Smart Global Holdings (SGH) reported a 65% dip in earnings for the second quarter of 2019 as its Brazil business was hurt by worsening pricing environment. The bottom line exceeded analysts’ expectations while the top line missed consensus estimates. Also, the specialty memory services maker guided third-quarter earnings and revenue below the Street’s view.

Net income plunged 65% to $12.8 million and earnings plummeted 66% to $0.55 per share. Adjusted earnings dropped by 53% to $0.77 per share.

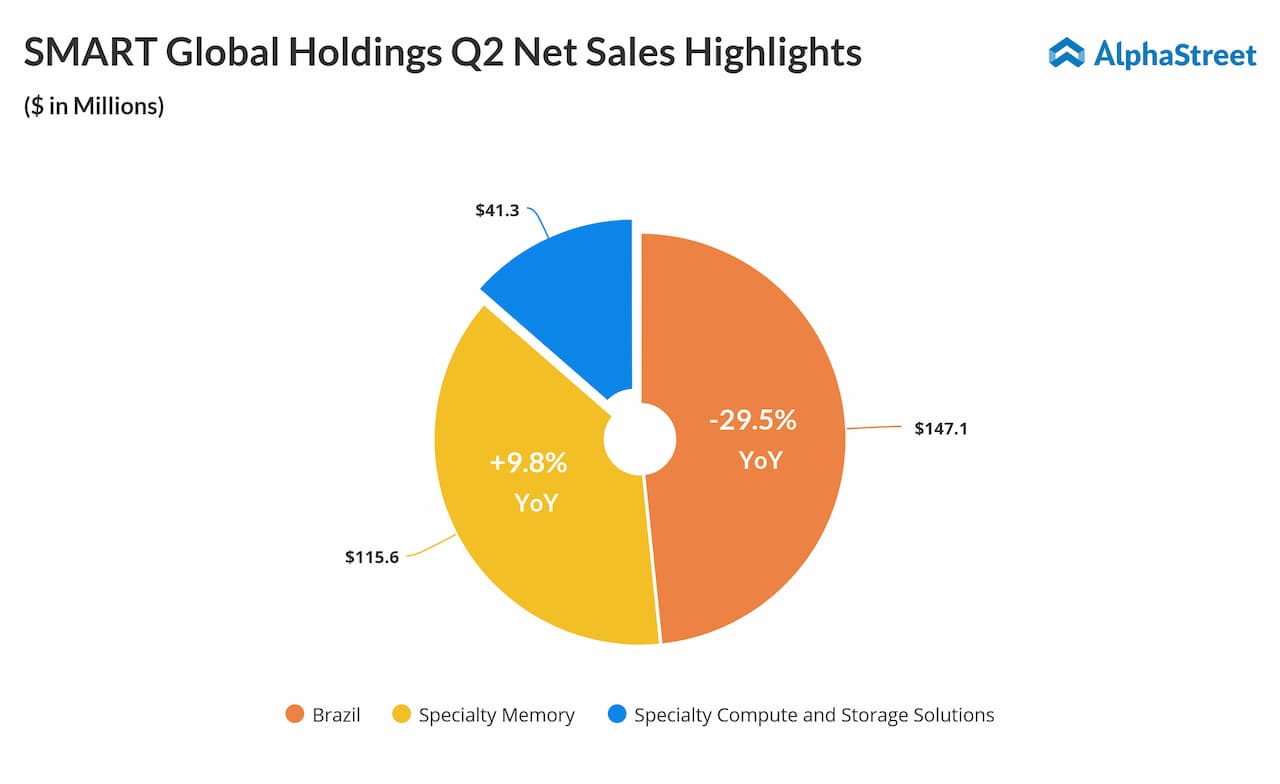

Net sales declined 3.2% to $304.1 million. The Brazil business, where the company supplies commodity memory products to high volume requirements in smartphones and PCs, was hurt by the worsening pricing environment for such products.

Looking ahead into the third quarter of fiscal 2019, the company expects net sales in the range of $260 million to $270 million and adjusted earnings in the range of $0.34 to $0.38 per share. GAAP earnings are anticipated to be in the range of $0.13 to $0.17 per share and gross margin is predicted to be 17% to 19%.

The company said it has made good progress towards realizing synergies from its purchase of Penguin Computing and remained focused on disciplined execution to drive its financial performance.

Shares of Smart Global ended Thursday’s regular session up 2.89% at $23.87 on the Nasdaq. Following the earnings release, the stock tumbled over 14% in the after-market session.