Revenue and profitability

While passenger revenues were impacted by the Omicron variant and severe weather during January and February, March witnessed an improvement thanks to a surge in leisure travel and bookings. Leisure and business demand exceeded expectations during March.

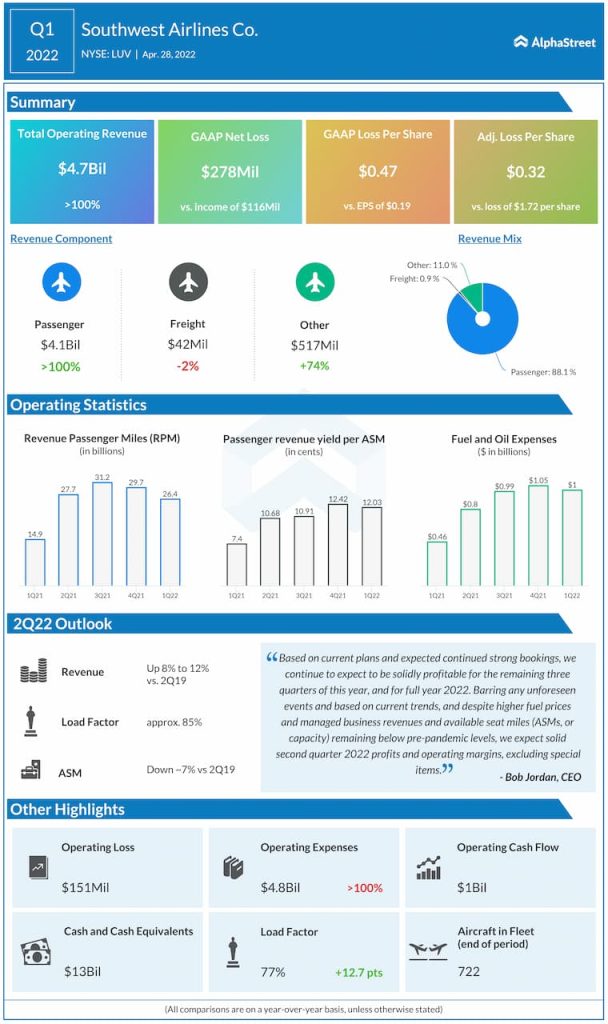

Looking into the second quarter of 2022, Southwest expects operating revenue to turn positive versus the second quarter of 2019 and to be up 8-12% from that period.

In Q1, Southwest reported a net loss of $278 million, or $0.47 per share, on a GAAP basis. Adjusted loss per share was $0.32, which was narrower than expected. Despite high unit cost inflation, the company expects to be profitable for the remaining quarters of 2022 and for FY2022. The airline expects to see a healthy profit along with solid operating margins in Q2.

Costs

In terms of non-fuel costs, Southwest is tracking in line with its 2022 cost plan. In Q1 2022, CASM-X increased 17.9% versus Q1 2019, coming at the lower end of the company’s previous guidance range. Looking ahead, Southwest expects to see unit cost pressure from operating at suboptimal productivity levels as well as higher inflationary cost pressures, mainly in salaries, wages and benefits.

In Q2 2022, CASM-X is estimated to increase 14-18% versus the same period in 2019, with roughly half of this increase coming from continued inflationary pressures in both labor and airport rates and the rest from operating at suboptimal capacity and productivity levels. For the full year of 2022, CASM-X is expected to increase 12-16% from 2019 levels.

Fuel price for the second quarter is estimated to be $3.05-3.15 per gallon, which is roughly $0.80 higher than the first quarter fuel price.

Capacity

In Q1 2022, capacity rose 48.6% YoY to 34.38 billion but was down 9.2% compared to Q1 2019. For the second quarter of 2022, capacity is expected to be down approx. 7% from 2019 levels.

Click here to read the full transcript of Southwest Airlines’ Q1 2022 earnings conference call