Shares of Stitch Fix Inc. (NASDAQ: SFIX) continued to stay in the doldrums a day after the company reported fourth quarter 2020 earnings results. While revenues increased 11%, beating market estimates, loss per share of $0.44 came in wider than anticipated. The stock was down 16% in afternoon hours on Wednesday.

Quarterly numbers

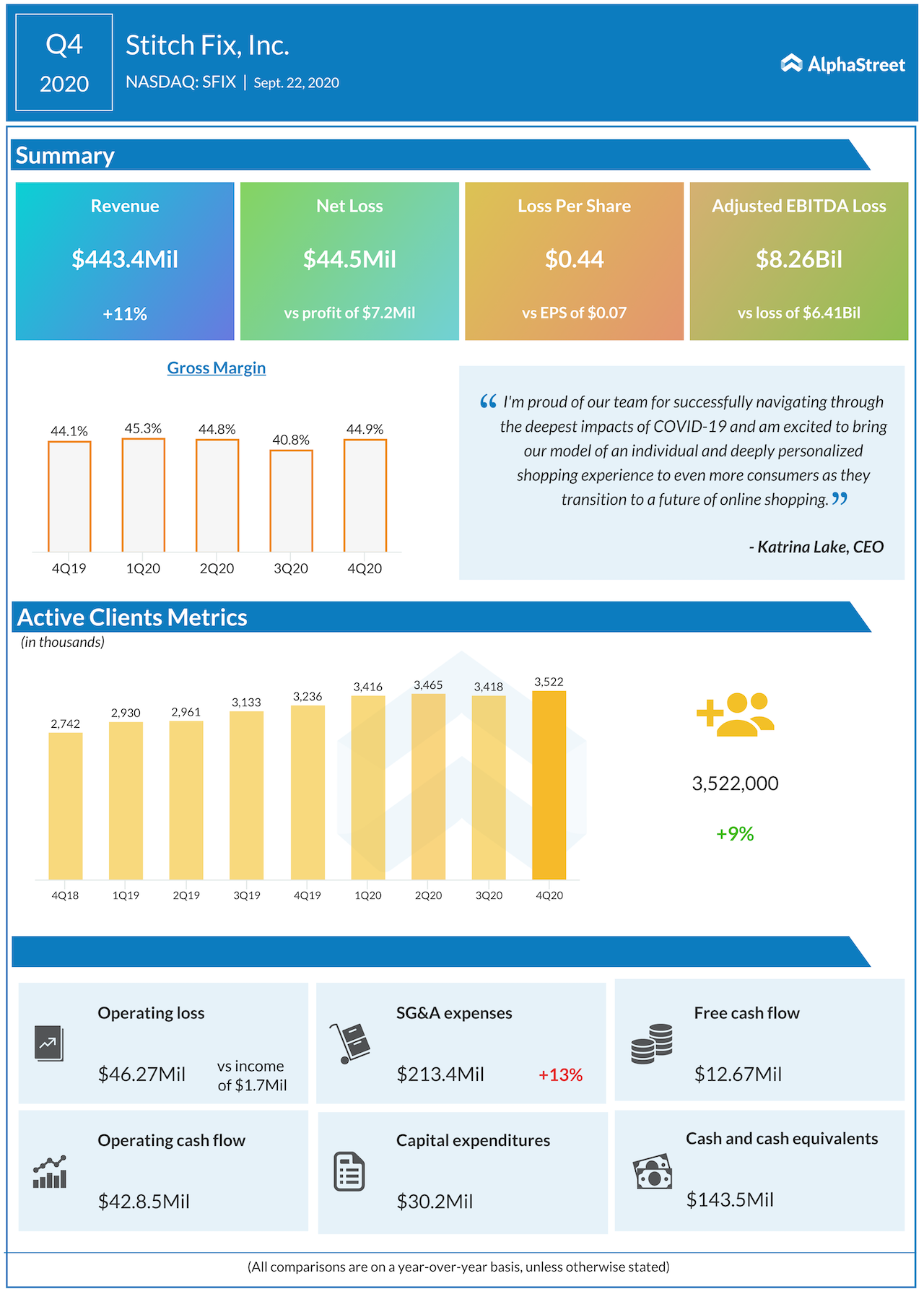

Revenues increased 11% to $443 million while net loss amounted to $44.5 million, or $0.44 per share, compared to earnings of $7.2 million, or $0.07 per share last year. Active clients grew 9% to 3.5 million while net revenue per active client was approx. flat year-over-year on a 53-week basis.

COVID-19 impact

Stitch Fix’s distribution centers were significantly impacted by the pandemic and the company faced supply constraints but the situation has improved now. The company also witnessed meaningful changes in the types of apparel that customers wanted. Stitch Fix also reduced its marketing spend so that it could use its limited capacity to serve its existing customers.

The company realigned its assortment and expanded its direct buy services for its active Fix clients. It also ramped up its marketing spend in June once distribution center capacity picked up. In July, Stitch Fix saw a 60% year-over-year increase in its first Fix shipment and this growth continued through August. The company expects this high first Fix demand to drive incremental subsequent Fix volume in the quarters ahead.

Category performance

Stitch Fix has been seeing strong demand in the Women’s category, particularly in the activewear assortment. In the fourth quarter, Women’s first Fixes grew approx. 25% year-over-year on an adjusted basis. The company also moved volume into categories like athleisure that were seeing more demand compared to categories like workwear and blazers that saw a slump during the health crisis.

Stitch Fix’s efforts in expanding its activewear mix over the past few years paid off during the pandemic period as it allowed the company to take advantage of the recent work from home trends. In Q4, Women’s activewear revenue grew by over 350% year-over-year on an adjusted basis benefiting from strength in Fixes and direct buy.

Within Women’s, the Plus offering saw first Fix growth in excess of 35% year-over-year on an adjusted basis. The Men’s category also saw high demand for activewear which boosted first Fix demand in the fourth quarter. The company will broaden its assortment in fiscal year 2021.

Strategy

Stitch Fix is all set to play offense and grow market share in fiscal year 2021. The company is seeing apparel purchasing move online approx. three times faster than the pre-COVID period. Although overall demand is not the same as pre-COVID levels, there are changes in consumer behavior and the company is able to toggle its inventory based on relevance.

Stitch Fix is seeing growth in demand and new customer shipments indicating that it is capturing market share. When retail spend bounces back in the coming months, the company expects more than $30 billion of market share to move online over a 12-18 month period. Stitch Fix hopes to capture a fair share of this through the expansion of direct buy. In 2021, the company plans to invest in growth opportunities like the UK and also incur higher capital spending to increase operating capacity to drive growth.

Click here to read the full transcript of Stitch Fix Q4 2020 earnings call