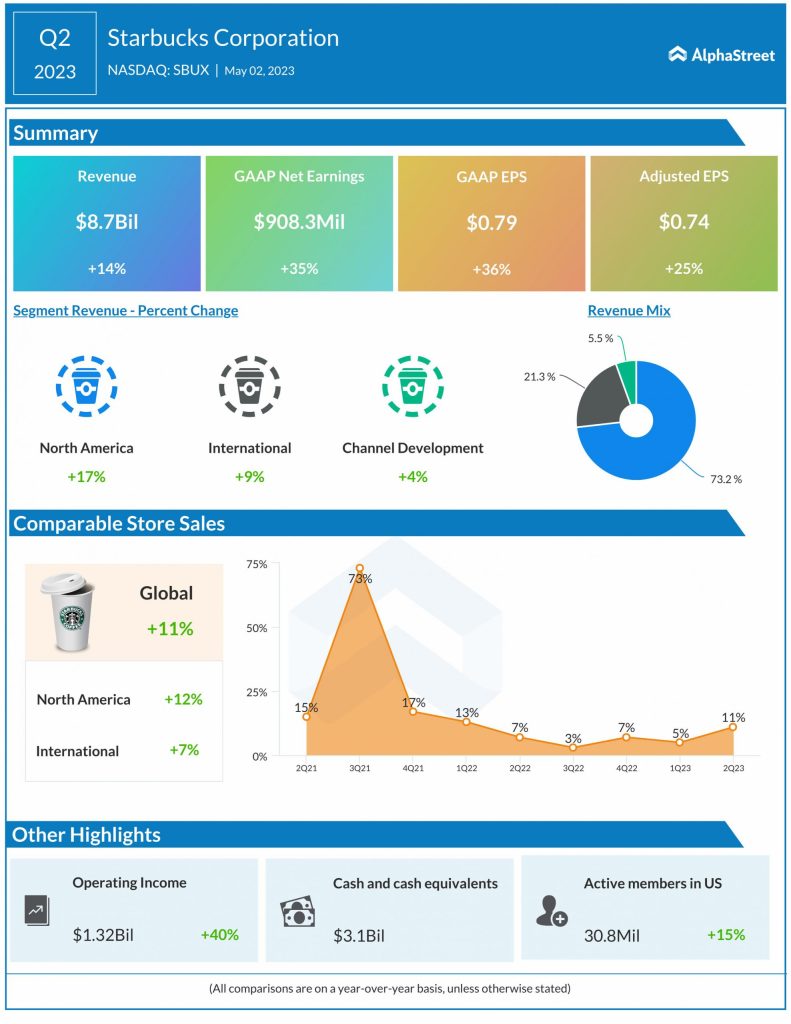

Revenue and profit growth

Recovery in China

In Q2, Starbucks finally saw a recovery in China after three years of pandemic-related disruptions. The recovery was faster than expected with the region generating $800 million in revenue, which was up 3% from last year. Comps turned positive for the first time since Q3 2021, rising 3%. The company opened 153 net new stores in the quarter in the region.

However, looking at the balance of the year, Starbucks expects average weekly sales in China to grow sequentially in the third and fourth quarters but more moderately. It expects to face uncertainties in terms of shifts in customer behavior and the pace of international travel recovery. The company also expects to see an improvement in comps during the latter half of the year.

Loyalty programs and omni-channel capabilities

Starbucks’ loyalty program and its omni-channel capabilities continue to drive growth. Starbucks Rewards loyalty program 90-day active members in the US grew 15% year-over-year to 30.8 million in Q2. Its convenience capabilities Mobile Order and Pay, drive-through, and delivery saw sequential improvement and now accounts for 74% of US company-owned revenue in Q2.

Outlook

Starbucks expects margins and EPS to improve sequentially in the third and fourth quarters of 2023. The company expects year-over-year EPS growth in Q3 to be meaningfully lower than its fiscal year guidance range of 15-20% while YoY EPS growth in Q4 is expected to be slightly above the high end of its guidance range.