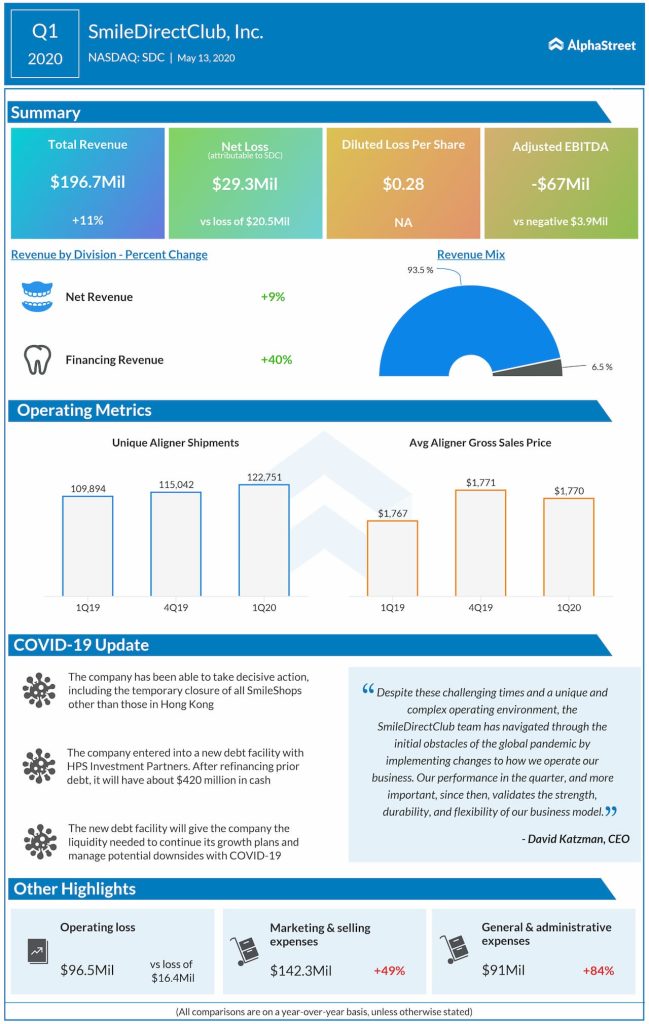

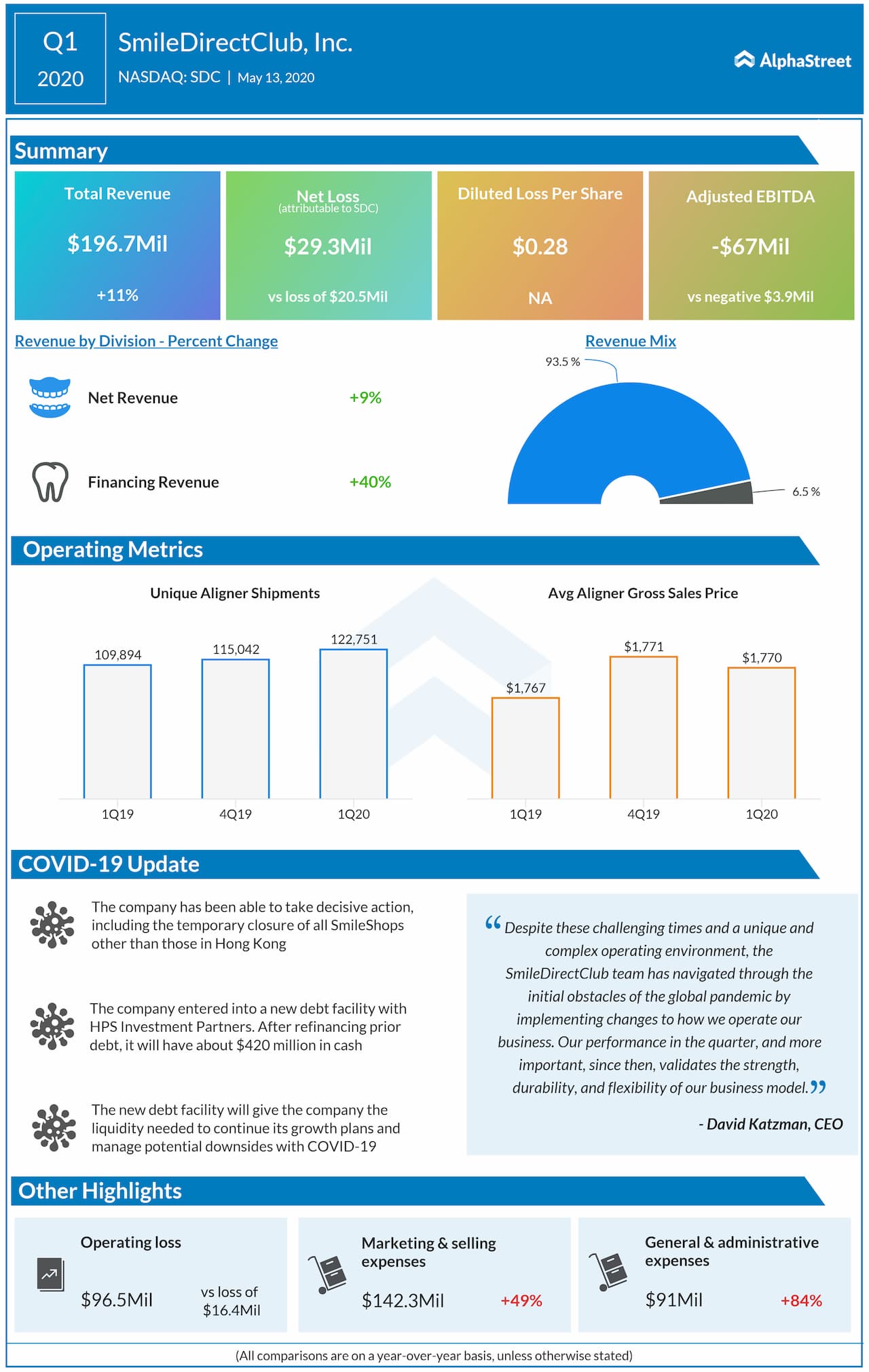

Due to very few fixed costs and the vast majority of its SmileShops around the world operate on month-to-month leases, the company has been able to take decisive action, including the temporary closure of all SmileShops other than those in Hong Kong. The company has also put in place several cost management measures, including the suspension of most of its marketing spend, to position it to operate cash-neutral during this period.

Also, SmileDirectClub has entered into a new debt facility with HPS Investment Partners. After refinancing the previous debt facility, the company will have about $420 million in cash on its balance sheet, giving the liquidity needed to continue its growth plans and manage potential downsides with COVID-19.

Take a look at our Health Care articles here