Roku Inc. (ROKU) topped market expectations on both revenue and earnings for the fourth quarter of 2018, sending the shares climbing over 3% during after-market hours on Thursday.

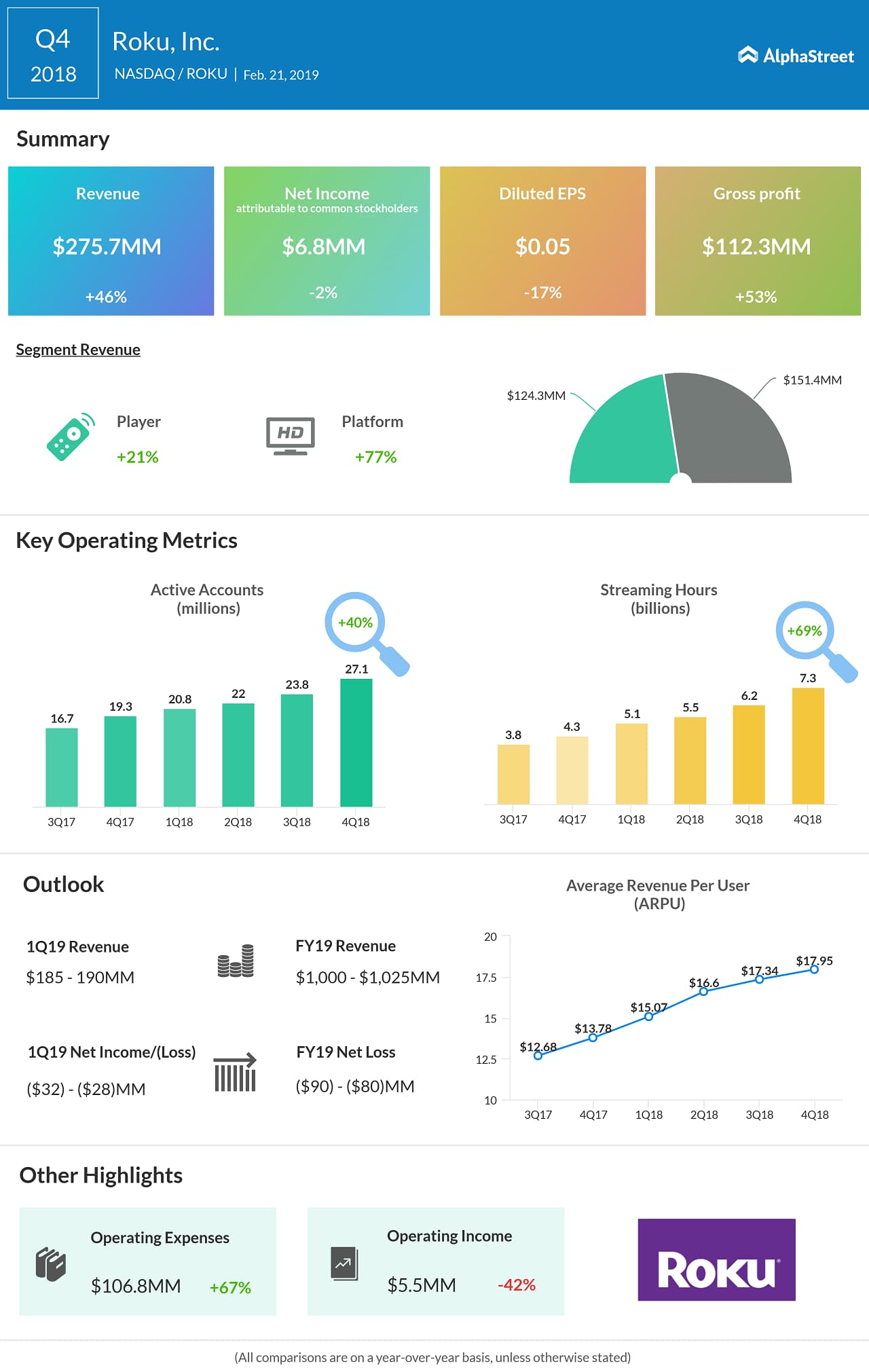

Total revenues rose 46% year-over-year to $275.7 million. Platform revenue grew 77% and Player revenue grew 21% during the quarter.

Net income attributable to common stockholders was $6.7 million, or $0.05 per share, compared to $6.9 million, or $0.06 per share, in the prior-year quarter.

Active accounts increased 40% year-over-year to 27.1 million while streaming hours improved 69% to 7.3 billion. ARPU grew 30% to $17.95. The results benefited from strong holiday sales for both players and TVs. The company also saw an increase in its smart TV market share in the US.

Also see: Roku Q4 2018 Earnings Conference Call Transcript

Although Roku sees the opportunity to grow active accounts in the US, the company is increasing its international investment. International distribution is unlikely to be a key driver of account growth in 2019 but Roku expects to see more benefits from these investments show up in international account growth in 2020 and beyond.

For the first quarter of 2019, Roku expects total revenue of $185 million to $190 million along with a net loss of $28 million to $32 million. For the full year of 2019, the company expects to achieve $1 billion in revenues, or around 36% year-over-year growth, with Platform revenue representing roughly two-thirds of total revenue. Net loss for the year is expected to range from $80 million to $90 million.