Quarterly performance

User growth

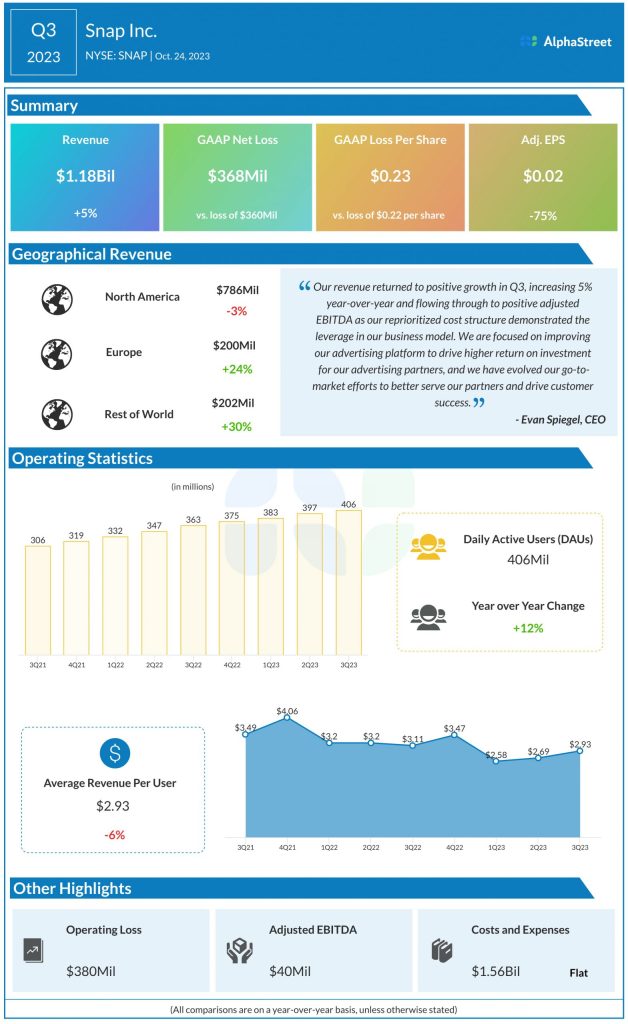

Daily active users grew 12% year-over-year to 406 million in the third quarter. The company recorded year-over-year user growth across all its geographic regions with the highest increase of 21% coming from Rest of World. Users grew on a sequential basis as well, with the exception of North America where it remained unchanged compared to last quarter.

However, Snap saw a decrease in average revenue per user (ARPU). In Q3, global ARPU decreased 6% YoY to $2.93. North America saw a 4% drop in ARPU while Europe and Rest of World saw increases of 15% and 8% respectively.

Advertising

In the third quarter, Snap’s brand-oriented advertising business remained flat YoY while its direct-response advertising business grew 3%. The slower growth in brand advertising compared to direct-response advertising seen in Q3 poses challenges for revenue in the fourth quarter of 2023 as revenue mix in Q4 has historically included a larger share from brand advertising revenue.

The company is also seeing pauses in spending from a large number of brand-oriented advertising campaigns due to the war in the Middle East, which is a headwind to revenue. Although some of these campaigns have resumed, there is still a level of risk and uncertainty related to these pauses and their magnitude.

Outlook

For the fourth quarter of 2023, Snap expects revenue to grow around 2-6% YoY to a range of $1.32-1.37 billion. DAUs are estimated to reach a range of 410-412 million.