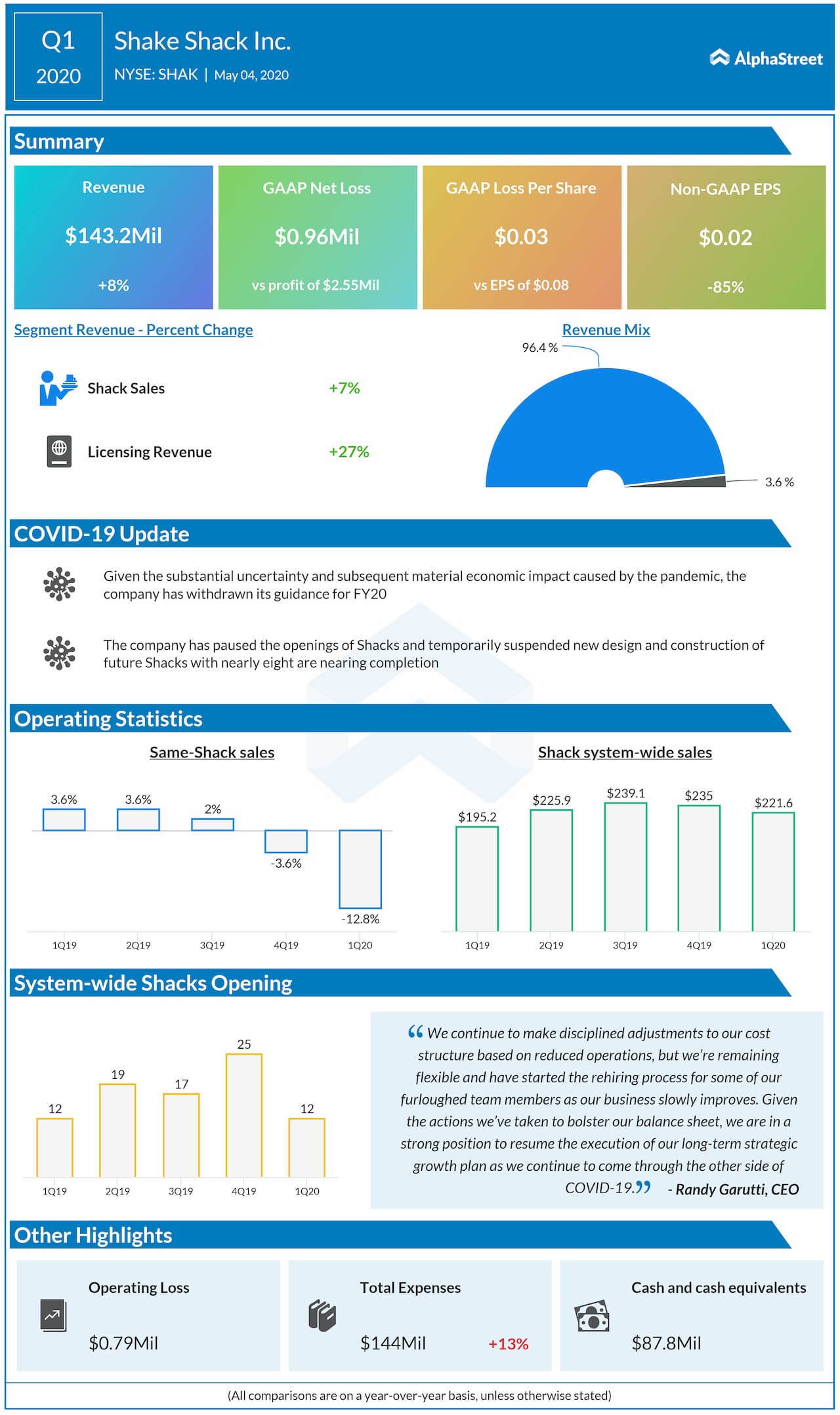

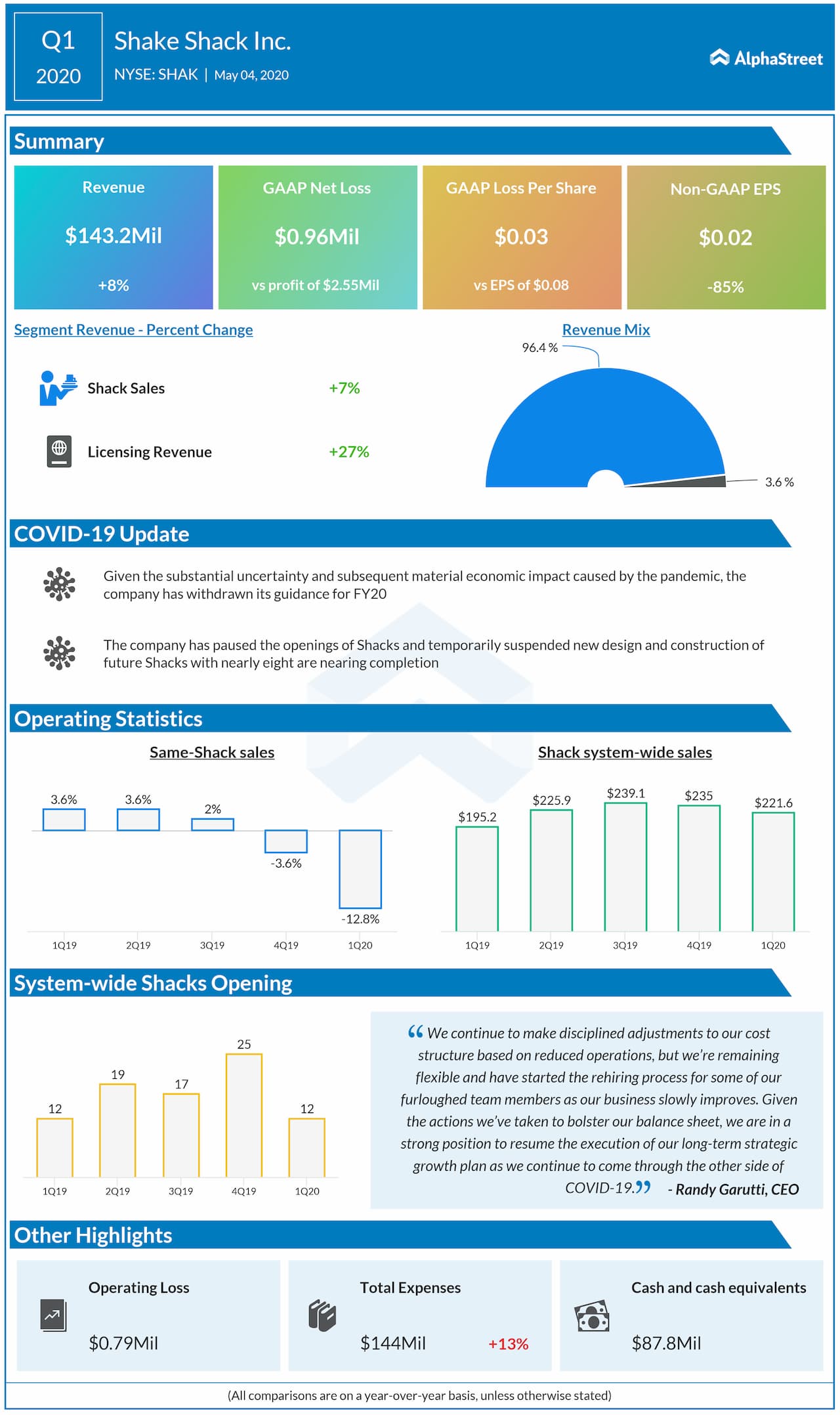

Shake Shack Inc. (NYSE: SHAK) reported its financial results for the quarter ended March 25, 2020, on Monday after the bell. The bottom line exceeded analysts’ expectations while the top-line missed consensus estimates.

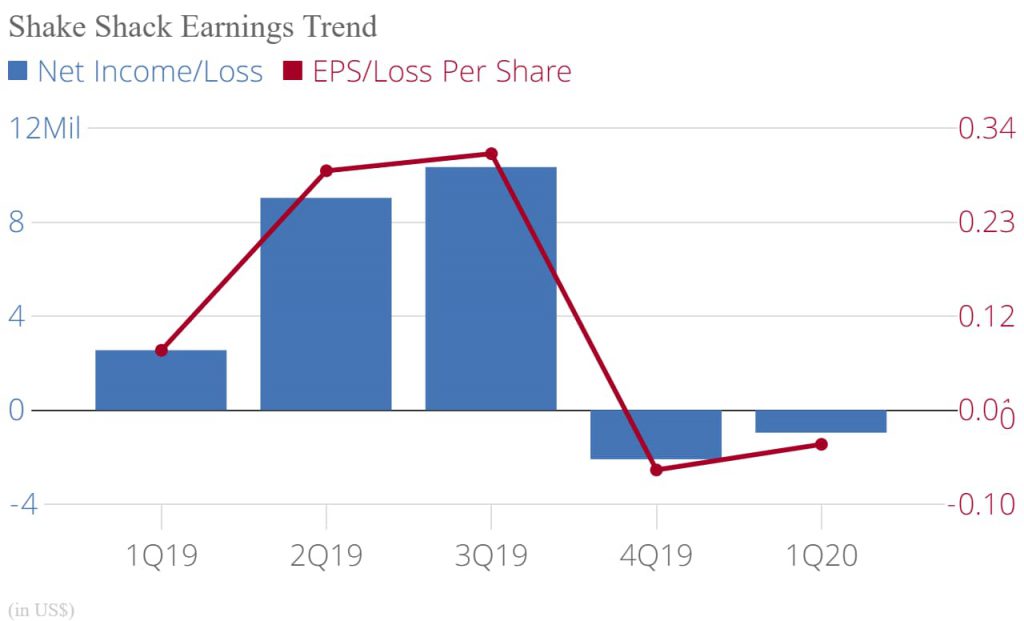

Shake Shack slipped to a loss in the first quarter of 2020 from a profit last year due to the inclusion of a non-cash asset impairment charge. The company experienced weakness in sales deleverage resulting from the impact of COVID-19, which was partially offset by food and paper costs.

Shack sales rose by 7.4% due primarily to the opening of 38 new domestic company-operated Shacks, partially offset by a decline in same-Shack sales. As of March 25, 2020, 12 Shacks were temporarily closed due to COVID-19.

Same-Shack sales decreased by 12.8% due to the adverse impact of reduced traffic during the second half of March 2020 resulting from the coronavirus pandemic. The decrease was primarily driven by a 14.9% decrease in guest traffic partially offset by a combined increase of 2.1% in price and sales mix.

Given the substantial uncertainty and subsequent material economic impact caused by the COVID-19 pandemic, the company has withdrawn its guidance for fiscal 2020.