Same-store sales increased 1.7% driven by initiatives to revamp the product assortment and associated clearance sales. E-commerce sales, including James Allen, improved 82.8% to $150.3 million, reflecting growth across all segments.

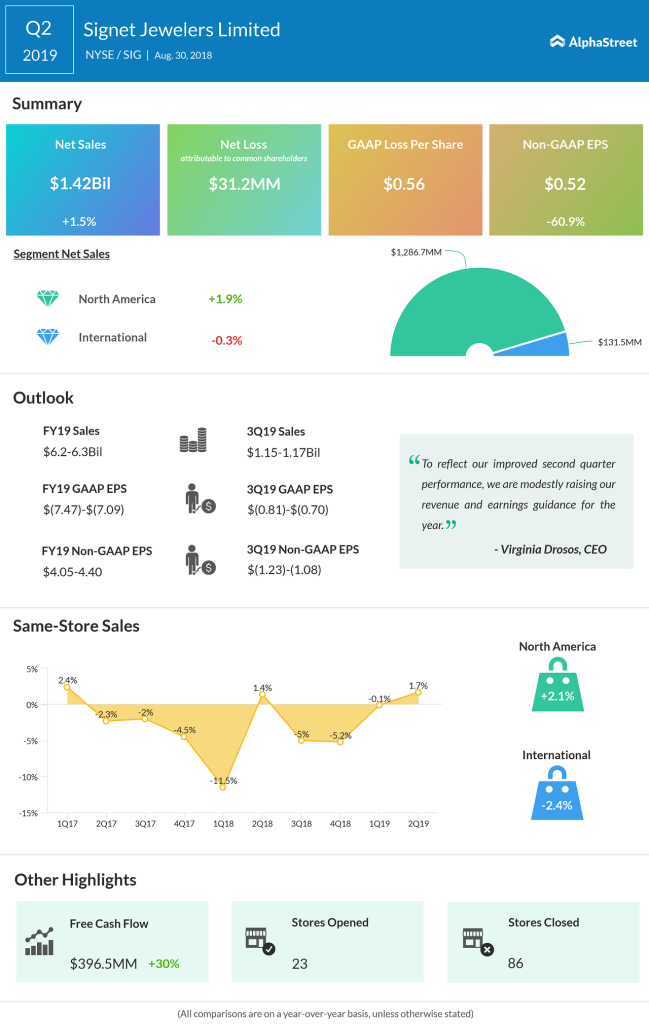

Total sales in the North America segment increased 1.9% while international segment sales dropped 0.3%. The Piercing Pagoda and Zales categories posted sales growth while Kay and Jared saw declines. Same-store sales in North America increased 2.1% helped by strength in bridal and fashion sales. International same store sales fell 2.4% due to lower sales in diamond jewelry and fashion watches.

Signet plans to achieve cost savings of $200 million to $225 million over the next three fiscal years under its Signet Path to Brilliance transformation plan. For fiscal 2019, the company expects to achieve net cost savings of $85 million to $100 million.

The company lifted its guidance for the full year of 2019. Total sales are now expected to be $6.2 billion to $6.3 billion versus the prior guidance of $5.9 billion to $6.1 billion. Same-store sales are projected to be down 1.5% to flat versus the previous outlook of down low to mid-single digits. GAAP diluted loss per share is expected to be $7.09 to $7.47 while adjusted EPS is expected to be $4.05 to $4.40.

For the third quarter of 2019, Signet expects total sales to be $1.15 billion to $1.17 billion while same store sales are expected to be down 1.5% to flat. Loss per share is expected to be $0.70 to $0.81 on a GAAP basis and $1.08 to $1.23 on an adjusted basis.

Signet declared a quarterly cash dividend of $0.37 per share for the third quarter of 2019, payable on November 30 to shareholders of record on November 2.

Signet also announced that its CFO Michele Santana will leave the company in 2019 to pursue other opportunities. The company has launched a search and expects to appoint a successor by the end of the year. Santana will remain with the company to assist with the transition.

Related: Signet Jewelers Q1 2018 Earnings Infographic