($23.88) at the end of last year, the stock has been struggling till the company reported Q1 results.

[irp posts=”64755″]

With Amazon (NASDAQ: AMZN) making big moves in this space, and Walmart (NYSE: WMT) and Costco (NASDAQ: COST) grabbing their share from standalone pharmacies, the future is going to be tough for the drugstore operators. It’s worth noting that peers Walgreens Boots Alliance (NASDAQ: WBA) and CVS Health (NYSE: CVS) have declined 28% and 13%, respectively, so far this year.

With the recent upward movement, Rite Aid stock has gained 12% in this year. However, if this upward momentum is not carried forward, RAD stock could fall again. Once the COVID crisis comes to an end, we will get a clear picture whether Rite Aid had recovered from its challenging times.

DISCLAIMER: This article does not necessarily imply the views of AlphaStreet, and contains opinions of the author alone.