The COVID-19 pandemic brought several restrictions with it

and led to shifts in consumer behavior in various aspects such as dining, shopping

and entertainment. This is where digital payments came in. As people were

forced to stay at home, they had to find new ways to go about their business

and as part of this change, most of them moved to online payment methods.

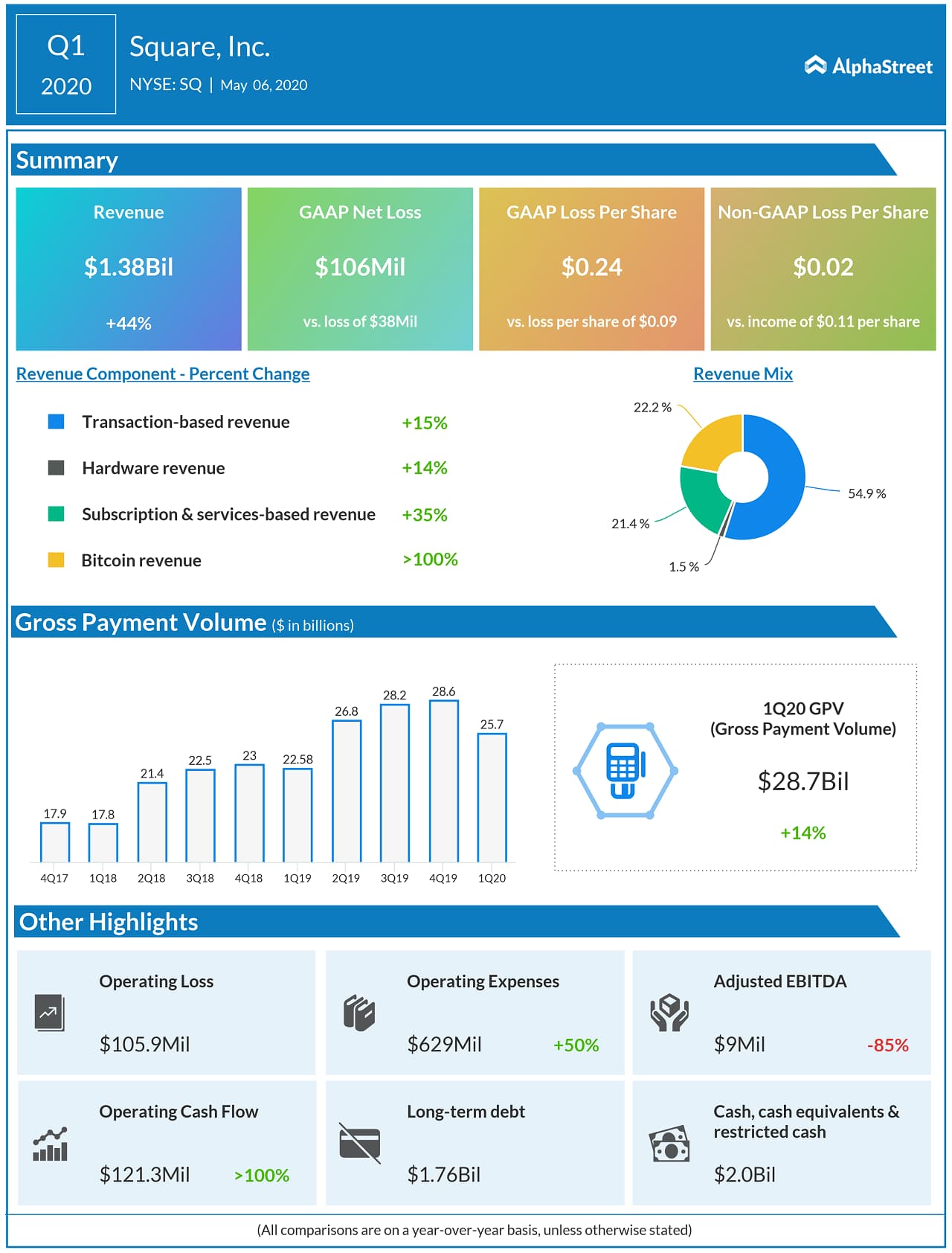

Digital payments firm Square Inc. (NYSE: SQ), despite facing some challenges in its most recent quarter, benefited quite a bit from this change. The company is expected to see further growth going forward as the digital payments industry picks up pace and online payments become the new norm.

Square Online Store

Square Online Store helps sellers build their website and online store and also makes it easy to sell on social media platforms like Instagram. Within two weeks of the first stay-at-home orders in the US, Square accelerated its Square Online Store product launches to enable contactless commerce between sellers and buyers.

Square Online Store witnessed strong growth in the first

quarter of 2020 as both new and existing sellers moved from in-person sales to

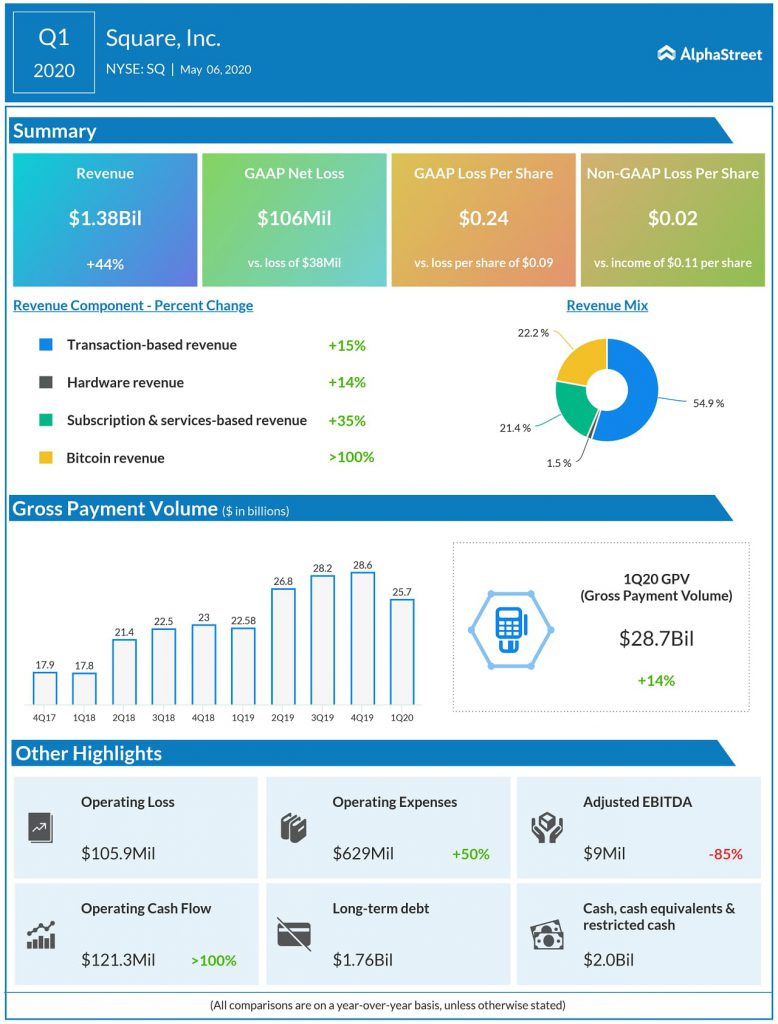

online transactions. Weekly gross payment volume (GPV) increased more than 5

times since mid-March when the company launched curbside pickup and local

delivery.

The number of sign-ups for Square Online Store outpaced the sign-ups

for Square Point of Sale and the strongest adoption by sellers were in the

retail and food and drink verticals.

Cash App

Cash App provides an ecosystem of financial services that help

people manage their money. Square benefited from the changes in consumer

behavior and move towards online payments as Cash App added its largest number

of net new transacting active customers in March.

During the pandemic, people used peer-to-peer payments in

new ways to support each other through donations, fundraising, online tipping,

reimbursing each other for supplies and even taking part in activities or

games.

Cash App provided services to help customers understand the CARES

Act stimulus programs and how to receive funds easily through direct deposit. Square

worked with its partner banks to expand direct deposit eligibility from 3

million customers in February to around 14 million customers in April.

Cash App also rolled out cross-border payments in March

which helped customers transfer money instantly between the US and UK without

paying any fees. This has helped drive an increase in net new transacting active

customers and peer-to-peer volumes.

In April, Cash App achieved its highest monthly totals for net new transacting active customers, peer-to-peer volumes, and direct deposit transacting active customers. After a slight slowdown at the end of March, Cash App peer-to-peer volumes and Cash Card spend improved in April.

Segment revenue

Square witnessed revenue growth across all its components in

the first quarter of 2020. Transaction-based revenue increased 15%

year-over-year helped by growth in payment volume from both new and existing

sellers. Subscription and services-based revenue climbed 35% driven by the

strong performance of products like Cash App and Square Capital. Hardware

revenue rose 14% driven by Square Terminal.

Industry and

competition

According to a report

by BusinessWire, the global digital payments market is expected to grow

from $3.8 trillion in 2019 to $5.4 trillion in 2020. The market is expected to

reach $8 trillion at a CAGR of 20% through 2023.

Another player in this market that is benefiting

from the shift to digital payments is PayPal Holdings Inc. (NASDAQ: PYPL). PayPal saw

a 12% growth in revenue and an 18% increase in total payments volume for the

first quarter of 2020. The company expects to see revenue growth of 13% in the

second quarter of 2020.

Stock

Square’s shares have gained over 101% since the beginning of the year and have jumped over 150% over the past three months. The stock was up 5% in afternoon hours on Tuesday.

Click here to read the full transcript of Square Q1 2020 earnings conference call