Seagate Technology (NASDAQ: STX) stock decreased above 2% during the pre-market trading hours as the first quarter earnings outlook fails to impress the street. However, the company reported better-than-expected results for the fourth quarter. The data storage company’s stock rose 20% this year recovering from a new 52-week low level of $35 mark in late December.

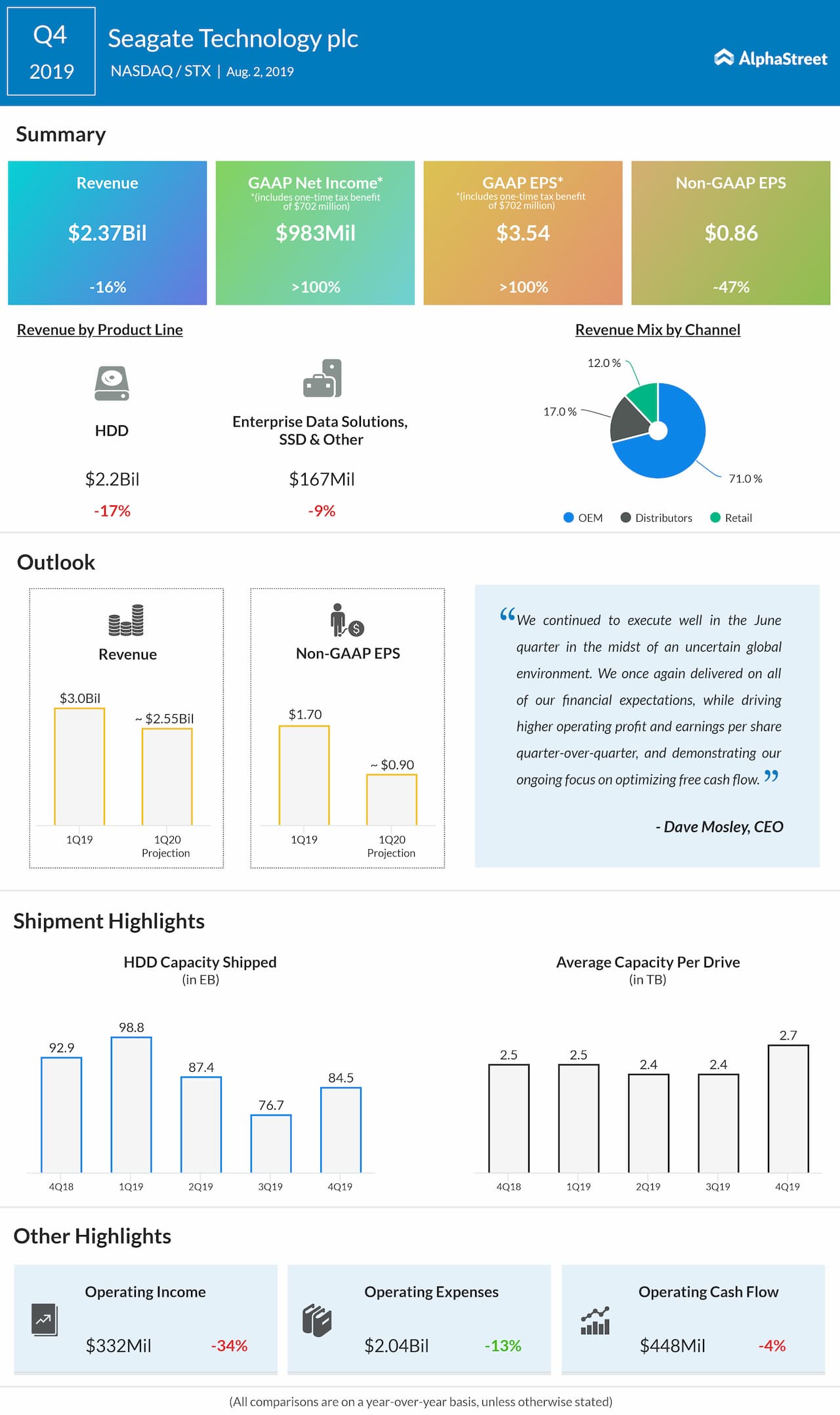

As expected, revenue fell 16% to $2.37 billion over prior year, but surpassed estimates of $2.33 billion. Adjusted earnings plunged 47% to $0.86 per share, beating analyst consensus of $0.84. Last quarter, the company has guided Q4 revenue of $2.32 billion and non-GAAP earnings of 83 cents per share.

During the quarter, Seagate reported one-time tax benefit of $702 million resulting in lifting the GAAP earnings to $3.54 per share compared to $1.57 reported last year.

CEO Dave Mosley is quite upbeat about the improving macros. He said, “As we enter our next fiscal year, global industry conditions have started to improve, particularly among cloud and hyperscale customers. Seagate is in a strong strategic position to address growing demand for mass storage.”

ADVERTISEMENT

The company also has declared a dividend of 63 cent per share with record date set at September 25. For the fiscal 2019 period, share repurchases came in at $963 million and has paid dividends of $713 million to the shareholders.

Adjusted gross margins contracted to 26.8% compared to 32.4% last year due to muted PC sales and less orders from the data center businesses along with competition from solid state drive (SSD) providers like Western Digital. Free cash flow dropped 20% to $297 million.

Q1 Outlook

Seagate is anticipating top line of $2.55 billion (plus or minus 5%) and adjusted EPS of 90 cents (plus or minus 5%). The street is anticipating revenue of $2.53 billion and non-GAAP earnings of $1.11 per share. The company earnings guidance fell short of estimates, which reflects the headwinds faced by the firm going into the next fiscal period.

Looking Ahead

Seagate has been staying away from the vagaries of the falling NAND prices due to abundant supply and muted demand across the board.

The company has been focusing on selling higher-capacity hard disk drive (HDD) offerings to cloud service providers who are looking for affordable alternatives to SSDs. It has launched 16 terabyte drives which started shipping in March.

The initial response for this high-capacity drives seems to be encouraging from the cloud and hyperscale clients, which is a good sign for investors. It would be interesting to see how the company is going to respond to the market challenges without compromising on the profitability.